As the seventh-most-traded cross currency pair, EUR/CAD represents a significant share of daily forex trading. Although this pair is not quite a classic trading instrument, it does offer an opportunity to trade the economics of the European Union.

To trade EUR/CAD:

- Study the EUR/CAD pair and what influences its movement.

- Find a reliable forex broker.

- Select a trading and charting platform that will suit your trading needs.

- Analyze EUR/CAD and create a trading strategy complete with risk management rules.

- Open a position and monitor it.

- Complete the trade.

The EUR/CAD pair allows traders to take advantage of the euro’s relatively high volatility without being exposed to undue risk. The pair also stands out for providing unrushed trading opportunities in the fast-paced forex market.

Table of Contents

Currency Pair Chart and Profile

EUR/CAD is composed of the euro and the Canadian dollar. This pair is sometimes known as Euro Loonie and its value corresponds to how many Canadian dollars are needed to buy one euro.

The economies behind EUR/CAD

According to GDP rankings, Canada is the world’s 10th-largest economy. The country’s economy relies heavily on the manufacturing industry and the exporting of natural resources, most notably crude oil. Canada exports most of its goods to the U.S. and so the two countries’ economies are closely linked.

The euro is the Eurozone’s domestic currency. The Eurozone comprises 19 different nations and it is the world’s largest monetary union. The services sector forms the largest share of the Eurozone economy, but the industrial and agriculture sectors also play a notable role in the economy.

Monetary policy in the Eurozone is set by the European Central Bank (ECB) while in Canada it’s set by the Bank of Canada (BoC).

What influences the movement of EUR/CAD?

- Central bank decisions. Monetary policy decisions play a significant role in the movement of EUR/CAD. Any interest announcements by either the BoC or ECB will likely move the pair.

- The state of Eurozone and Canadian economies. Besides interest rates, EUR/CAD will likely be affected by changes in other economic data that affects both the Eurozone and Canada. For example, the euro is influenced significantly by economic data from Germany.

- The state of the U.S. economy. Both Canada and the Eurozone are affected by the state of the U.S. economy. For instance, the difference in bond yields between Europe and the U.S. has significant bearing on the values of the euro and U.S. dollar respectively.

- Global commodity prices. Canada is a large exporter of commodities such as gold, crude oil, wood, and grain. Commodity prices tend to influence the movement of the Canadian dollar, and in turn, EUR/CAD.

- Any changes in the Eurozone including political unrest. Socio-economic and political issues in the Eurozone have a significant impact on the euro’s value, and by association, EUR/CAD.

Is EUR/CAD an exotic pair?

EUR/CAD is a minor pair. Often called a cross or a cross-currency pair, a minor currency pair compares major currency pairs, excluding the U.S. dollar.

Pros of trading EUR/CAD

Trading the EUR/CAD cross has several merits.

- EUR/CAD provides the opportunity to avoid the risk attributable to global macroeconomic factors. For example, EUR/CAD typically shows no correlation to U.S. equity markets.

This can be advantageous when trying to hedge an existing position in one of the major pairs. Additionally, the isolation of EUR/CAD from the U.S. dollar provides insulation from the fluctuations of the major, dollar-based pairs.

- The pair can experience high volatility. With the right strategy, this volatility can allow traders to potentially make large profits in the market.

- The discrepancies between euro and Canadian dollar interest rates make EUR/CAD a good vehicle for executing carry trades.

- The EUR/CAD pair is typically more prone to strong trends than the majors. This provides many trading opportunities for intra-day traders and swing traders alike.

Cons of trading EUR/CAD

EUR/CAD is often not as liquid as the major currency pairs and this is a common factor among minor currency pairs. Besides the issue of liquidity, there are also some other drawbacks to trading EUR/CAD.

- The significant volatility of EUR/CAD makes trading the pair risky for traders without knowledge of volatile markets. This means that the pair is not ideal for traders without an understanding of the complexities of volatility.

- As one of the euro crosses, EUR/CAD is vulnerable to political and macroeconomic events (e.g. intermarket push and pull) that trigger high correlation between commodity, stocks, currencies, and bond markets around the world.

