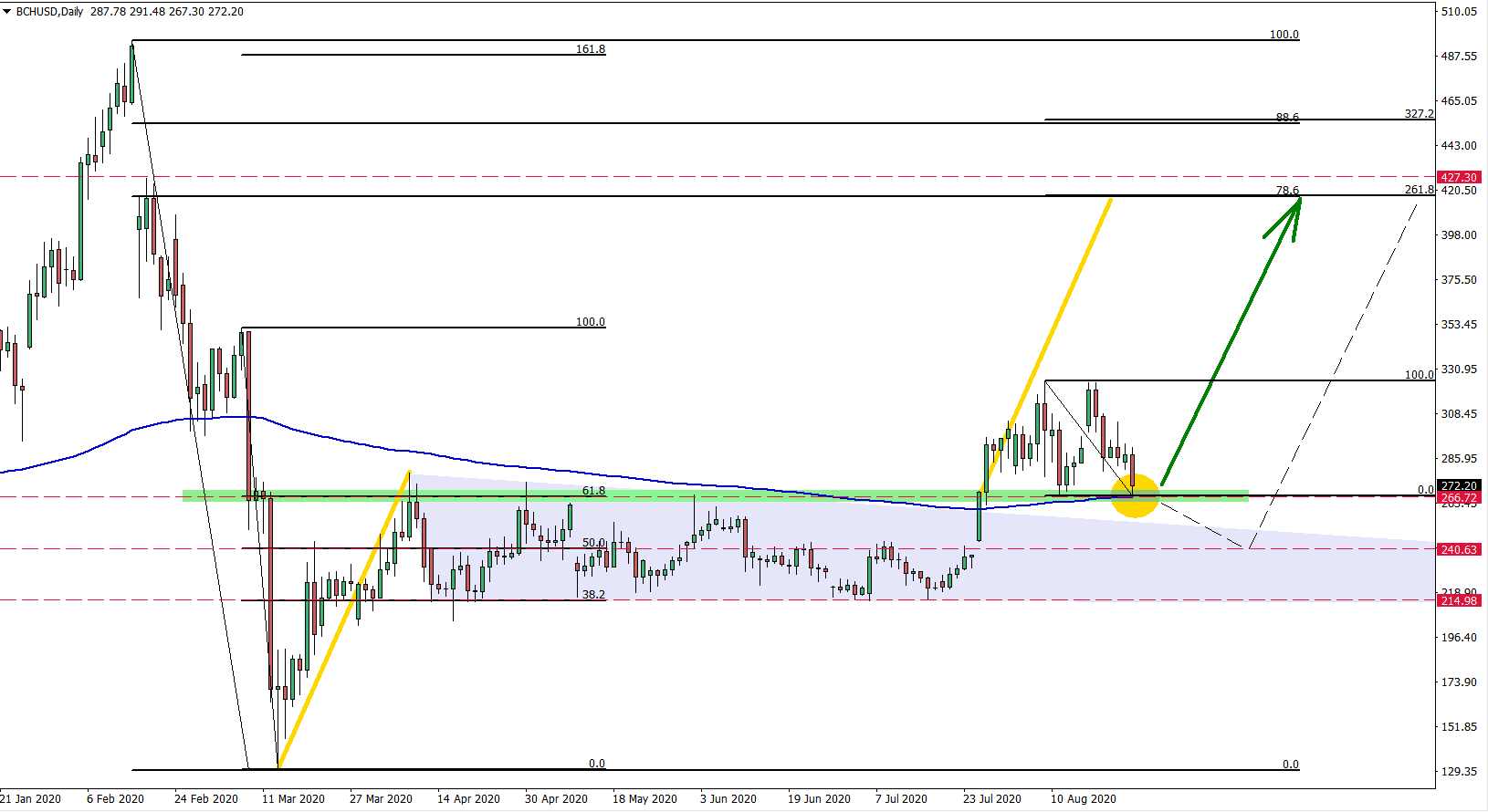

As long as daily closing price remains above $266, BCH/USD will be attempting to move up, potentially to test one of the key resistance levels supported by Fibonacci retracement levels. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice. This analysis was done […]

Currently the NZD/USD is forming a triangle pattern, break and close above the 0.6548 recently printed high, could be a strong confirmation of the buying pressure. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice. This analysis was done on MetaTrader 4. Click […]

