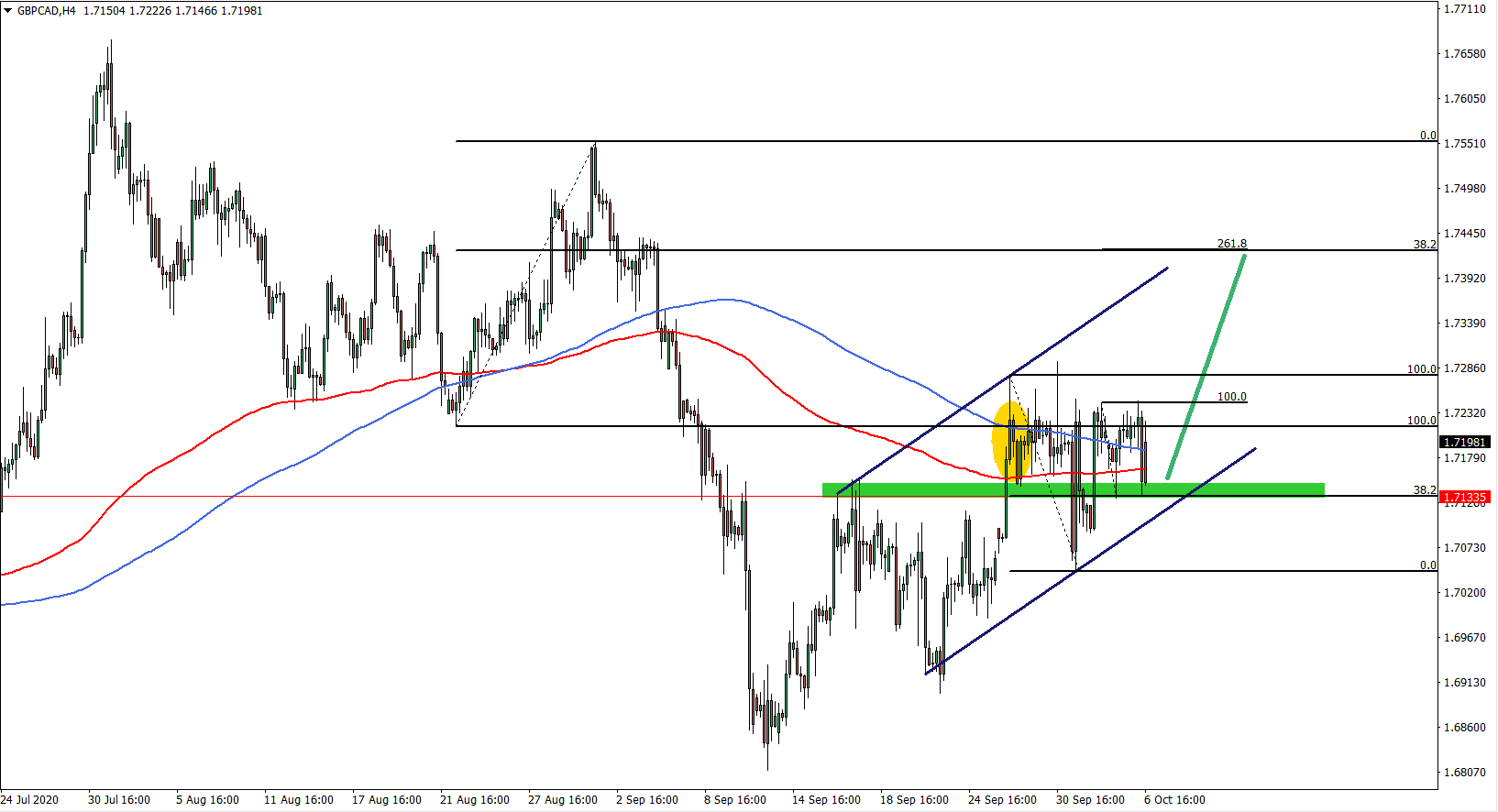

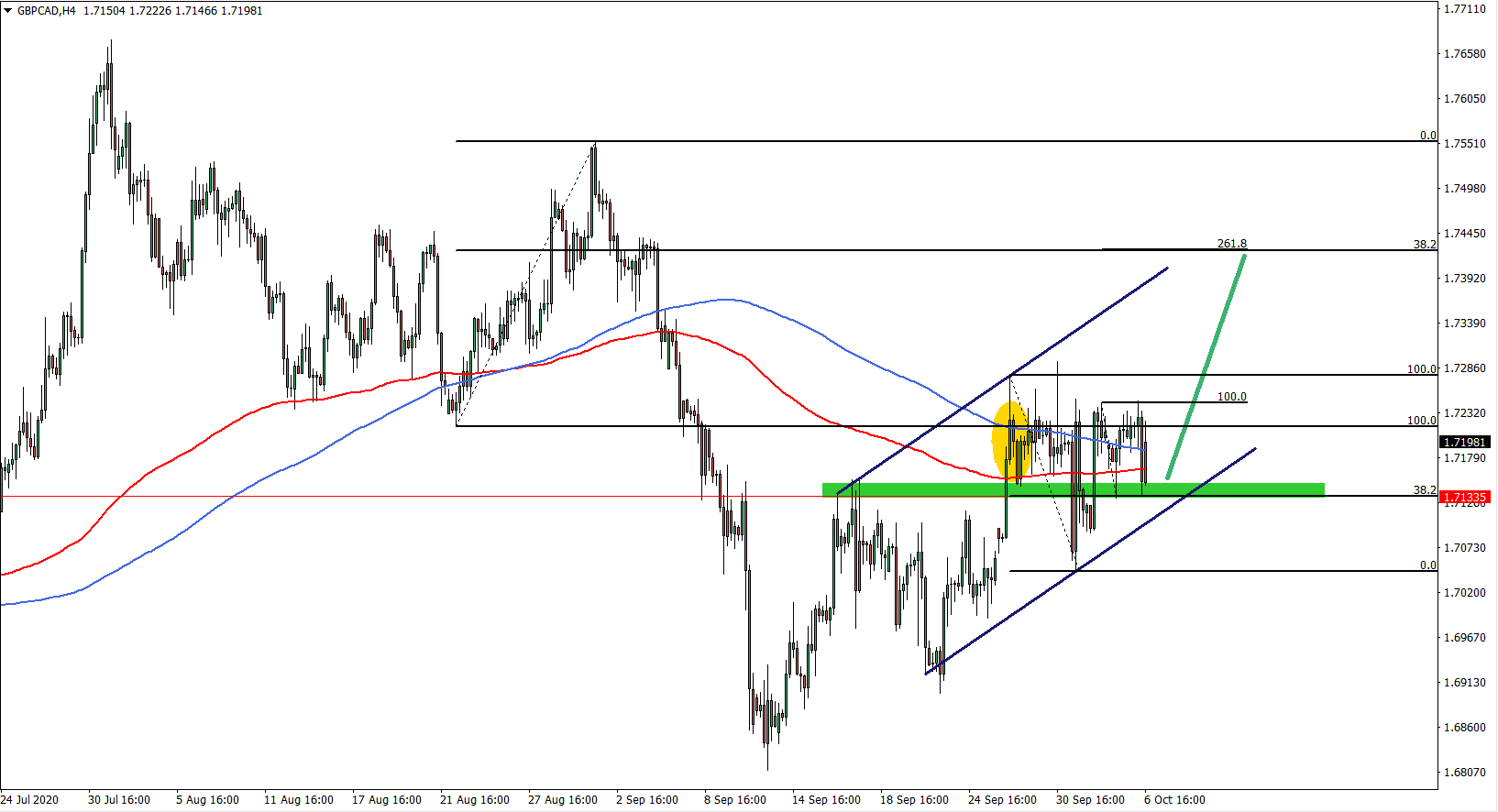

The GBP/CAD has started to produce higher highs and higher lows suggesting the validity of an [...]

Our analysts share trading insights and ideas after taking a look at different Forex charts and indicators across different time frames. Although this content shouldn't be considered as financial advice, it is a great way to get a robust notion on how to perform Forex analyses and identify profitable trades. Join our Free Telegram Channel to get started!

The GBP/CAD has started to produce higher highs and higher lows suggesting the validity of an [...]

