This article is about profit. More precisely, how to use the Forex market to get a high reward from a trade. But does a high reward come with a high risk?

And, if yes, what is more efficient? A constant high win rate or a high reward as part of an appropriate risk-reward ratio?

In other words, it is about money management. Or, how we, as traders, should manage a winning trade but also a losing one.

There is a constant struggle between what traders do and what they ought to do. Don’t think for a second that traders don’t know when they’re on the wrong side of the market!

All the technical indicators are there to show that. However, something keeps them from pulling the trigger.

Is it hope? Or, maybe the desire to keep the Forex percentage intact?

In any case, there’s one thing we do know. It is human nature!

Many traders never heard of what a risk-reward ratio is. Hence, we’ll explain it here.

Moreover, most retail traders can’t make a difference between a high risk approach and a conservative one. Thus, we’ll clear that too.

Also, we’ll touch subjects like:

- why traders lose if they have a winning strategy

- why isn’t a high win rate always bringing profits?

- how to avoid overtrading to obtain a high reward

- appropriate risk-reward ratios in Forex trading

- human nature and its importance in FX trading

- how to become pro trader

Lastly, we’ll cover the rise and fall of retail traders. That is, the emotional rollercoaster trading is.

Sometimes even the best Forex strategy results in a losing trade. But that’s ok if it is part of the plan. If that’s the case, traders avoid the emotional pitfall easily.

Money Management – Key to a High Reward in Forex Trading

Retail traders come to the Forex market for various reasons. Some expect to get rich overnight. Good luck with that!

Others just want to “play the game.” But this is no game. Games are fun, but Forex can take a healthy bite of your savings if you have a high risk approach. And, don’t know what you’re doing.

Some other traders like the adrenaline. Or, like losing, in the sense that they don’t care if they lose or win, as long as they are in the game.

Yes, you got it right! Human nature makes us do the same thing but have different motives for it.

A high risk approach doesn’t always lead to losses, though. Instead, it may result in a high profit trade setup at the right time.

All traders listed above know Forex trading can change everything. But do you have the balls to come and get it?

We know that markets mostly consolidate. Hence, looking for a high reward in terms of pips, won’t help.

However, a scalping Forex strategy may do the trick. First, set up the parameters. That is, set the stop-loss and take-profit levels. Or, define the risk and the reward.

Second, adjust the volume. There’s a time to stay put, and there’s a time to be aggressive. Decide what the time is!

Finally, trade the plan. This is where most retail traders fail. But again, it’s normal – it’s only human nature.

A high risk approach to markets can break you. It’ll break your account, and your self-esteem too.

However, without a high risk, there’s no high reward. They go hand in hand all the time.

Ever trader heard of George Soros. The man who broke the Bank of England!

He looked for a high reward. But, he risked everything.

High Risk-Reward Ratios in Forex Trading

Few know that it wasn’t the first time Soros played a big hand. Or, had a high risk approach to go for the high reward.

Only the previous time he did that, he lost about five hundred million dollars. However, he didn’t lose his faith. And that served him well, eventually. He became a pro trader.

Trading terminology defines the risk-reward ratio as a mandatory setup. How much traders win for a designated risk!

Trading is a game of probabilities. If anything, an analytical mind helps.

An old saying goes that you should know your way out before you go in. That’s from war strategies, but the same applies to trading.

If traders know the risk-reward ratio that makes sense for the trading account, they know what to look for. Moreover, they’ll know how to research for the best approach to a winning Forex trade strategy.

For example, assuming a trader has an eighty percent Forex trade win ratio. Effectively, it means that eight out of ten trades the trader makes a profit.

That’s great! However, the devil stays in the details.

An eighty percent win rate with inappropriate risk-reward ratio leads to disaster. In time, the twenty percent losing trades will account for more than the winning ones.

Hence, the focus is to find high risk-reward ratios. And, to let the market go for them.

Don’t just close a trade for the sake of booking profits. Instead, let the profits run.

For the moment that one rule for one trade is broken, the entire arithmetic crumbles. Next, traders’ faith crumbles too. Finally, the trading account suffers significant losses.

