Forex trading is full of success stories. Just search the Internet or follow the trading community on the leading social media websites. Everyone is a winner! Real statistics though tell just the opposite. But what are the Forex pitfalls that make Forex trading so difficult?

It all starts with the approach to trading. People focus on how much they’ll make.

Instead, the focus should be on how to manage the risk. How much they’ll stand to lose.

Focusing on losses or embracing losses is part of a sound money management system. A system that focuses on setting the risk before concentrating on the reward.

When doing that, traders become selective. They’ll skip more trades than initially thought.

Moreover, they’ll sit on the sidelines more often. They will have less margin stuck in the market. Hence, they’ll pay fewer commissions and other fees to the Forex broker.

One of the significant Forex pitfalls comes from the trading attitude. And, the from the strategy too.

If a trader has a scalping strategy based on the economic news release, that’s fine. But, if he/she is not around when the news is released, then the strategy won’t work. As simple as that.

If a trader can’t cope with losses, the tendency to overtrade appears. Instead of managing the risk, overtrading leads to even more losses. Before you know it, the account vanishes.

In this article we’ll cover:

- Forex pitfalls for a novice trader

- Forex mistakes to avoid when trading for a living

- Forex tips when swing trading

- how to trade successfully on the bigger timeframes

- successful traders’ Forex habits

- how to profit from the price action in different London sessions

- what mistakes to avoid when scalping Forex

Every business has its pitfalls. Let’s see Forex trading ones!

A Beginner’s Forex Pitfalls

People come to Forex trading to make a profit. Or, money.

More precisely, extra money to complement the regular income stream. What’s wrong to want to earn some more?

Forex trading grew in popularity together with the Internet. The online environment made it possible for anyone to take part in the most exciting game of them all. The money game!

Problem is, this is not a game. However, Forex brokers advertise Forex trading as so easy, even the sales lady in the grocery store makes a couple of extra thousand bucks per week.

Makes one wonder why she still works at the grocery store? But never mind that. For now.

A major pitfall for beginners is to understand that this is not a game. Trading is serious business capable of sucking every piece of energy from a person. And, together with it, his/her money too.

Numbers don’t lie. Most traders (almost everyone) lose their first deposit. Bang!

When beginner retail traders realize that, unfortunately, it is too late. The first deposit is long gone.

Some came back to Forex trading after a while. With a trading plan, they last more than the first time. However, chances are still against the retail trader.

It is only normal. Before talking about Forex trading strategies and the pitfalls to succeed, one needs to understand the market participants.

The neighbor or the chatty online friend is not your enemy. In fact, retail trading size in Forex trading is so small we can ignore it. Only about six percent of the daily trading volume belongs to retail traders.

Instead, central and commercial banks, investment houses, quant firms, even brokers and liquidity providers, have a say in Forex trading.

With that in mind, the beginner retail trader avoided a major Forex pitfall. He/she knows the enemy.

Loosing and Winning When Starting Forex Trading

When starting Forex, one of the significant Forex pitfalls comes from how to handle the pressure. That is the pressure of winning and losing.

Like it or not, winning is more dangerous than losing. Here’s why.

A winning streak makes a trader think great about his/her capabilities. Therefore, complacency replaces heightened attention. As a result, the road to a losing streak just started.

When loosing, the trader starts paying attention to details. Becomes innovative, proactive, and gains an edge over the market.

This doesn’t mean that is better to lose than to win. No.

It only means that Forex pitfalls from handling a winning streak are far more significant. Hence, when in a winning streak, the longer it takes, the more the trader needs to reduce the trading volume.

As such, the trading account is protected from the inevitable loss.

Scalping Forex Trading – Mistakes to Avoid

Retail Forex traders aren’t aware of different types of trading style when they first come to the trading table. As such, they’ll settle for small profits and break any possible money management rule, such as:

- don’t place a stop loss

- don’t use proper risk-reward ratios

- add to a losing trade

- don’t cut the loss short

- overtrade an account

- risking more than one or two percent on any given trade

All these are mistakes to avoid especially when scalping. Forex pitfalls when scalping relate to the trading time too.

Scalping the Forex market is difficult enough for pro traders too, not only for beginners. The problems come from:

- too many commissions paid

- the economic news makes the prices move on nothing at all

- any speech, interview, source, can suddenly turn the market

Most importantly, scalpers rarely have a proper risk-reward ratio. If the trading setup comes from the one-minute chart, the stop loss and the take profit levels become irrelevant.

The reason comes from the way the brokers execute trades nowadays. ECN (Electronic Communication Network) or STP (Straight Through Protocol) promise to close a trade when there is a market.

However, when the market moves too fast, the execution may differ by a couple or a few pips. Just enough to screw a risk-reward ratio when scalping on short and very-short-term timeframes.

Understanding the economic calendar is one of the most common Forex pitfalls to address. People fail to realize that the market won’t move all the time.