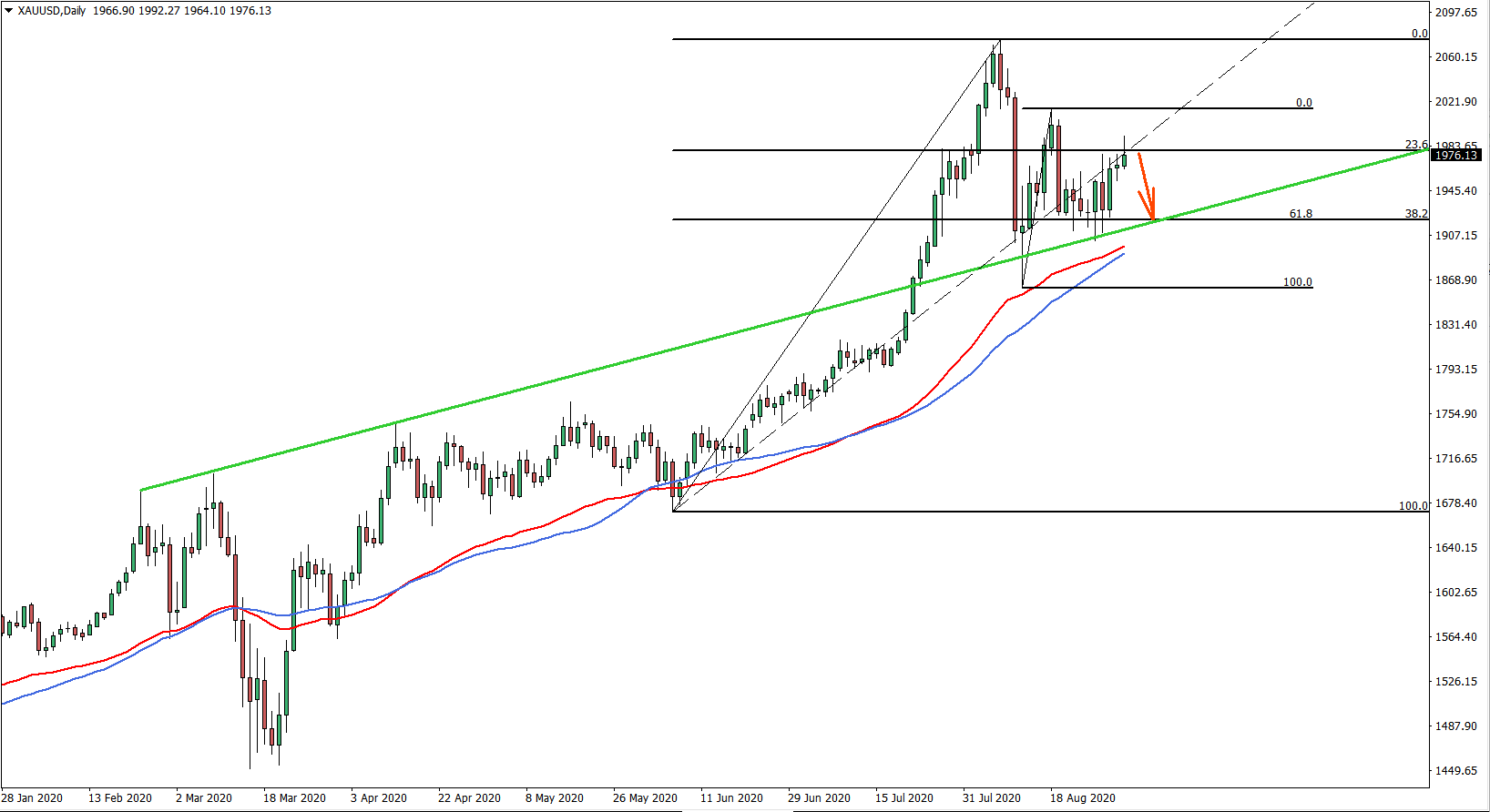

The long-term trend for Gold remains extremely bullish especially considering a strong ongoing devaluation of the [...]

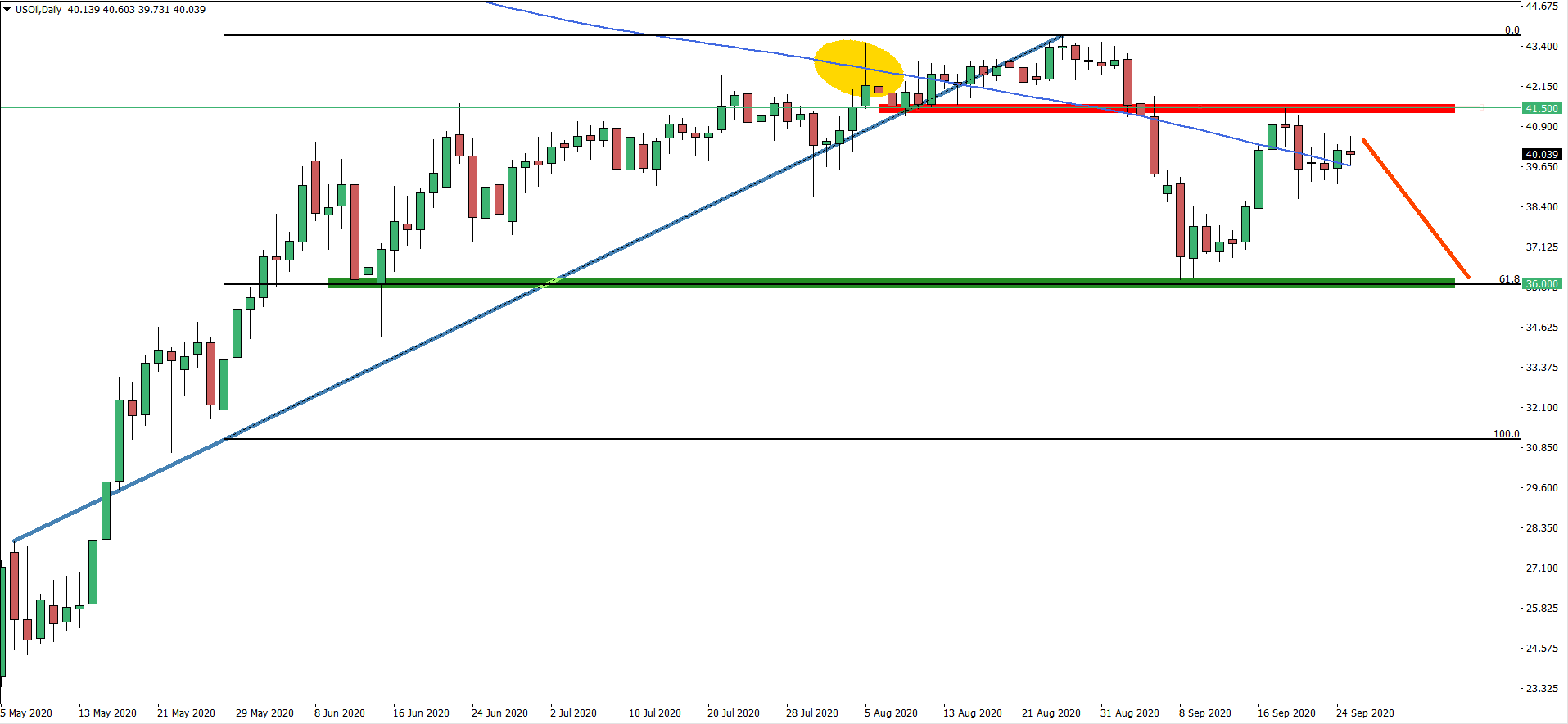

Starting with a daily chart it can be seen that USOIL rejected the 200 Simple Moving [...]