But how to find proper risk-reward ratio? Moreover, what is a high reward forbidden to retail trading? Or, is it one? What works best?

High Risk-Reward Ratios – The Rules of Engagement

Don’t risk more than you can afford to lose. If you think of it, this serves well in life too.

In Forex trading, it sounds better like this: don’t risk more than you can afford to lose on any given trade.

From a money management point of view, it is better to risk a percentage for all trades. It could be one or two or even three percent. Apparently, the lower, the more chances to survive in the game.

After all, that’s the aim. Or, it should be the aim. Make sure you don’t lose in such a way to damage the account.

Traders strive for a high profit rate as soon as possible. And, with as low risk as possible.

But that approach isn’t right. The right path is to look for or find the risk-reward ratio that won’t damage the account if several trades go wrong. Even consecutive ones!

Therefore, instead of searching for a high risk-reward ratio, traders should focus on the RIGHT risk-reward ratio. Here’s what to consider:

- whatever the risk is (a.k.a. the stop loss), don’t EVER settle for a lower reward

- any trading plan with 1:1 risk-reward ratios is a bad plan

- anything beyond 1:1.5 is not a high reward ratio, but a good one

- between 1:1.5 and 1:3 is a normal ratio

- anything above 1:3 is an exceptionally high risk-reward ratio

Obviously, the higher the rate, the better. How come?

The answer comes from the number of losing trades the account can stand without profits declining. Statistics help here.

Risking one percent of the account on every trade and loosing seventy-two (72!) trades in a row won’t blow the account. Instead, it’ll have a fifty percent drawdown.

With that statistic, one shouldn’t trade anymore!

Avoiding Overtrading – Key to Reaching a High Reward Ratio

One of the major “sins” in Forex trading is not understanding the rules. Or, how the markets function.

An important rule refers to correlations. Like it or not, correlations exist both intra- and extra-markets.

For example, some of the Forex pairs correlate with different financial markets. Oil, for instance, enjoys a direct correlation with the Canadian dollar. Or, the other way around.

JPY pairs do the same with the U.S. equity markets. Only that the correlation is an inverted one.

Thus, knowing a few tricks about how financial markets work will help to avoid overtrading. Next, this will lead to a better selection of what to trade. Finally, a high reward ratio for the trading account.

For a high reward, Forex traders go to extreme lengths. Most of the times, they risk more than what’s appropriate.

If it works, it looks like the holy grail. But in trading, the holy grail doesn’t exist.

Or, the holy grail does exist in the form of money management. Managing the risk and the reward in a trading setup is the one thing that leads to a constant growth for the trading account.

Risk on/risk off moves keep tricking traders. When the Forex market moves in a coordinated fashion, human nature intervenes.

And, it has ugly faces. Fear and greed dominate trading.

FOMO (Fear of Missing Out) leads to overtrading. Overtrading leads to overexposure. Overexposure leads to a margin call. Just like that, that’s the order of bad money management decisions.

Even if trading with the right risk-reward ratio, correlations lead to overtrading. Instead of taking five trades averaging one percent per trade, in reality, you’ll trade five percent on the same trade. Correlations matter!

Technical Analysis Tips for High Reward in Forex Trading

Technical analysis provides the ways to reach high risk-reward ratios. So many technical concepts give excellent results, and yet traders disregard them.

The reason is that they don’t apply the right risk-reward ratio as part of any trading setup. Hence, this part of the article aims to show something you already know.

For sure, you must know what’s about to come. But, for whatever the reason, you failed to use it properly. Or, you didn’t believe in the potential of the proper trading setup.

Every trader knows about rising and falling wedges. Besides the fact that they’re known for reversing a trend, they have another advantage. A tremendous one: they give birth to stunning risk-reward ratios.

Looking for a high reward for your trade? Look for wedges and stay disciplined.

Like all things in life, a simple approach means a better plan. Traders look for the best Forex indicator, winning trade ratio at max, and no risk. That’s impossible.