NZD/CHF is expected to initiate a long term trend reversal, and we might be witnessing the very beginning of a huge upside move. This can only be true as long as 0.9000 support holds. It is also worth mentioning that it is a counter-trend trade idea, which makes it a risker opportunity. However, this idea […]

We have shared multiple CHF related ideas where Swiss Franc is expected to be outperformed by other major fiat currencies. It is highly likely that JPY will outperform the CHF, at least in the short term, which will result in a CHF/JPY downtrend. Disclaimer: The analysis presented in this article is for educational purposes […]

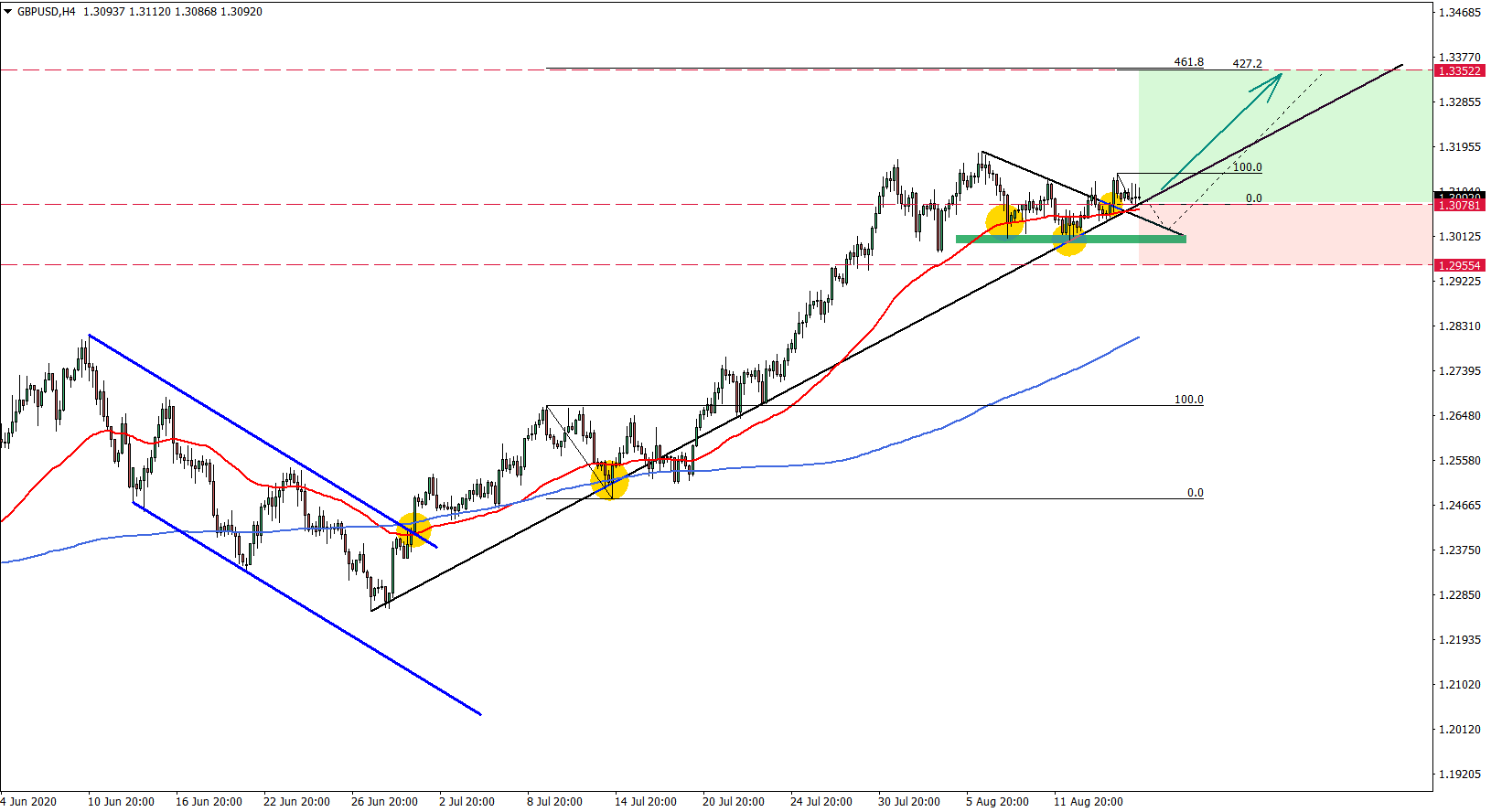

The GBP/USD trend remains extremely bullish and probability is highly in favor of the uptrend continuation. Although 1.3000 must be watched for a break below very closely as it remains a key support area. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice. […]