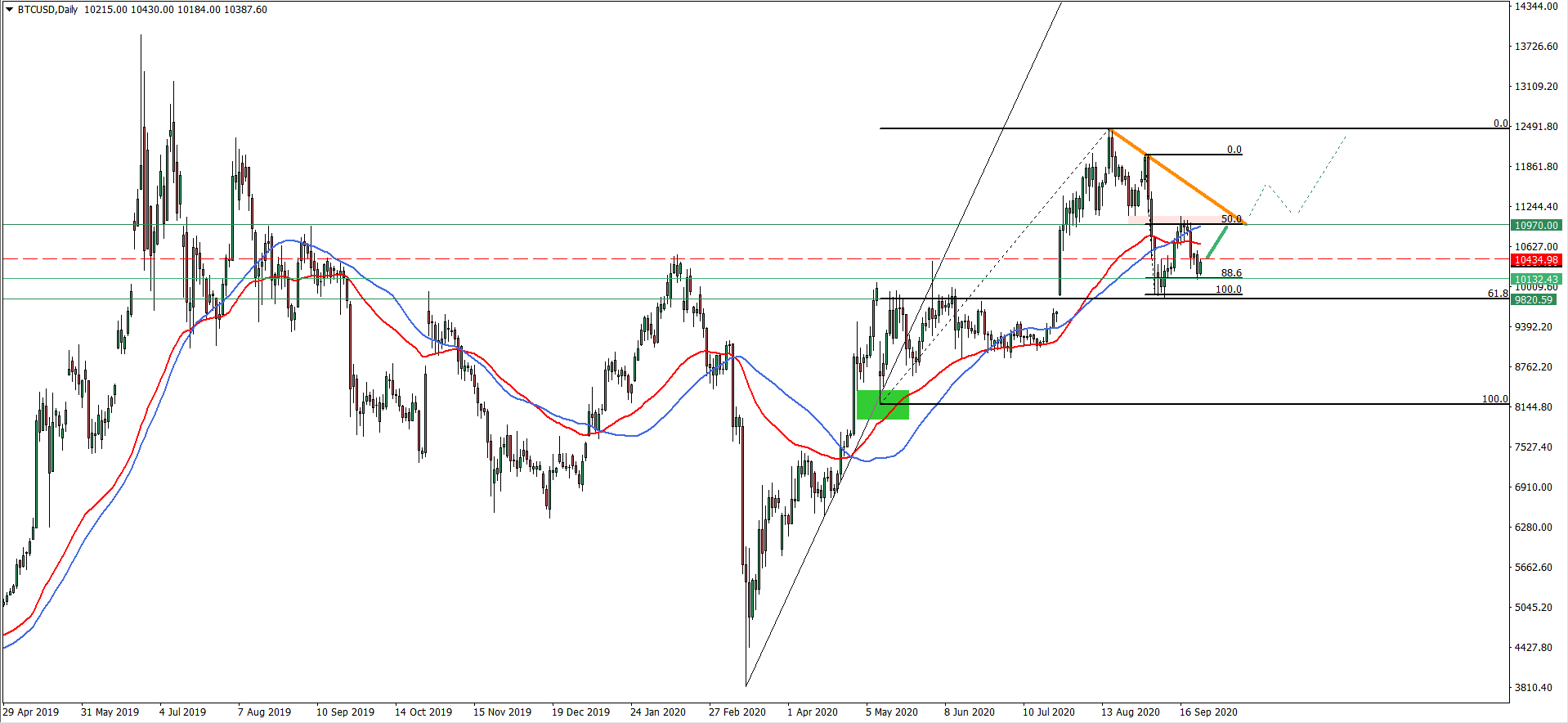

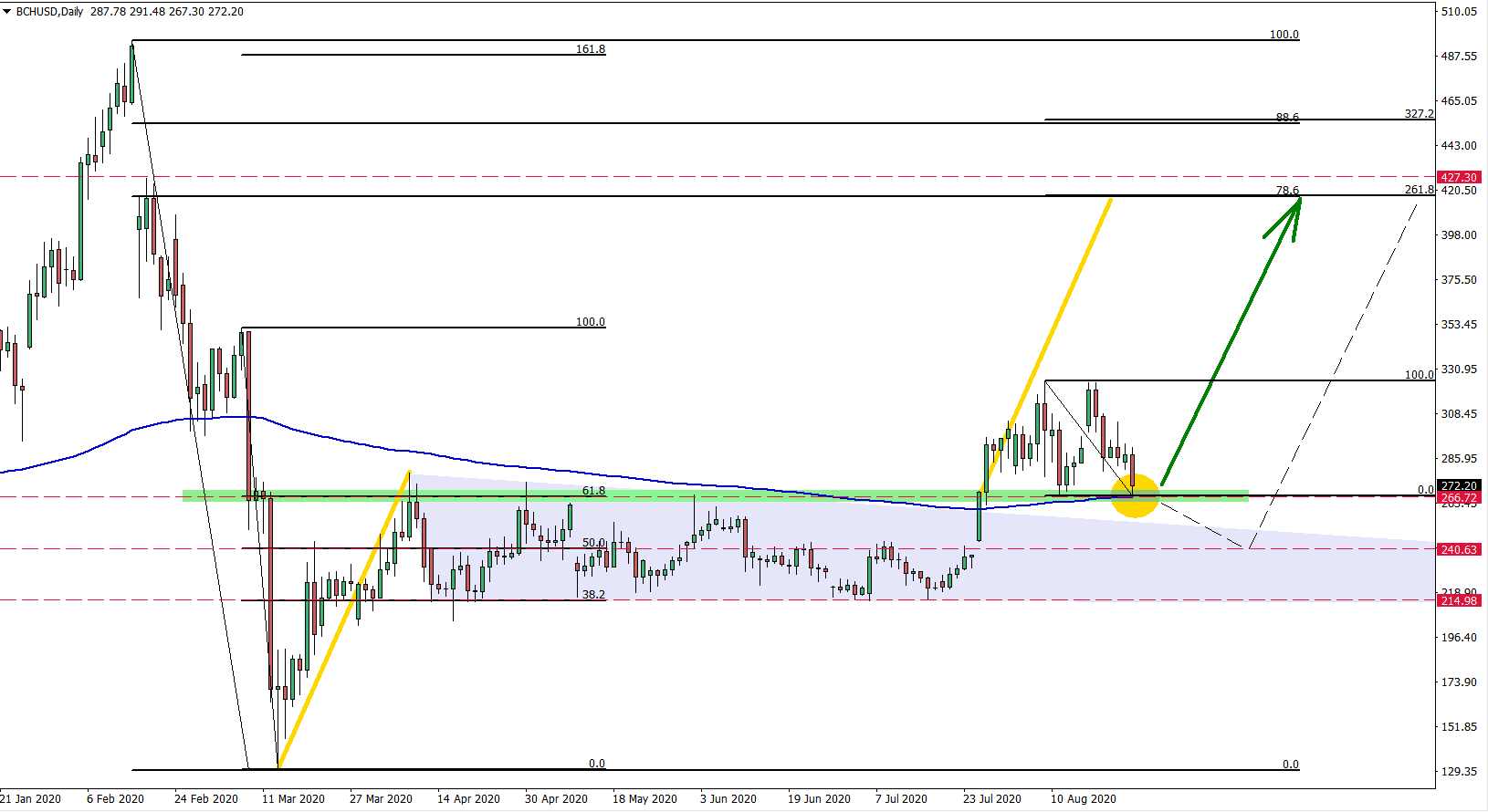

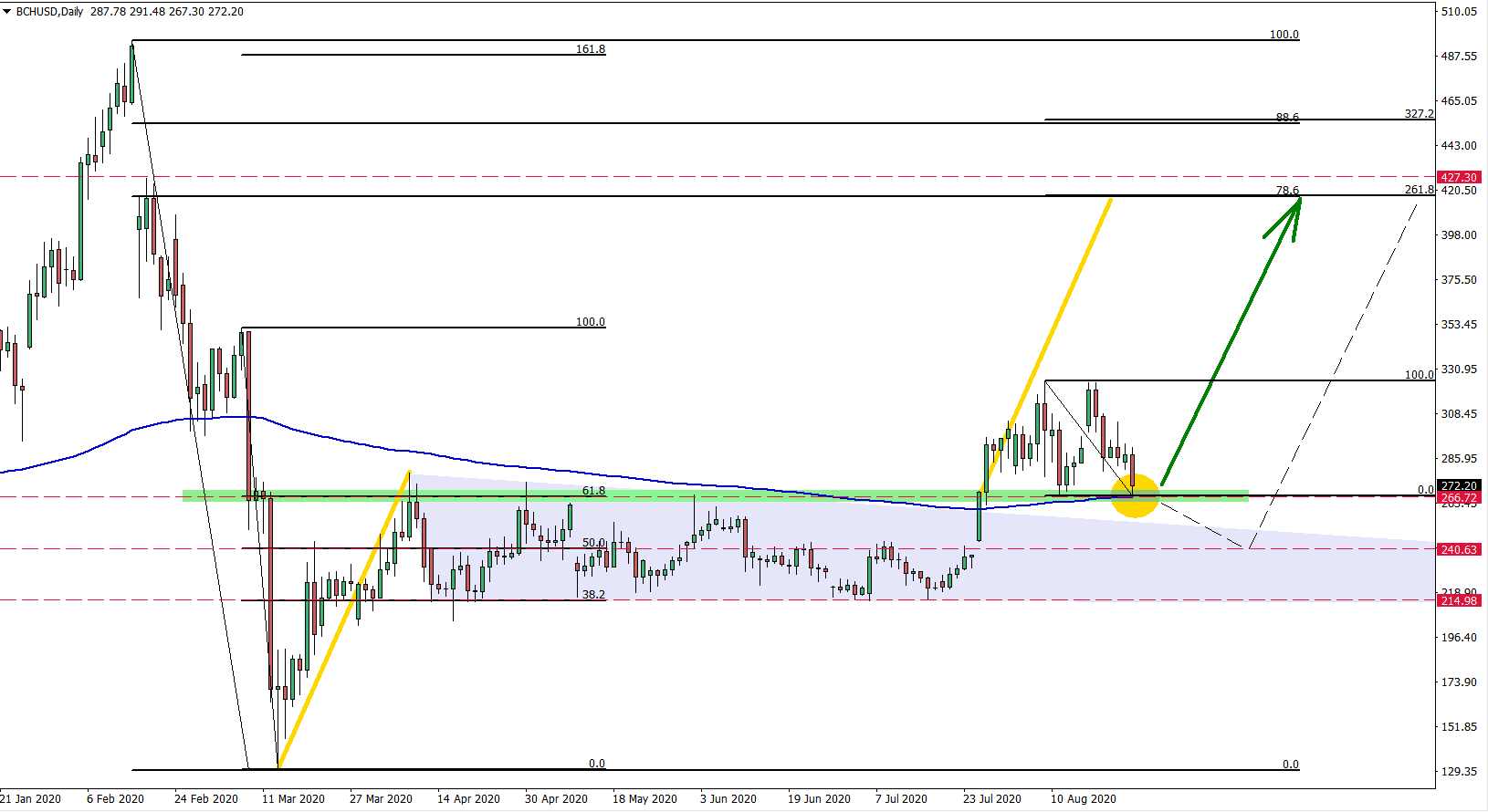

The Bitcoin long term trend is clearly bullish as the price continues to produce higher highs [...]