Hence, why not focus on patterns already documented? Or, on trading setups, we know they work? And, try to make them better?

Think of trading theories we still use today. The Elliott Waves Theory, Gartley (a.k.a. harmonics trading), Gann, etc., they were all developed/documented almost a hundred years ago.

How come we still use them today? If traders did not search for a better approach, trading wouldn’t make sense anymore.

For it is human nature, that drives progress. Curiosity, persistence, patience and, in the end, success!

In trading, there’s always the conservative and aggressive approach. And, they both refer to the entry (a.k.a. the trading style) and the way to approach a trade.

Wedges as Part of Disciplined Trading – Key to High Risk-Reward Ratios

Rising and falling wedges belong to the classic technical analysis patterns. Traders love them for the powerful setups they bring. And, the great risk-reward ratios.

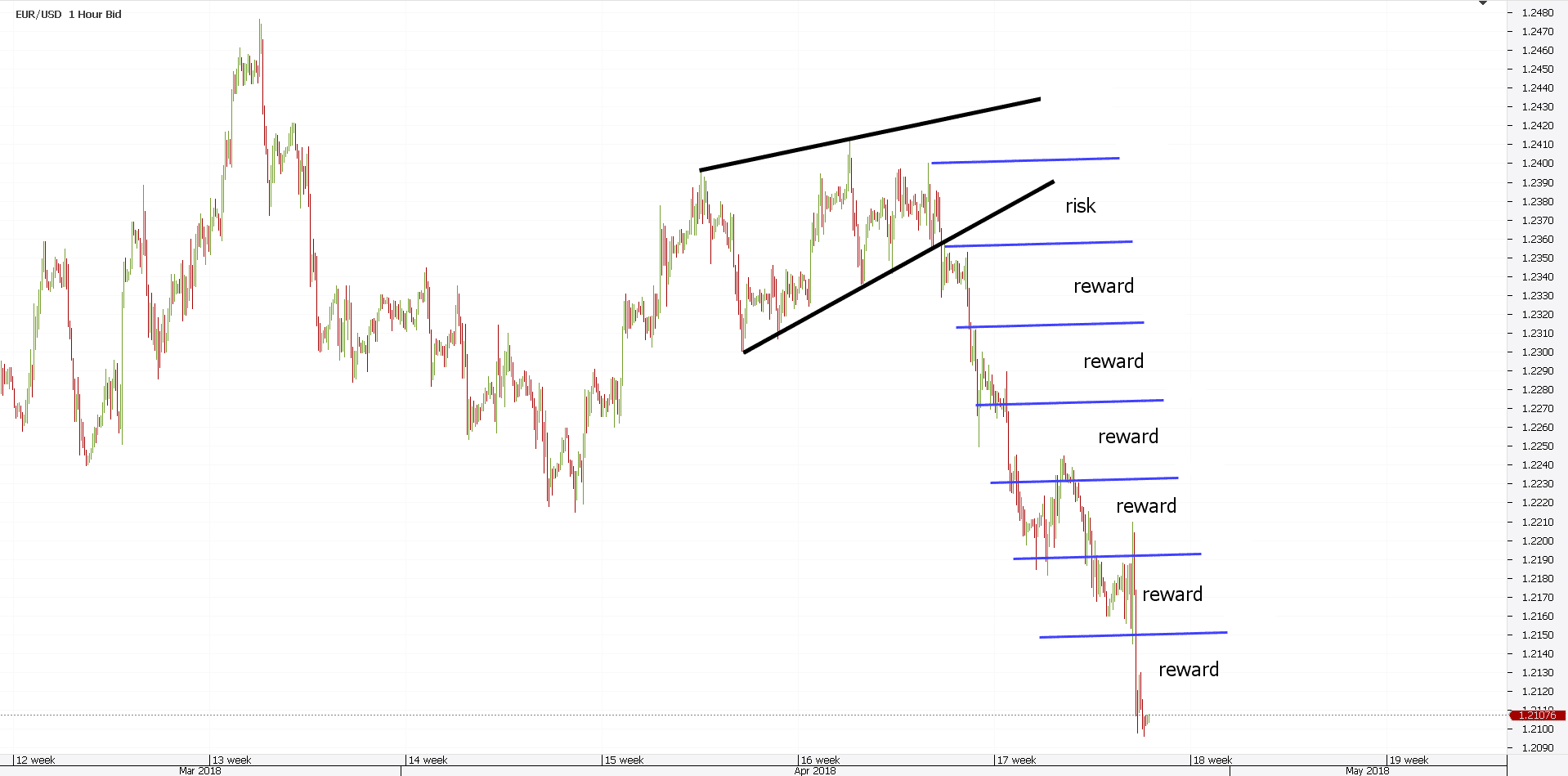

Below is the recent EURUSD price action. The move lower came in preparation for the April 2018 ECB (European Central Bank) interest rate decision and press conference.

As a rule of thumb, when Draghi opens the mouth, Euro falls. Spot the irony, please, it is just a way of saying!

But Euro did fall, the EURUSD in particular. However, before breaking lower, it formed a rising wedge pattern.

Reviewing the rules of trading a wedge, we should go short when the lower trendline, in this case, gets broken. So, that’s the entry.

How about the stop-loss, or the risk? Again, the same rules say that the stop-loss must be at the previous swing’s high. Done?

Hence, we defined the risk. How about the reward?

This is what makes the difference between a high risk and a high reward trade. Pay attention!

After the entry, the risk is defined. Next, human nature comes into play.

With every pip lower, traders will “argue with the tape.” Am I right? Am I wrong?

That’s especially true if the trading setup takes place on a Friday afternoon. Should I leave the trade open over the weekend? Why not closing everything here and now? Take what the market gives you!

Wrong! Wrong! And again, wrong!

If there’s a trading plan in place, let’s stick to it. When doing research and back-testing patterns, few traders consider if between some candles it was a weekend or not.

Also, no one considers greed and fear. Hence, ignore the facts, feelings, sentiments, and stick to the plan.

How Much is Too Much

As already stated, a risk-reward ratio below 1:1 doesn’t make sense. Casinos work like that. Anything beyond, and we have an edge.