The Best Time to Trade EUR/CAD

When trading euro-based pairs, you’ll likely see the most movement during the overlap of the London and New York sessions. This overlap occurs between 12 pm and 4 pm GMT. You’ll also have to remember that most euro movement coincides with the release of economic news in the Eurozone.

Best Trading Strategies for EUR/CAD

Day trading

Day trading is a strategy in which a trader buys and sells an instrument within the same day. The trader may even open multiple positions, but they all have to be closed by the end of the day.

There are several intra-day trading strategies. One strategy you can use when trading EUR/CAD involves taking advantage of small price gaps that arise due to differences in the pair’s bid and ask prices. This strategy is called scalping and it normally involves holding a position for a few minutes or even seconds.

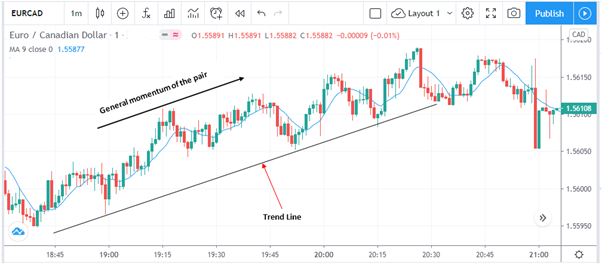

When scalping, you could enter trades by following the general momentum of EUR/CAD, i.e. the pair’s trend.

Whilst there’s no “best” time frame for scalping, traders generally tend to favor time frames between 1 and 15 minutes. The time frame you choose will play a role in determining your acceptable profit or loss per trade. For instance, a 5-minute scalp could have a profit target of 10 pips, but the target profit for a 1-minute scalp could only be 5 pips.

Swing trading

EUR/CAD is often marked by price swings that form well-defined ranges over long periods. This makes the pair ideal for swing trading. Swing trading involves holding an instrument for one or more days in an attempt to profit from the instrument’s price swings.

Swing trading EUR/CAD involves identifying a range within which the movement of the pair is confined. Once you have found the range, you could sell when the price reaches the top of the range (resistance) and buy when the price reaches the bottom of the range (support).

The general assumption is that when a pair is trading within a range and the price reaches the resistance or support, it won’t breakthrough, but will start moving in the opposite direction of either the resistance or support.

Carry trading

In forex, carry trading involves borrowing a low-interest-rate currency to invest in a currency with a higher interest rate. By doing this, you lock in a higher interest profit on your investment.

When using the carry trade strategy, you first need to identify the funding currency and the asset currency. The funding currency refers to the currency that is exchanged in the trade. Typically, this currency is the one with a lower interest rate. Historically, the euro has been an attractive funding currency due to the negative yields in the Eurozone.

Successful EUR/CAD carry trading involves going short, i.e. selling the euro and simultaneously buying the Canadian dollar. When this happens, you will receive an interest payment based on the interest rate differential between EUR and CAD and the size of your position.

In addition to their geographical connection, the U.S. and Canada are also major trade partners. U.S. economic data usually has a significant impact on the movement of the Canadian dollar. Due to the two country’s strong connection, EUR/CAD tends to have a strong correlation with EUR/USD.

In addition to having a strong correlation with EUR/USD, EUR/CAD also shows a significant inverse relationship with CAD/CHF. This is because, traditionally, the euro and the Swiss franc have exhibited a strong correlation to one another.

Correlation of EUR/CAD with other instruments, commodities, or indices

Crude oil is one of Canada’s largest exports. As such, the Canadian dollar is normally sensitive to movements in oil prices. As oil prices go up, the Canadian dollar usually strengthens, and vice versa. As a result, oil prices tend to be inversely correlated to EUR/CAD.

Related Questions

Why is Euro stronger than dollar?

The euro is stronger in relation to the U.S. dollar due to its relatively lower supply compared to that of the U.S dollar. The lower supply affects demand for the euro compared to the U.S. dollar and this increases the strength of the euro. However, while the euro is stronger than the U.S. dollar, it sees high fluctuations in value. This suggests that the euro is relatively unstable.

What is the best time to trade EUR/USD?

The three-hour window between 1 pm and 4 pm GMT is the ideal time for trading EUR/USD. This time frame is characterized by high volume for both euro and U.S. dollar trading since both the London and New York sessions will be open. Besides higher liquidity, this overlap in sessions also tends to provide traders with the tightest spreads.