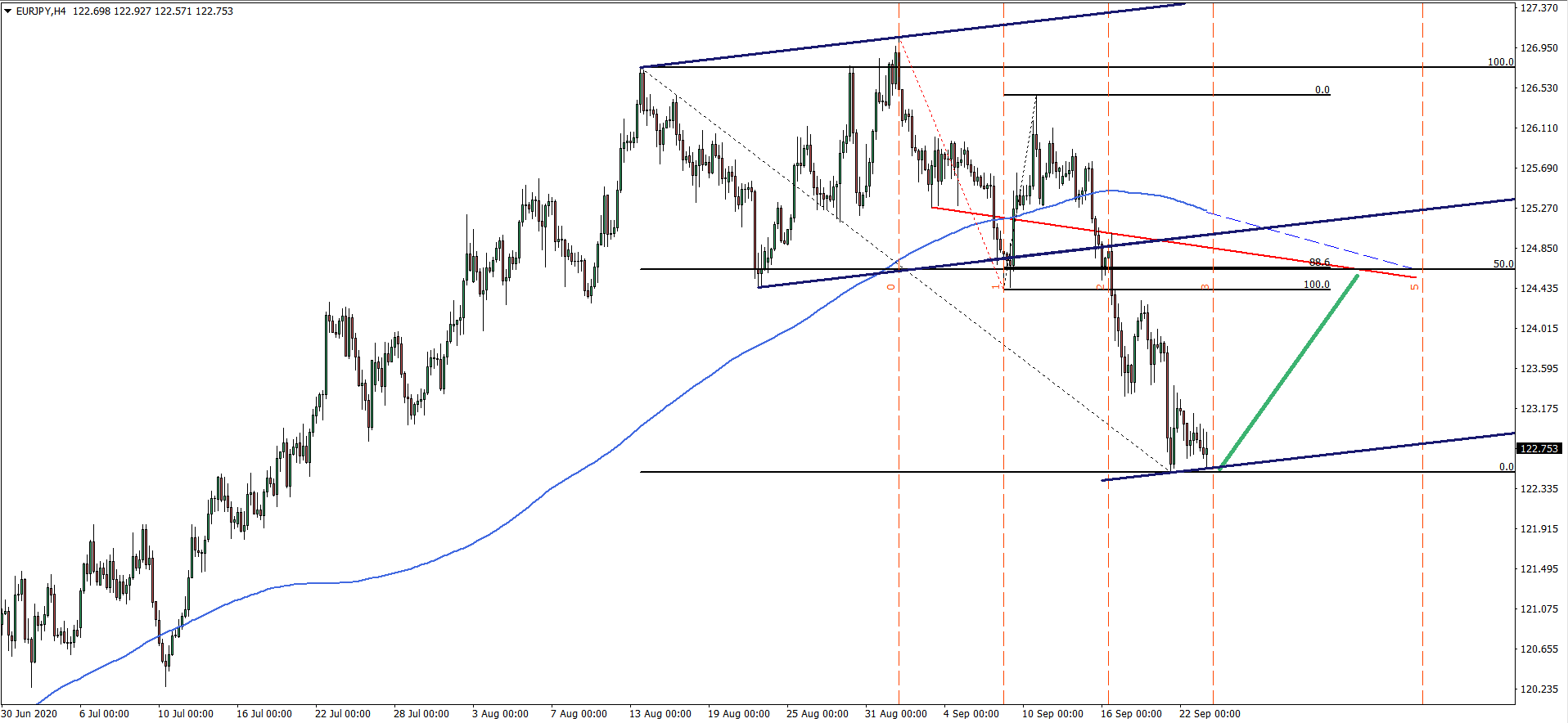

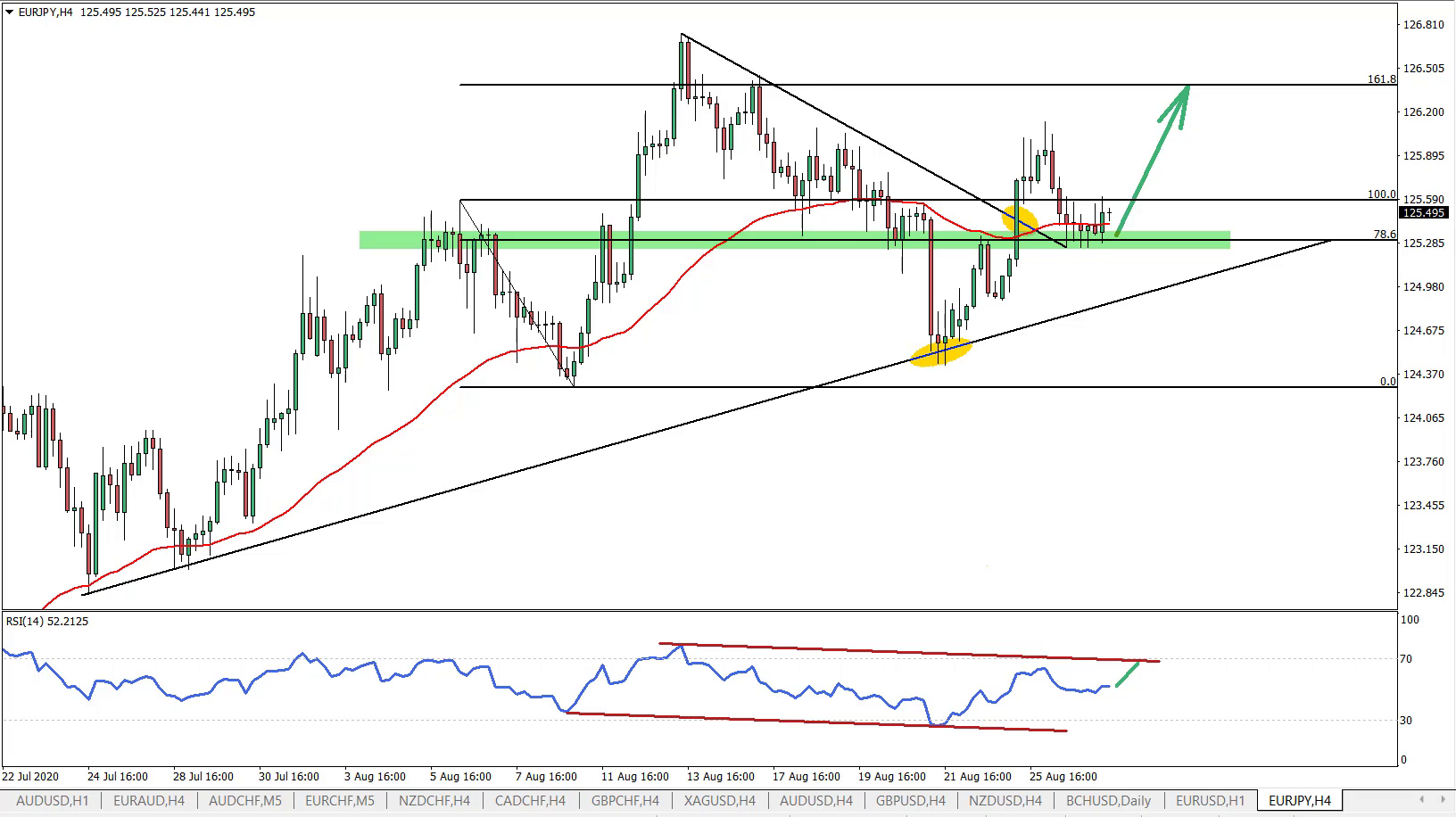

As long as daily closing prices remain above the 122.50 support, correctional move to the upside [...]