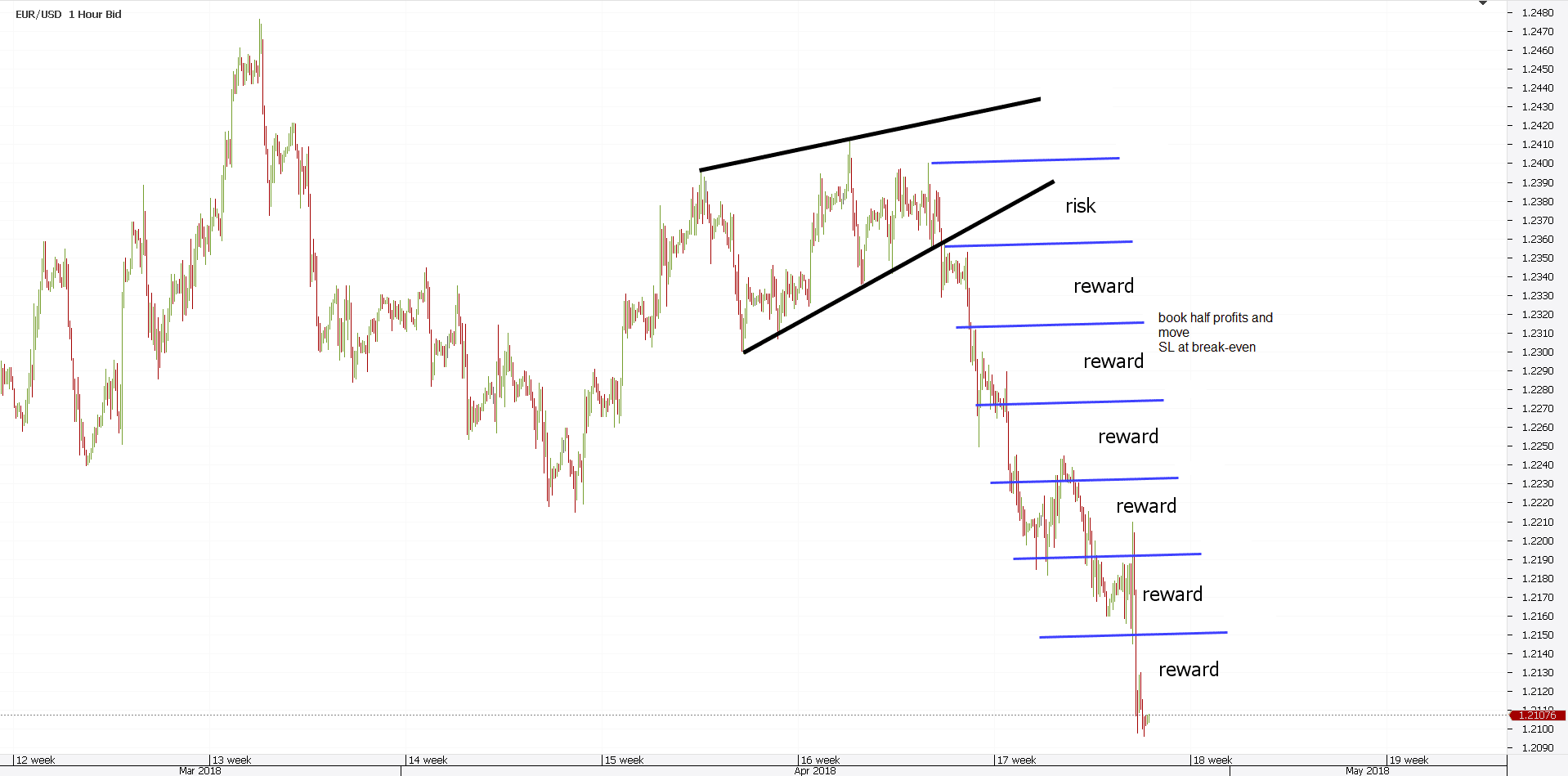

The conservative approach says that by the time 1:1 is in place, move the stop loss to break-even. And, book half of the profits. Just like below:

This way, nothing wrong can happen with the trading account. No matter what the market does next, no loss will appear in the trading account.