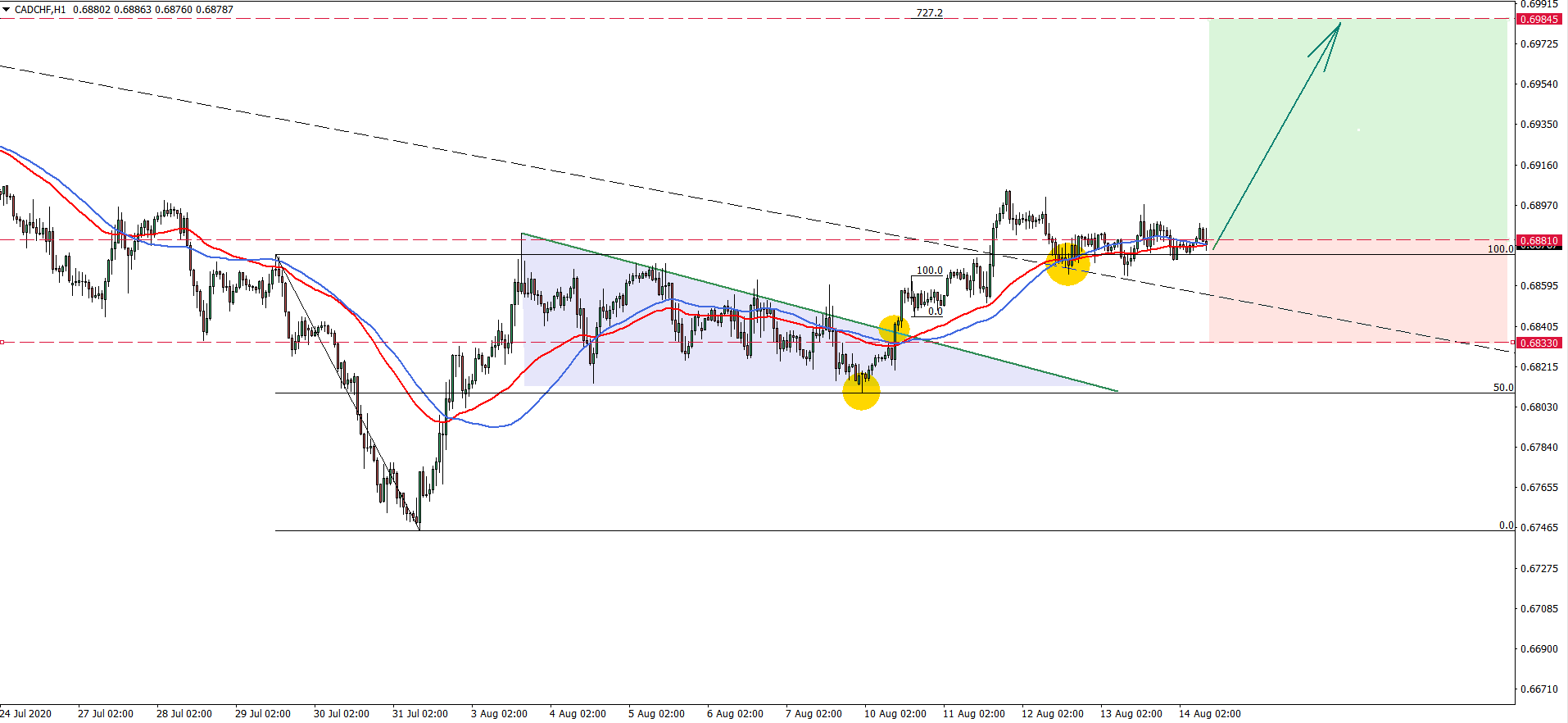

We have provided multiple CHF ideas, where each and everyone one of them suggests weak Swiss Franc. It is very probable that CAD/CHF will follow the path of the CHF weakness and pair will continue to produce higher highs and higher lows at least in the short term. Disclaimer: The analysis presented in this […]