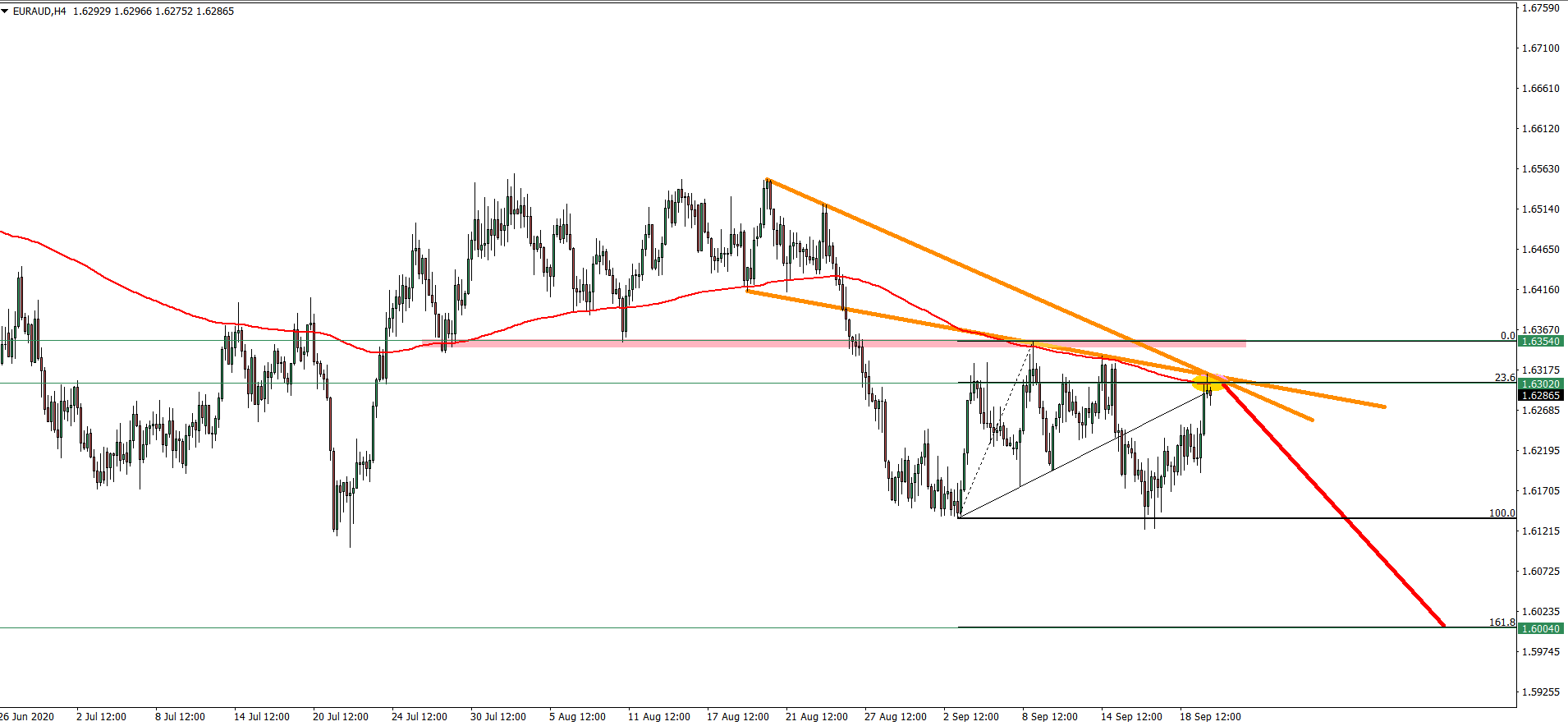

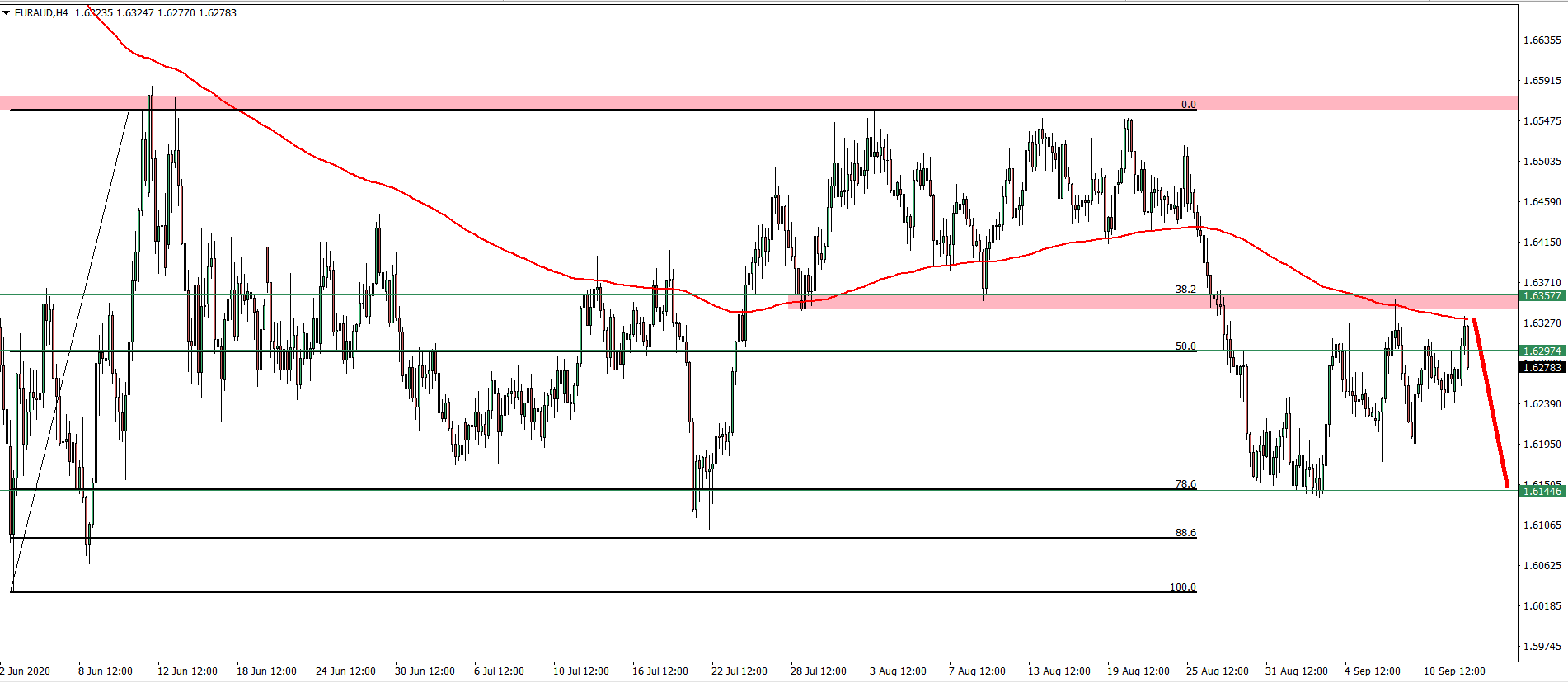

The EUR/AUD major trend remains bearish as the price continues to produce lower lows and lower [...]

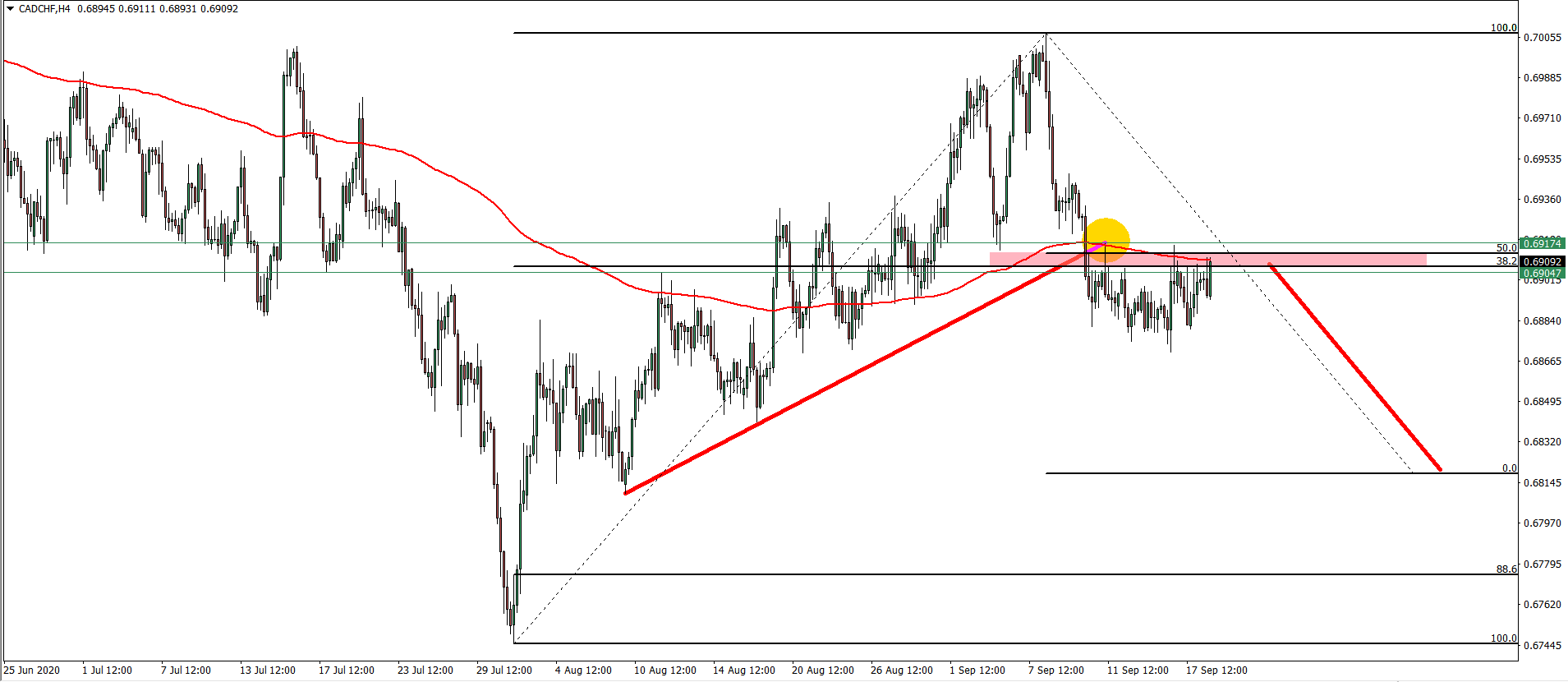

On September 10th, the CAD/CHF broke and closed below the uptrend trendline as well as the [...]

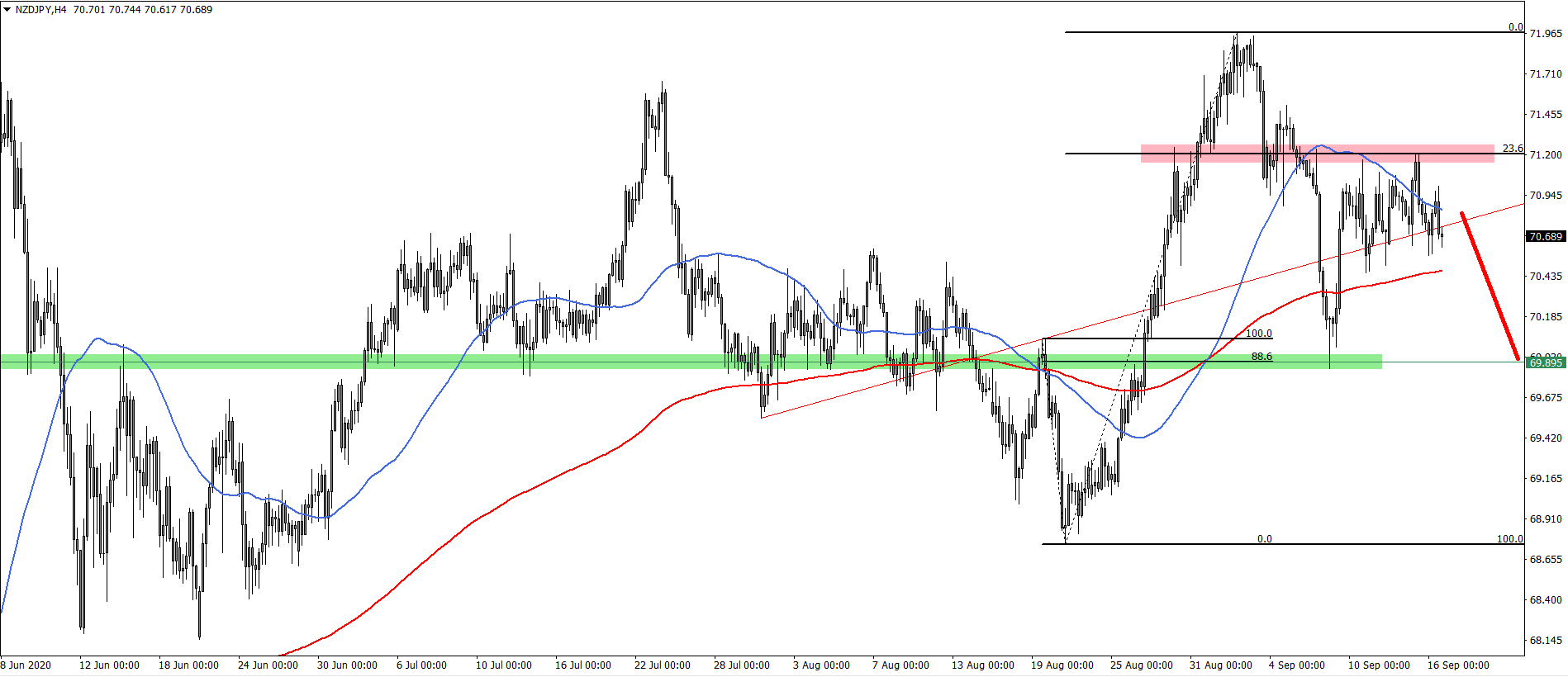

NZD/JPY started to produce lower lows and lower highs, suggesting the validity of the downtrend. Besides, [...]