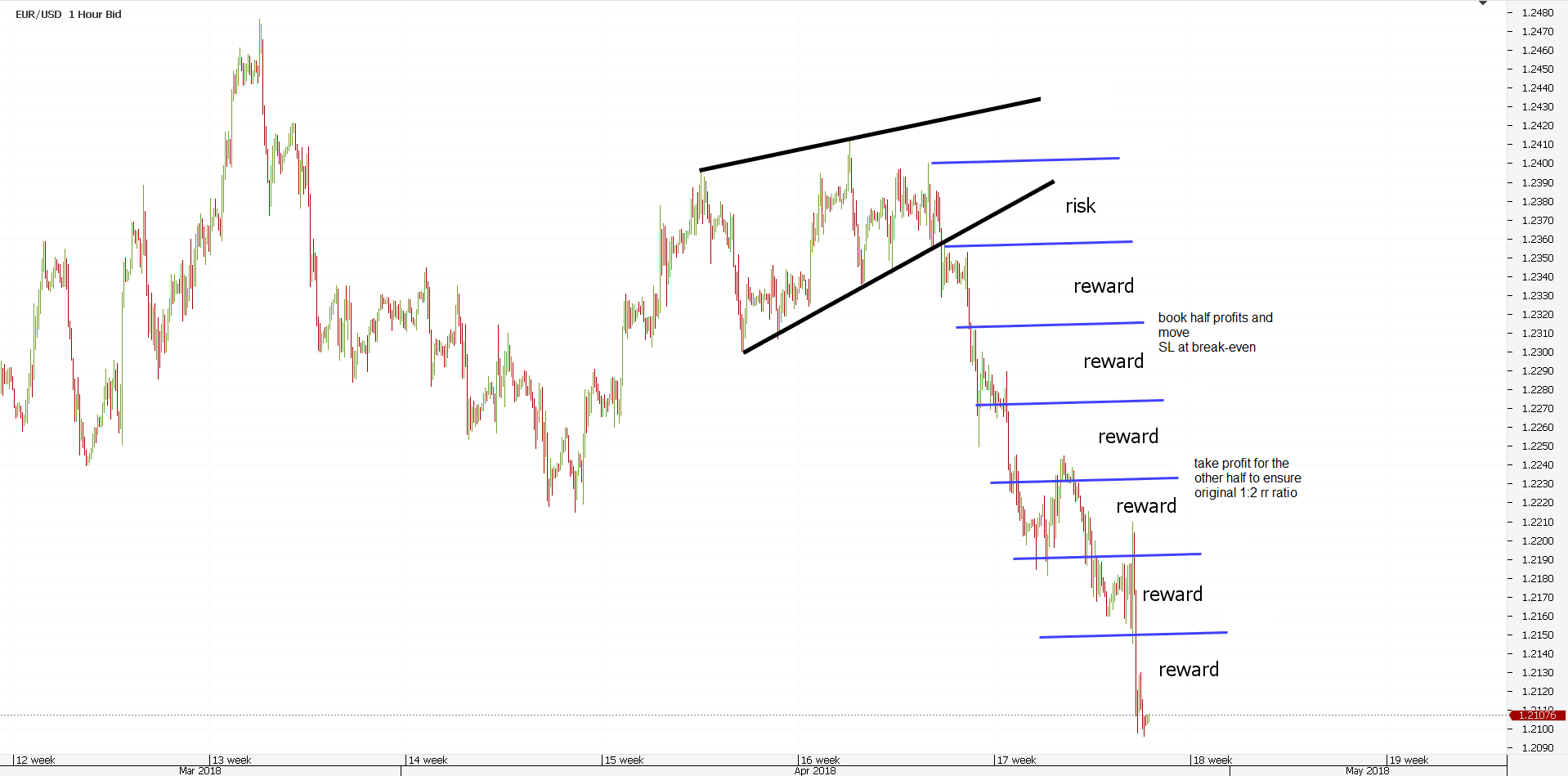

What about the other half of the trade? The key is to move the take profit for the remainder to such a length that it covers minimum the original 1:2 ratio.

Hence, the take profit for the second half comes here:

Anything below that level is a God’s gift. This is how you build a high reward approach to a conservative trading style!

How about the aggressive style? That’s easier to explain:

- set a minimum 1:2 risk-reward ratio

- add to the short side every time the price travels the original risk

- move the stop loss for the entire trading position to the previous level

Comparing the two, one requires more attention, patience, and dedication than the other. But again, it results in a high reward with no high risk at all!

I’m sure by now you have a different perspective on how to trade a wedge. And all because of a disciplined approach!

Conclusion

High risk-reward ratios don’t come quickly. In fact, in Forex trading, finding such ratios as the one described above is not for the average trader.

A disciplined approach to trading increases the chances to survive in the long run. And, in most cases, this is what matters in the end.

As mentioned in this article, the market mostly consolidates, not trending.

But this is the entire purpose of money management. Of moving the stop loss, adding, cutting losses, and so on.

If the market turns, so be it, it’ll turn without affecting the trading account. Until one time, maybe once a month, when THE trading setup comes.

When prepared, the disciplined trader makes a killing out of it. He/she knows its coming, knows what to do, and how to react to it.

No emotions, just executing the trading plan. It is, in the end, like in a sport or an exercise.

You become better at it the more you practice.

Hence, pick a trading setup that you like the most. In this case, we used the wedges.

Next, set some rules to respect a high risk-reward ratio. Finally, place a high emphasis on supervision, discipline, and execution, for the best high reward possible.

The rest is history down the road of a successful trading story.

START LEARNING FOREX TODAY!

- FOREX

- Forex indicators

- Forex Risk Ratio

- FOREX Strategy

- Forex Technical Analysis

- FOREX trading

- Risk Management

- Risk Reward

share This:

Leave a Reply