We have shared multiple ideas related to the Swiss Franc, where all of them suggest that CHF will be outperformed by other major fiat currencies. The EUR/CHF is expected to follow this path and the uptrend might resume this or next week.

Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice.

This analysis was done on MetaTrader 4.

Click below to open a Free Demo Account with our trusted brokers:

Trade Idea Details:

EUR/CHF symbol on the MT4 platform

Type: Bullish

Key support levels: 1.0742, 1.0717

Key resistance levels: 1.0837, 1.0890

Price Action:

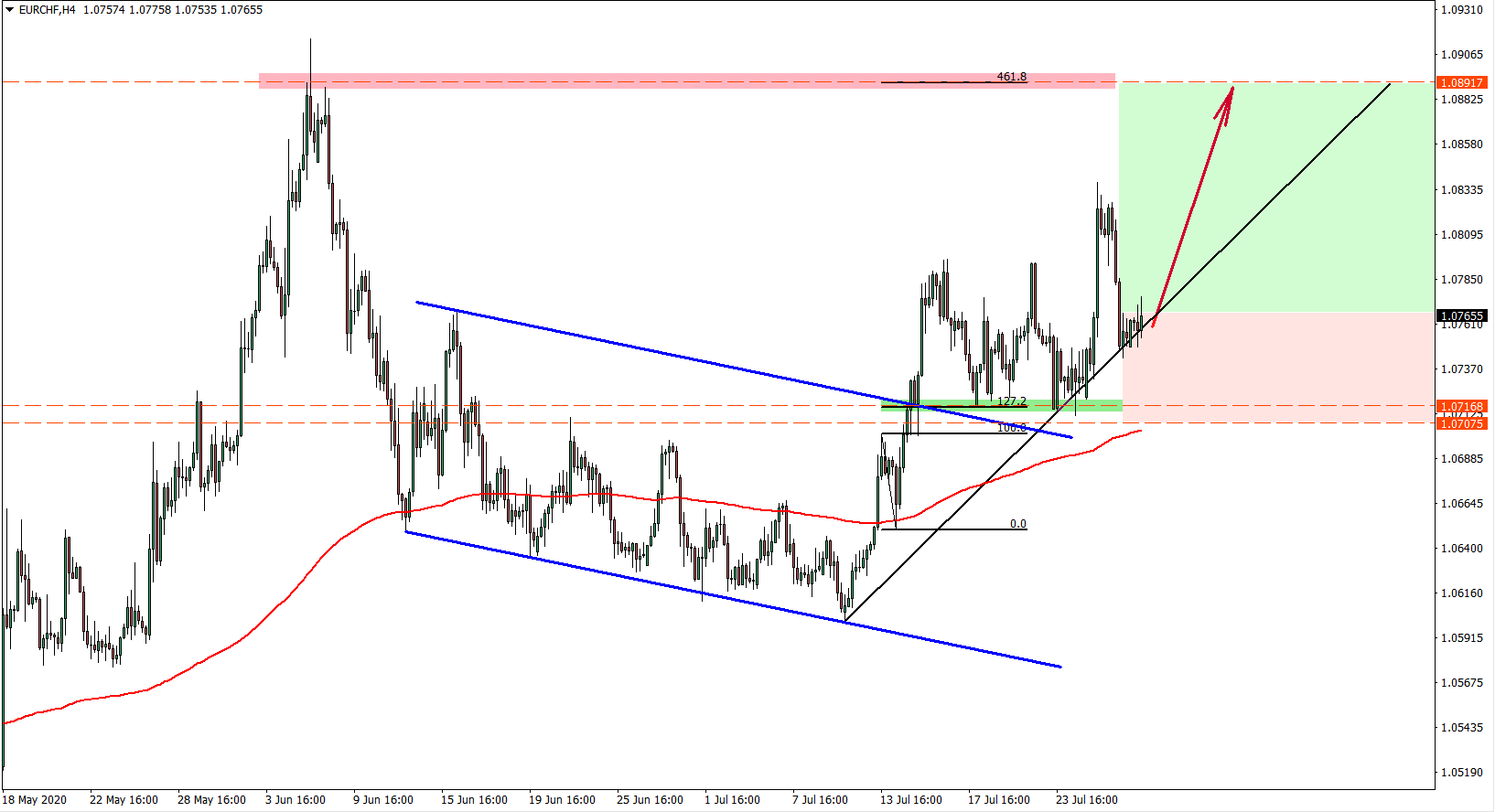

On the 4-hour chart, the EUR/CHF tested and cleanly rejected 1.0600 psychological support back on July 10. Since then pair has been in a steady uptrend producing higher highs and higher lows and remained above the 200 Exponential Moving Average.

The Fibonacci retracement indicator was applied to the corrective wave down after the price broke above the EMA. We can see that the 127.2% retracement level at 1.0717 clearly corresponds to the breakout point of the descending channel. Throughout the past several weeks, this level was strong support that has been respected multiple times. Then the price went up and produced a new higher high suggesting the validity of an uptrend.

Today EUR/CHF corrected down and rejected the uptrend trendline. This could mean that pair is preparing for yet another and potentially final wave to the upside as long as previously established low at 1.0711 is being respected. The next upside swing might result in price moving towards the previously established resistance area near 1.0890. This price also corresponds to the 461.8% Fibs, suggesting a 125 pip move to the upside in the coming weeks.

Potential Trade Idea:

The ideal entry point is seen near 1.0757, which is the 4-hour closing price after the rejection of the uptrend trendline. The upside target is a potential double top near 1.0890 with the stop loss being at 1.0707. The stop loss is placed just below the previously made low (1.0707) and provides a 1:2 risk/reward ratio.

Leave a Reply