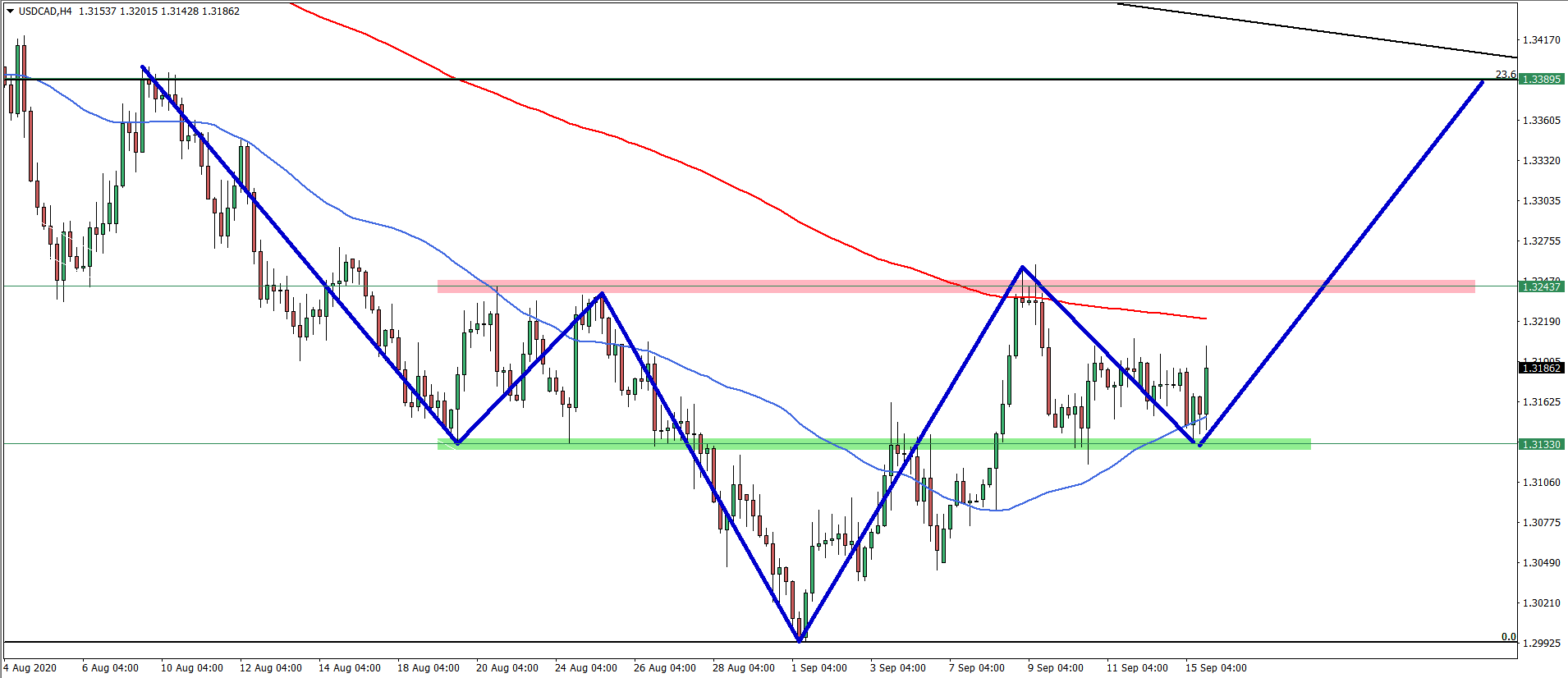

On the daily chart, the price has reached and rejected the key psychological price area near [...]

The EUR/AUD 4-hour chart shows a clear consolidation phase which has started back in June this [...]

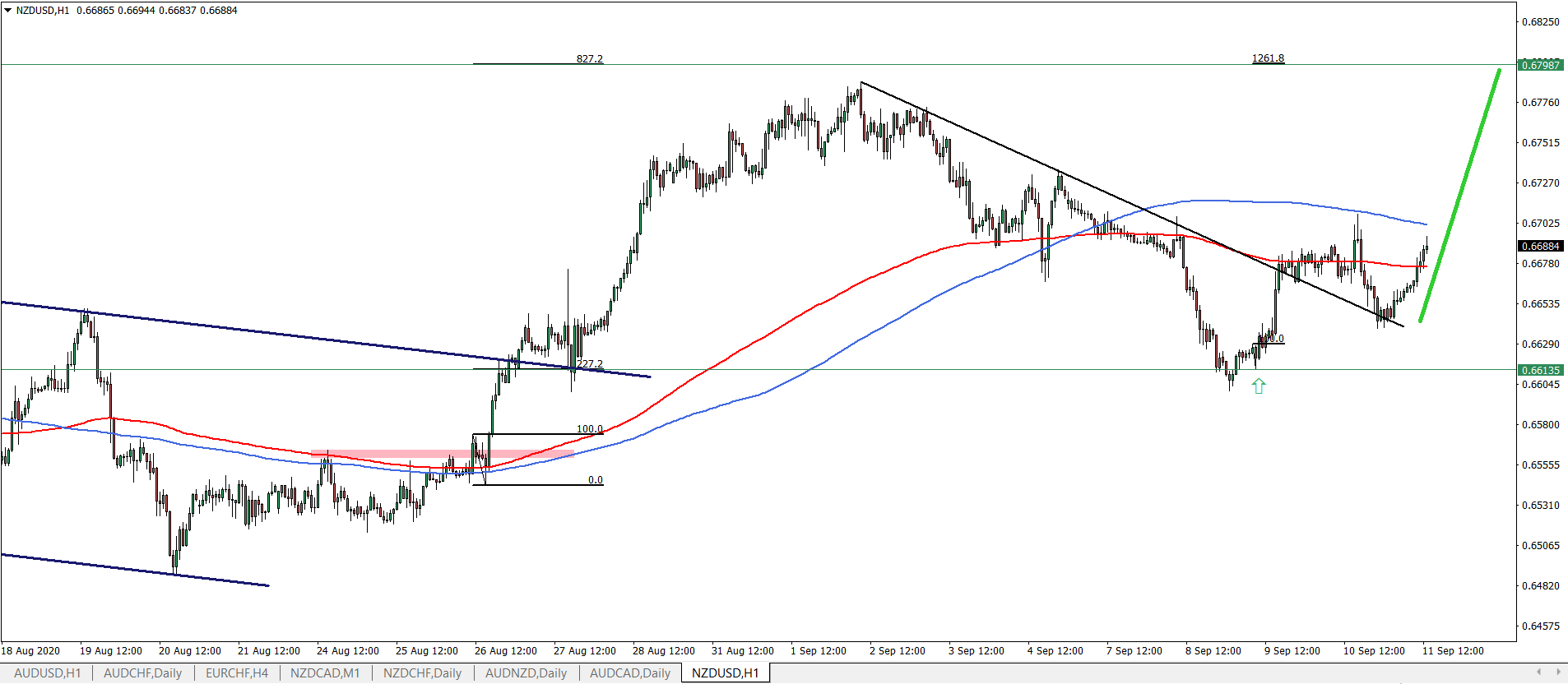

Between September 9-10, the NZD/USD broke above the downtrend trendline as well as 200 Exponential Moving [...]

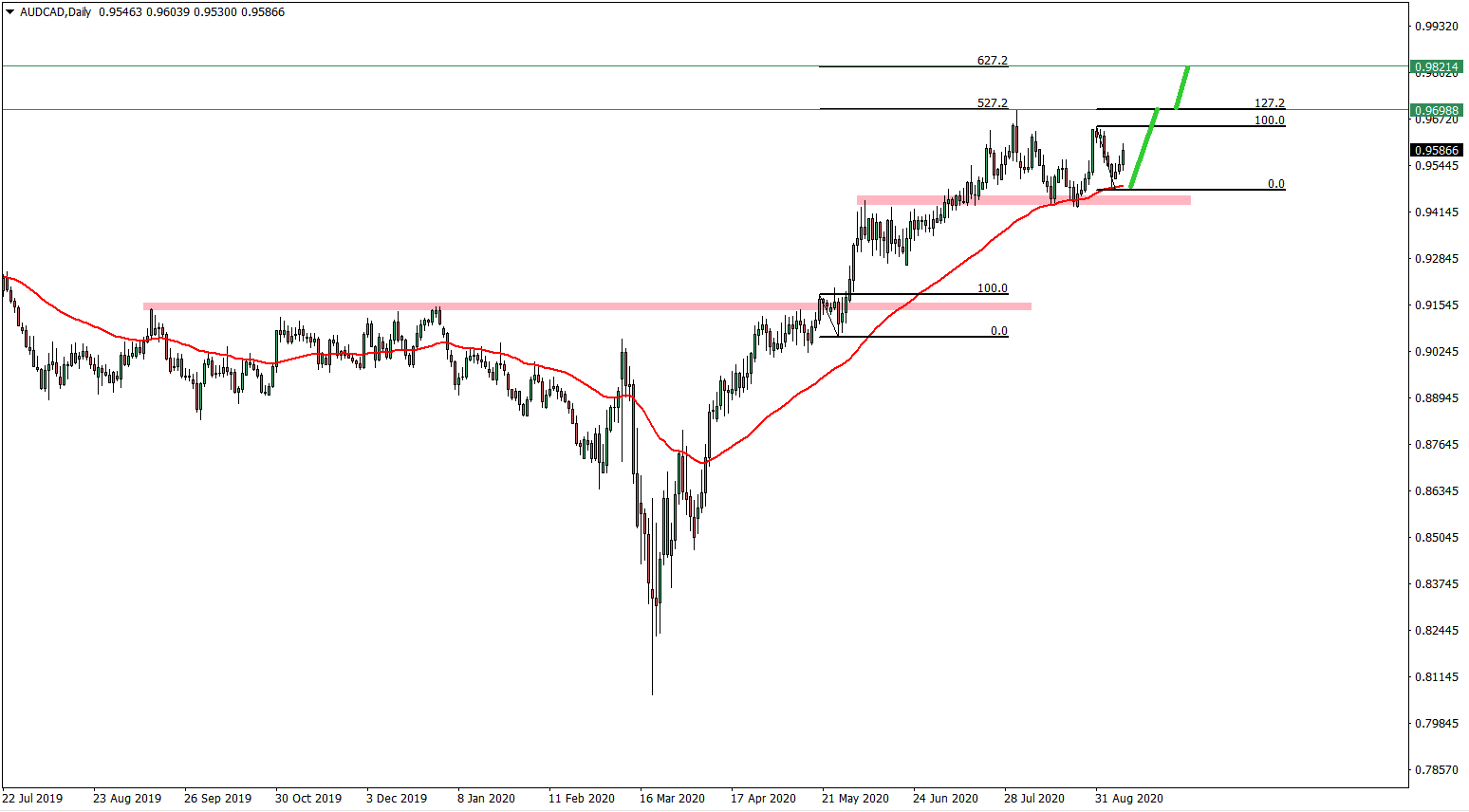

The AUD/CAD shows a potential uptrend taking shape as key resistance levels are tested. Disclaimer: [...]

