Online Forex trading for beginners is not can be challenging if you are not with the right broker. Therefore, choosing the best Forex broker online is the first thing that you need to do as a beginner trader.

Many Forex-newbies fall into the trap of scam brokers, whose only purpose is to steal their money. In order to avoid scammers, it is essential to learn how to recognize the best Forex broker for beginners. We will share with you some of the most important qualities that good Forex brokers share. Then, you will be able to make the right choice and proceed with your first deposit.

The best Forex brokers for beginners combine a few crucial qualities: top-tier regulation, low fees, and high-end user experience. Everything else is secondary.

Table of Contents

Regulation of the Best Forex Brokers for Beginners

The first thing that you need to do when looking for a Forex broker is its regulation. Don’t forget that trading is a financially sensitive activity where you deposit funds with the broker. This is why the best Forex brokers are highly regulated. In consequence, this helps you to ensure the safety of your funds, as you need to have the confidence that someone regulates how brokers do their business.

In advanced economies, there is a governmental entity that follows the business activity of trading brokers. Here are the main Forex trading and financial regulatory bodies around the world:

- Australia – Australian Securities and Investments Commission (ASIC)

- United States of America – Commodity and Futures Trading Commission (CFTC)

- United Kingdom – Financial Conduct Authority (FCA)

- New Zealand – Financial Service Provider (FCP)

An example of a highly regulated broker is AxiTrader – one of the best Forex brokers in Australia. AxiTrader holds a financial service license with the ASIC and the FCA. Also, Axi is a member and holds a license with the Financial Commission.

Forex Broker Fees and Spreads

Every Forex broker needs to charge its clients to be profitable. Some brokers do this by specifying certain fees per trade. Others, especially Forex brokers, charge spreads.

What is Spread?

You have probably spotted that there is always a difference in the price of the Forex pair for going long or short. This is known as the spread.

Imagine you go long with the EUR/USD at 1.1245 USD for 1 EUR. If the EUR/UDS spread is 1 pip, you will pay 1.1246 USD for 1 EUR. The extra pip goes to the pocket of your broker.

You probably now understand that the lower the spread, the less you pay per trade. It is in your interest to work with a broker that has low spreads, especially for the more popular Forex pairs. For instance, let’s take a look at AxiTrader:

AxiTrader Account Types

AxiTrader offers a standard and a pro account. The standard account will charge your trading based on the spread. The pro account will charge you based on minimal raw spread plus a commission of $3.50 per side per trade ($7.00 for a round turn).

AxiTrader Live Spreads

Here are the approximate live spreads that you will get with the AxiTrader standard and pro account:

| Pair | Standard Account | Pro Account |

|---|---|---|

| EUR/USD | 1.1 | 0.1 |

| GBP/USD | 1.3 | 0.3 |

| USD/JPY | 1.1 | 0.2 |

| AUD/USD | 1.2 | 0.3 |

| USD/CAD | 1.2 | 0.5 |

| USD/CHF | 1.2 | 0.4 |

| XAU/USD | 18 | 8 |

The standard and the pro account give great flexibility to your trading. If you are trading small amounts, you don’t need to pay the $3.50 commission per trade. The standard account is the cheapest choice for you here. But if you are trading bog, then the spread will increase. In this case, the pro account will be a better solution for you. It will keep the commission you pay at $3.50 per trade plus a very little spread.

The spreads of AxiTrader can go as low as 0.1 for the EUR/USD with their pro account. Spreads are live and dynamic, there are cases when the EUR/USD spread even goes to 0. On the other side, popular brokers like Plus500 and Etoro, charge a minimum of 0.6 pips and 3 pips, respectively. This puts Axi among the lowest spread Forex brokers on the market.

So, choose your account carefully, it is important to get the best possible deal after all.

About Broker Leverage and Margin

Leverage and margin are very similar concepts and refer to borrowing money from your broker. Leverage is the opportunity to borrow money from your broker. Margin is the money that you have already borrowed.

This might sound strange, but you will need to borrow money from your broker to make sense of trading. If you trade with $10,000 and you put 25% of your bankroll into your trade, how much would you profit? Let’s say the EUR/USD moves from 1.0800 to 1.0770 (30 pips) today.

What is your profit if you are trading in the right direction?

$10,000 X 0.25 X ((1.0800 – 1.0770) / 1.0800)) = $2,500 X (0.0030 / 1.0800) = $2,500 X 0.0028 = $7 profit.

Is $7 a day a high profit? Please note that catching a 30 pips move is a great success in trading. It won’t happen every day.

If every second day you gain $7 and you lose $6, you are profitable. For one month you would make 15 days X $7 = $105 and you would lose 15 days X $6 = $90.

Giving you a net profit of $105 – $90 = $15 for the month.

If you have traded with leverage from your broker of 1:100, you would have multiplied that effect by 100:

$15 X 100 = $1,500 for the month. This is a sum that you can make a living with.

See, with leverage you can “lift” a bigger “object”.

It is the same in trading. Forex brokers will give you leverage to “lift” trades that you usually can’t.