During the NFP (Non-Farm Payrolls) week, for instance, the chances are that the market will range the entire week. Traders will overtrade, and by the time the NFP comes, they’re out.

Pitfalls When Trading for a Living

After trading for a while and having relative success, the retail trader starts thinking of making this a real job. Why not trading for a living?

Have a small room somewhere in the attic or basement, align a few computers and monitors, have a stable Internet connection and Forex trading can start. What can go wrong?

Many things. First, think of the time zone you live in and correlate it with the Forex trading sessions.

The most active Forex trading sessions are the London and the New York ones. Even starting with the second part of the New York session, ranges begin to settle in.

The Asian session is mostly lethargic. The last years (make this the last many years) see the prices consolidate in minimal ranges during the Asian session.

Hence, if you live in a time zone that makes it difficult trading in the London session, and part of the New York one, think twice. One answer would be to trade with a robot. Or, algorithmic trading.

However, algorithmic trading has its Forex pitfalls too. No one wants to wake up and find out the markets pulled a flash crash like:

- when the SNB (Swiss National Bank) dropped the EURCHF peg from 1.20

- the GBP (Great Britain Pound) fell several hundred pips in less than five minutes during a terrible Asian session

Robots don’t handle that kind of stuff easy. Ask survivors of the two events, if any.

Facing Range Markets in Forex Trading

Second in line after the time zone is how traders face range conditions. Like it or not, the currency market mostly ranges than trends.

When trading for a living, the focus suddenly shifts. It shifts from a short to very short-term oriented approach, to a medium one. Or even longer.

A medium-term Forex trading strategy is called swing trading. When traders keep positions open from a few hours to a few days or even weeks, that’s swing trading.

Essential Forex pitfalls of swing trading come from range markets. A swing trader lets the profits run.

Or, trades with a different time horizon. Yet, if the market doesn’t move, or move in a range, a problem arises.

The problem comes from the need to do something. Only because the market is open, traders feel the need to open a trade.

In other words, they “marry” with one direction. And, if they’re wrong, when the market starts trending in the opposite direction, usually it is too late.

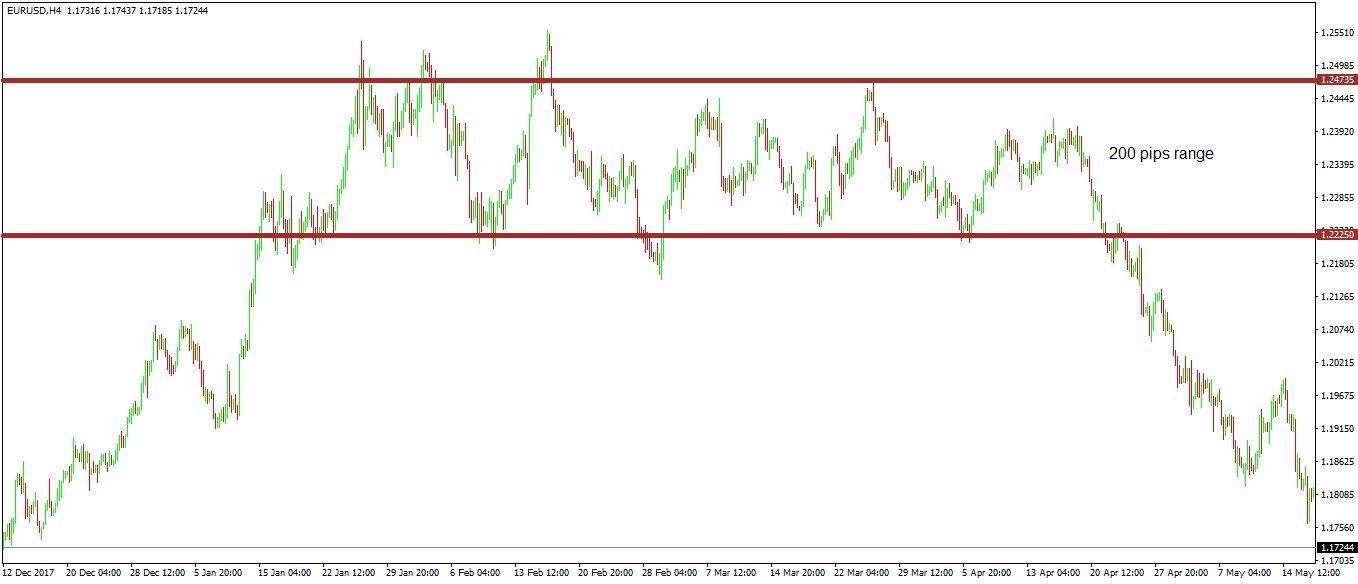

This is EURUSD 2018 price action. About two-hundred pips range for the first four months of the year.