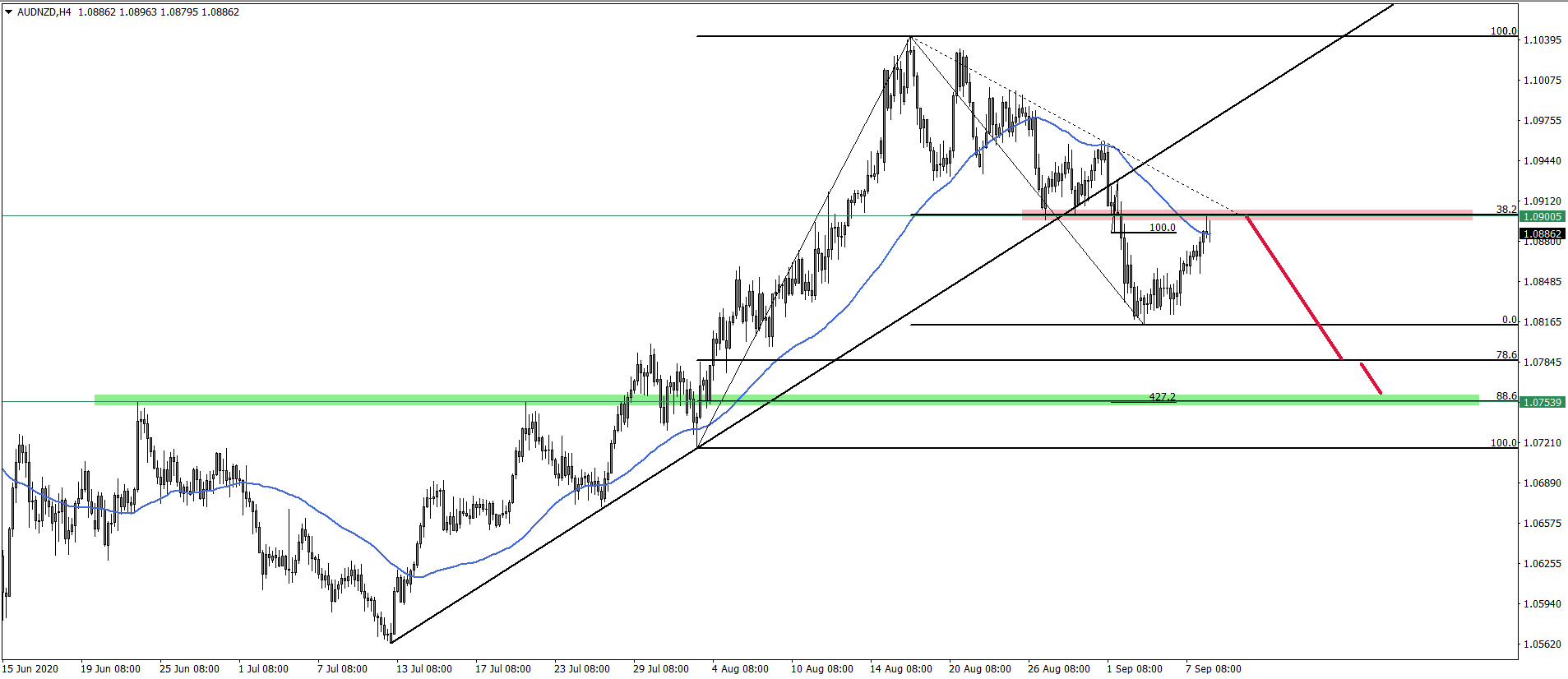

The AUD/NZD currency pair has established a downtrend after there was a confirmed break below the [...]

NZD/CHF has established a clear uptrend on the daily as well as lower timeframes. The first [...]

As long as daily closing prices remain above that support, uptrend continuation should be expected. [...]

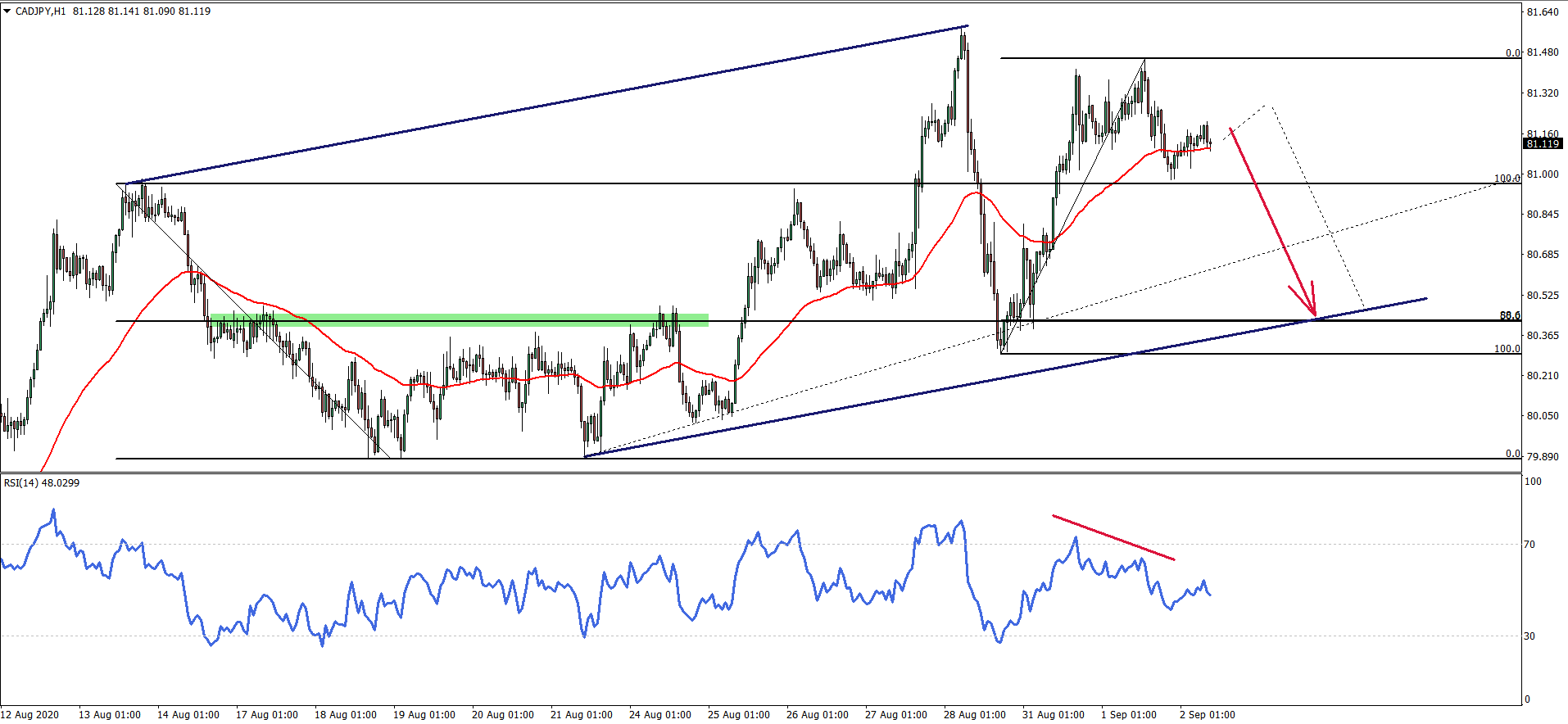

As long as daily closing price remains below the most recent high at 81.45, the selling [...]

On the Daily chart we can witness a strong uptrend which is still valid. This is [...]

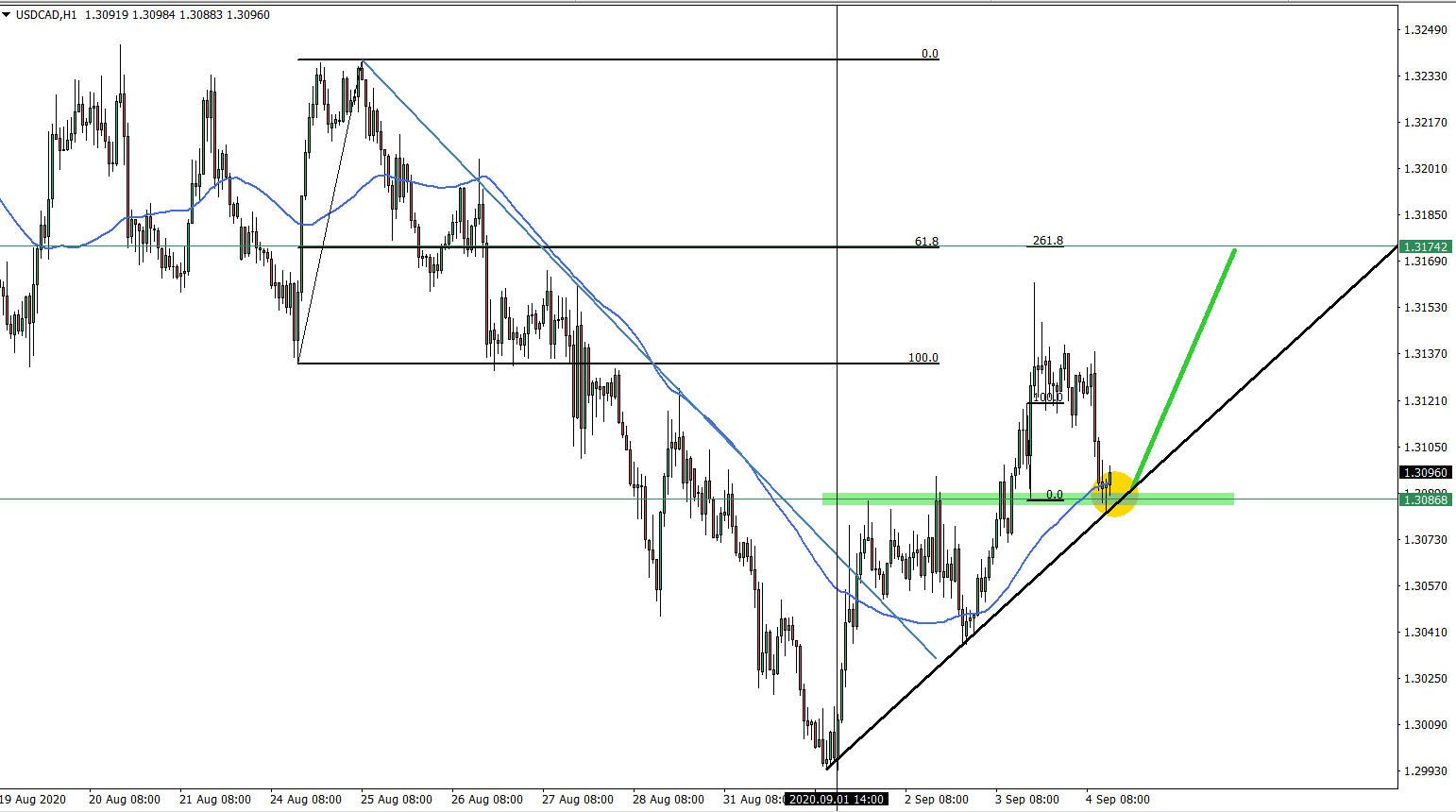

On the Daily chart, the RSI oscillator formed a bullish divergence suggesting either a corrective wave [...]