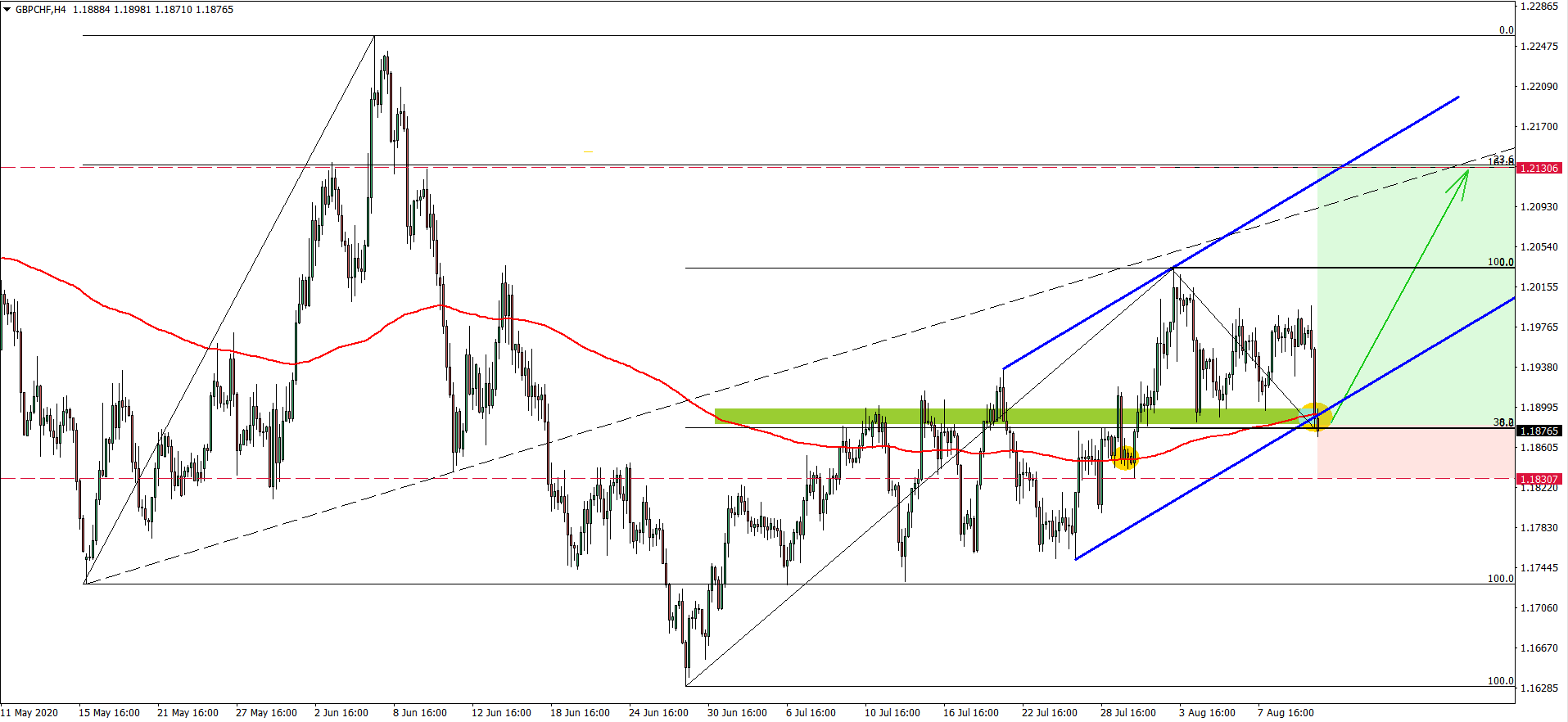

Along with multiple other CHF pairs, where Swiss Franc is expected to be outperformed, GBP/CHF short, medium, and even the long term uptrend might be about to start. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice. This analysis was done on MetaTrader […]