When trading for a living, the pressure mounts to make it every month. Month in, month out, the bills keep pouring.

If the market ranges and the trading strategy is swing trading or even investing, it takes time. This leads to another critical Forex pitfalls traders face: funds.

Available Funds in Forex Trading

Third in a row of major Forex pitfalls, the funds to trade. After all, it comes down to money.

This one is a major hurdle in Forex trading. The available funds in the Forex trading account go beyond just that.

Human nature plays tricks on us. As such, even when wrong, traders still believe the market will turn.

Therefore, they’ll ignore the basic money management rule of cutting the loss. Instead, they’ll drop the stop loss.

Part of important Forex failures to avoid, lack of funds in a trading account leads to irrational decisions. But lack of funds doesn’t come always as a result of not enough funds deposited.

Instead, it comes most of the times as a result of overtrading.

Overtrading means are taking multiple positions or one excessive position so that the smallest market move will squeeze the heck out of the trading account. Effectively, traders will receive a margin call, and after that, the market will turn to the desired direction.

Naturally, the trader will blame the market for that “nasty swing.” Or, the broker, for widening the spreads.

However, the only one responsible for such a terrible Forex trading situation is the trader himself/herself.

A trading account can survive in any environment. As long as there is enough available margin to sustain a swing that doesn’t reach the stop loss, apparently.

Therefore, when a trade reaches the stop loss, isn’t necessarily bad news. Traders should embrace it as part of the trading game.

Instead of widening the stop or removing it and praying for the market to turn, traders should use the released margin for another trade. That’s how the wheel spins for a new trade and a new opportunity.

Learn From the Pro Traders – Forex Habits to Remember

By default, a pro trader does that for a living. And, in doing that, there’s no pressure for a daily, weekly or monthly target. Neither in pips nor money.

Instead, a pro trader knows what he/she is against. Forex trading is one of the most daring jobs in the world, so there’s not enough safety to consider.

A pro trader is aware that the market may range more than the norm. Or, it can stay overbought or oversold more than one would resist.

Moreover, such a trader knows that there is always another opportunity. Above all, when trading for a living, the worse thing that can happen is to have pressure on results.

To avoid that, a money management plan coupled with a trading approach will do the trick.

Namely, traders in this category give themselves a year. Twelve months.

To start with, they calculate the average expenses for the family needs for every month. Add to this the kids school, savings, holidays, the little treat, mortgage, and so on, and that is what the trader needs to make over the course of a year.

Why a year, you ask? That’s easy and already answered in this article. Before a decisive move, markets tend to range, and a more extended period is needed.

Hence, a pro trader always has a safety net for the twelve months ahead. Money to live from, and money to trade with.

No pressure. No strings attached. No nothing, but pure, stress-less trading. Guaranteed improved results!

Sitting on Your Hands

We already mentioned that traders feel the need to do something only because the markets are open. Pro traders, or the ones that do that for a living, love to do nothing.

The market takes what it has to take from the novice trader and the beginner one, and that doesn’t even matter in the overall price action. Remember that the size of retail trading in the total trading volume is more than insignificant?

Sitting on your hands do the trick to avoid overtrading. Having no position on the market is a position. A cash position! After all, cash is still king, right?

This article mentioned the NFP and the difficulty in trading the NFP week. All eyes are on the release and any possible clue from the ADP (private payrolls) or other news.

In fact, the market doesn’t give a crap until the NFP comes out. Hence, if pro traders do take a position during the NFP week, the horizon for the take profit isn’t a day or two. But weeks or months ahead.

Hence, the analysis doesn’t come from lower timeframes, but from more significant ones. Daily, weekly or monthly will do the trick.

Pro traders look into details of a release. They won’t settle for the NFP to beat expectations, and therefore to buy the USD.

First, they have a technical scenario. One that comes from multiple timeframes and multiple theories and strategies.

Second, they check revisions to past data. Finally, they look at small details that the average Joe doesn’t even know they exist.

Such details come with data like:

- labor participation rate

- employment component in the ISM Non-Manufacturing

- M&A (Mergers & Acquisitions) potential influence

- regular option market expiries

- fixings throughout the trading day, week and month

Conclusion

Forex trading is a challenging task. Unless you do this as a hobby, with penny money and trading cents, Forex trading has its Forex pitfalls.

The challenges to succeed are so significant that the pressure builds up with every trade. Retail traders, above all entities involved in the currency market, have the least chance to survive.

This is statistics, not an invention. But funny enough, human nature plays tricks on us all again.

Mainly because it is so complicated, almost impossible to make it, it represents a daring task. Traders, above all, are courageous people.

Risking something for the sake of gaining more isn’t only in Forex trading. All businesses are bound to bear the same risk.

However, few businesses risk loving everything so fast. This is what makes a stringent task for retail traders to understand Forex trading and the major Forex pitfalls that come with it.