All-in-all, price rejecting the 50 Exponential Moving Average, and is in favor of the uptrend. [...]

The big picture is that EUR/USD is still trending up, although the price could be slowly [...]

As long as daily closing price remains above $266, BCH/USD will be attempting to move up, [...]

Currently the NZD/USD is forming a triangle pattern, break and close above the 0.6548 recently printed [...]

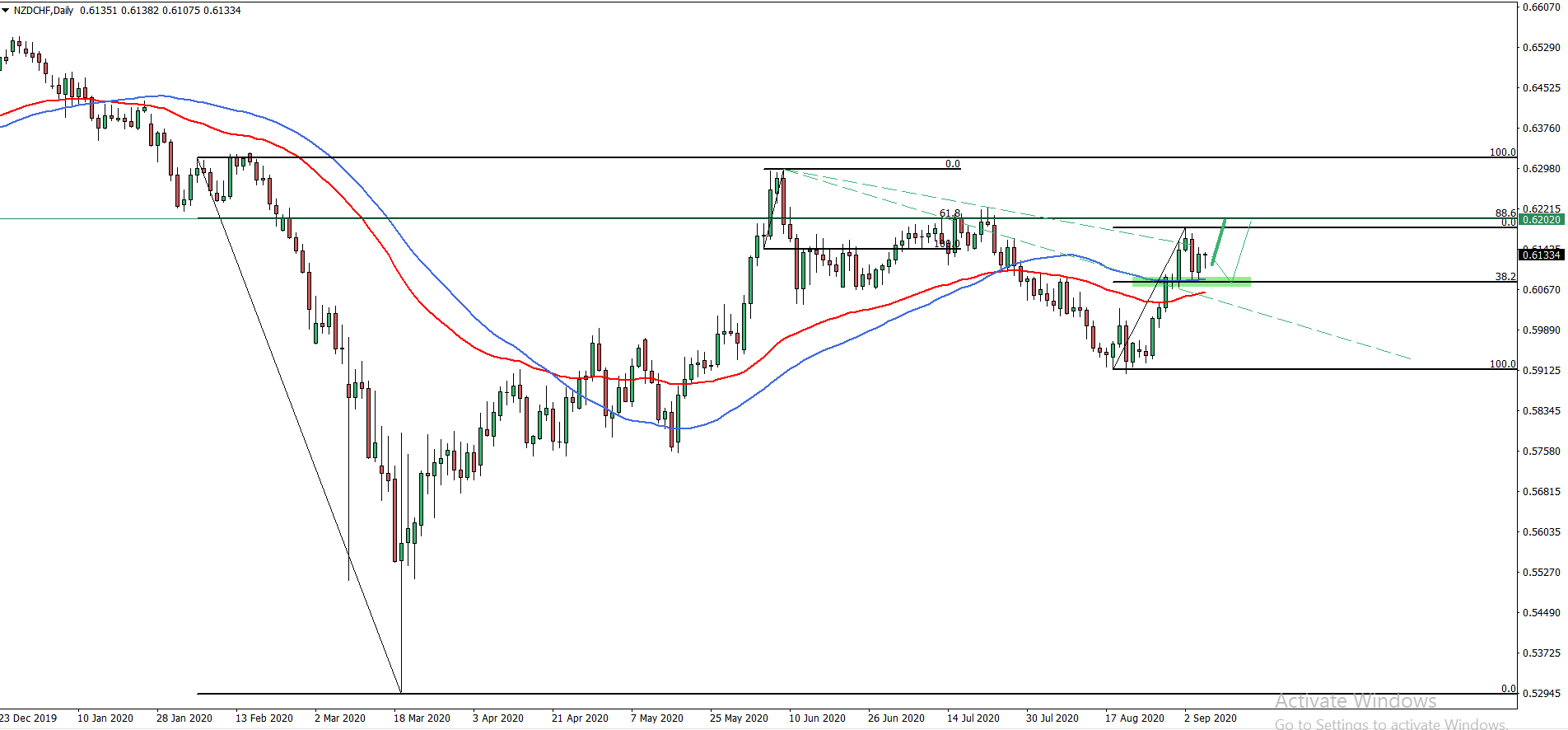

NZD/CHF is expected to initiate a long term trend reversal, and we might be witnessing the [...]

We have shared multiple CHF related ideas where Swiss Franc is expected to be outperformed by [...]

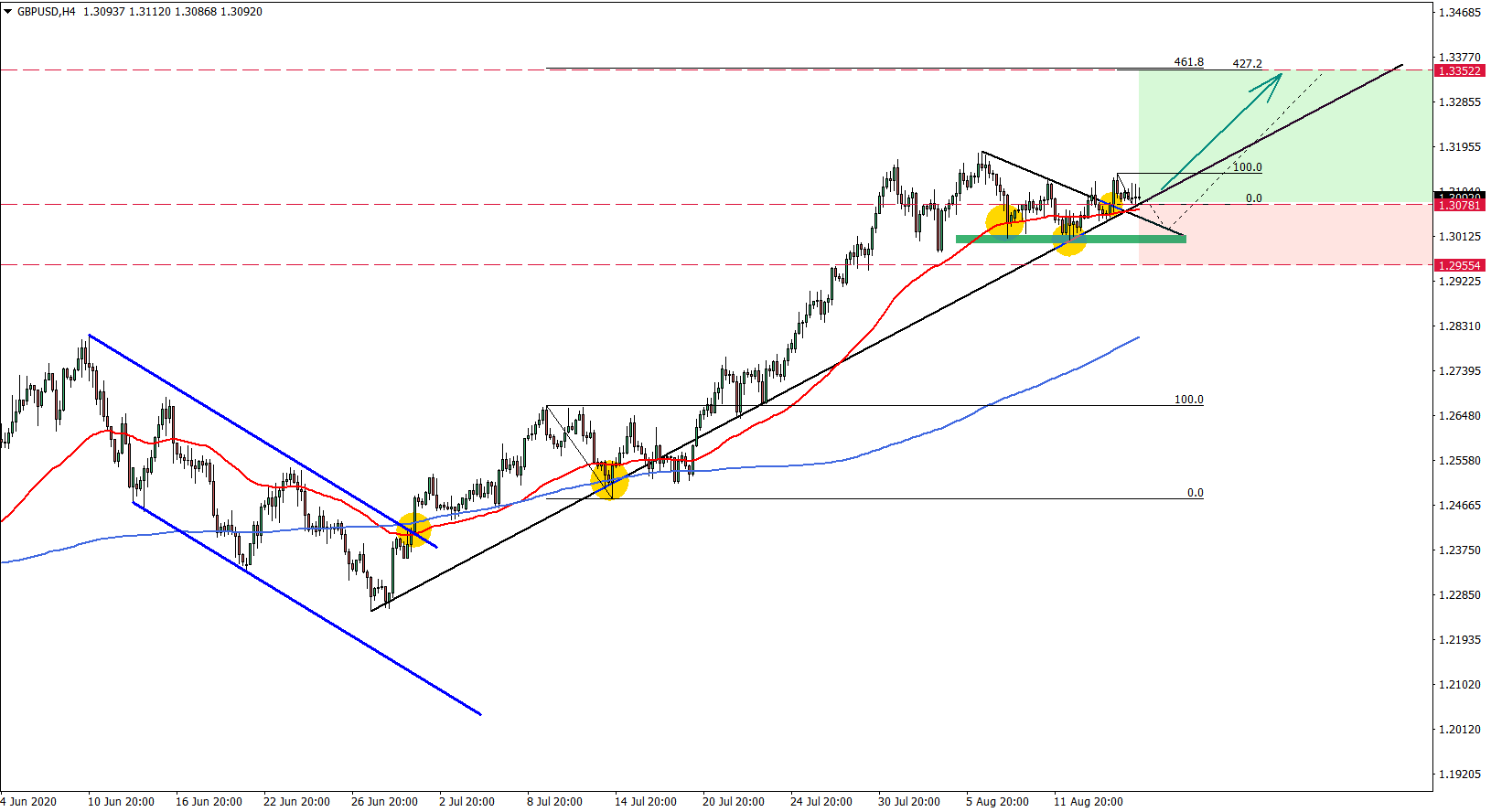

The GBP/USD trend remains extremely bullish and probability is highly in favor of the uptrend continuation. [...]

Join our Telegram Channel

Join our community and get notified right-away when a new trading idea or analysis is out!

And make sure to turn on the channel notifications!

Watch the Videos:

Watch the videos included on each of the blog posts, this will help you to get a better understanding behind the potential market opportunity and you will also learn the rationale that our Forex analysts are using. They might mention critical support or resistance levels, price patterns that they identified and how they are applying different indicators on the charts to help them determine which currency pairs might be worth considering for potential market entry.

Check the currency pair for each analysis:

Our analysts have included the name and symbol of the currency pair related to a specific analysis. Make sure to open the same chart in your trading platform so you can follow along.

Make sure you understand the trend direction:

We publish both bullish and bearish setups. The nature of each analysis is included in the post. Don't forget to consider this, especially if you want to place a trade on your demo account.

Replicate the setups in your trading platform:

Practice your skills by replicating the analyses we share; this will help you to gain traction and come up with your own trading ideas.