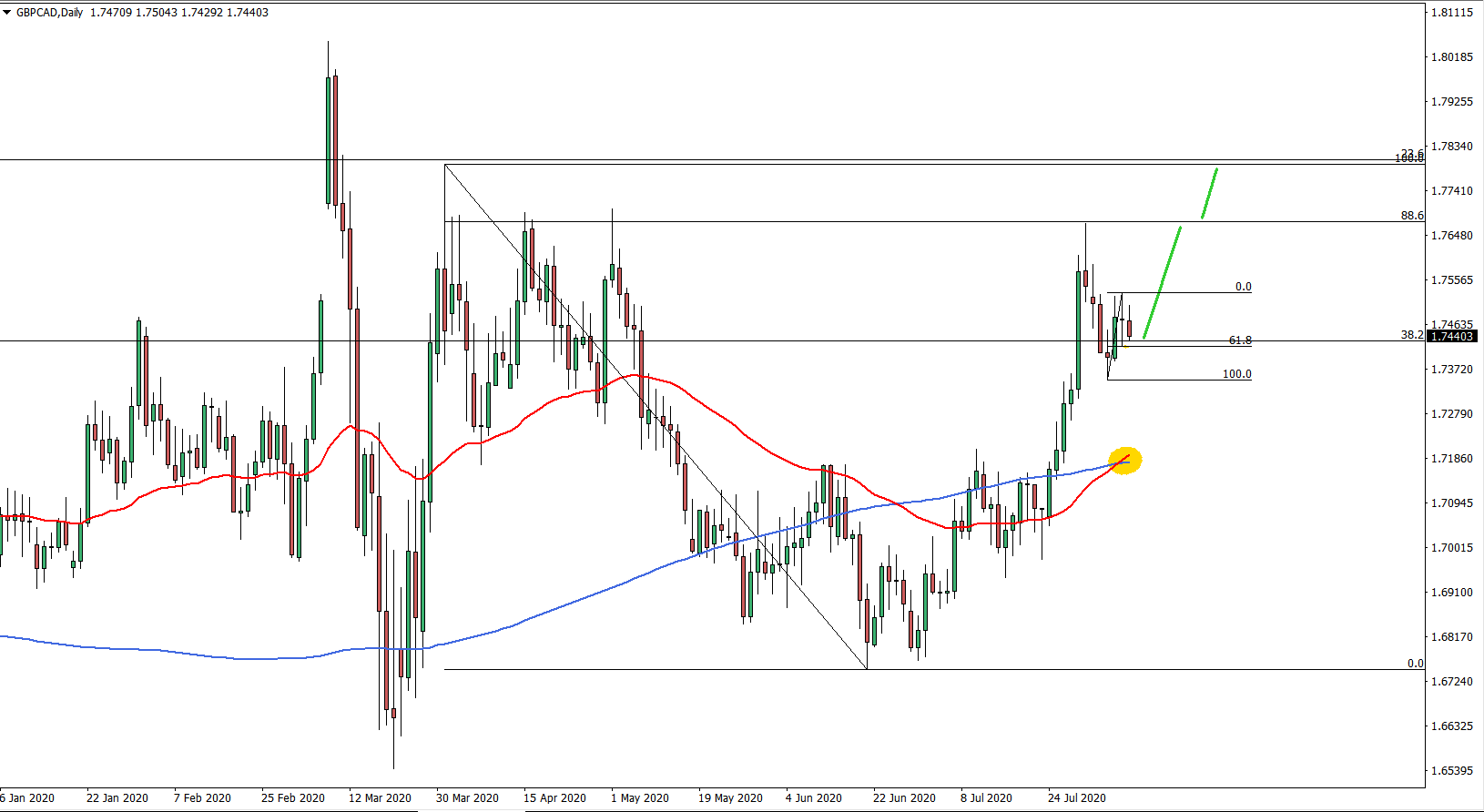

The GBP/CAD trend remains very bullish and the current pullback could be providing a reasonable buying opportunity for the short, medium and even long term. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice. This analysis was done on MetaTrader 4. Click below […]

All-in-all, AUD/JPY trend remains strongly bullish and triangle breakout just emphasizes growth potential. Considering the rejection of multiple support levels and indicators, the price should be ready for yet another 200 pip upside wave. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice. […]

While the uptrend is expected to continue, the downside correction could be extended. Daily break and close below 1.5707 is likely to result in the price drop towards the next support at 127.2%, which is 1.5628, before/if uptrend will resume. Disclaimer: The analysis presented in this article is for educational purposes only and should […]