With AxiTrader you enjoy healthy leverage of 1:400 under both the standard and the pro account.

Best Forex Trading Platform for Beginners

MetaTrader 4 is the most popular platform for retail Forex trading. Beginners in Forex tend to prefer MT4 because it is comprehensive and easy to understand. Also, you can customize it the way you want. It uses the MQL4 programming language, which is handy to build your tools and forex robots.

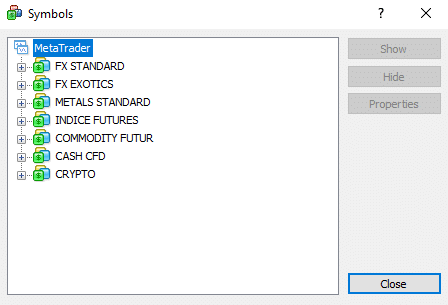

Both the pro and the standard accounts from AxiTrader use the MetaTrader 4 platform. Since MT4 is considered the best Forex trading platform for beginners, Axi stays as one of the top brokers for newbie Forex traders. Here is how the MT4 platform looks like:

In the middle of the screen, you will see a trading chart on a black background. Your trading tools are in the panel above the chart. On the left side of the chart, you have the available trading instruments. At the bottom of the screen is the list of trades. Whenever you open a trade, you will see it there.

Trading Instruments Available

To get started as a Forex trader, you should have access to a diversified trading portfolio for risk management purposes. Good Forex brokers will offer you a wide range of trading instruments to achieve this. Although the major Forex pairs are important, some of the Exotics can give you a rare trading opportunity. This can result in riding a big market swing and many pips in your pocket.

AxiTrader includes more than 80 Forex pairs available. Furthermore, Axi gives you access to trading metals, commodities, indices, crypto, and more.

This set of trading instruments is more than enough for every beginner Forex trader.

Forex Trading Chart Tools

Technical analysis is crucial in online Forex trading. This is how you spot potential short-term price moves to open a trade. But you can’t conduct a proper on-chart analysis if you don’t have the needed Forex trading tools.

The best Forex brokers on the market offer a rich set of charting tools to their clients. These tools will help you draw trend lines, support and resistance levels, and project market moves. Other tools are built-in indicators and oscillators, which sometimes can forecast an upcoming price move.

Fortunately, the MetaTrader 4 platform includes a rich set of trading tools by default. So, if you choose AxiTrader to be your Forex broker, you will enjoy a high-end technical analysis toolbox. And if a tool is missing, you can always build one using the MQL4 coding language or hire someone to do this for you.

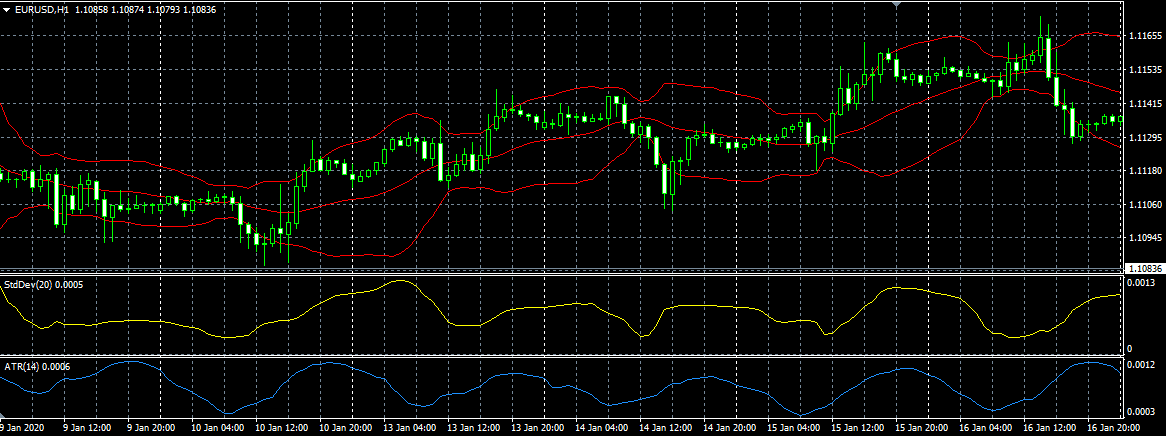

The best feature of the MetaTrader 4 platform is that it has built-in chart templates. Above you see one of them:

- The Bollinger Bands indicator on top of the candlesticks (red)

- Standard Deviation at the bottom of the chart (yellow)

- ATR indicator at the bottom of the chart (blue)

A great asset to your AxiTrader account will be the unique Autochartist tool. This is a separate platform that scans the market for trading opportunities. It gives you indications about the presence of a chart pattern, support and resistance levels, or an unusual market condition. This makes it extremely useful, especially when determining your stop-loss levels. Besides, Autochartist will cost to supply you with daily market reports.

In addition, the Autochartist tool comes as a bonus tool in every live account– standard or pro account. The best is that AxiTrader offers a free Autochartist plugin for MetaTrader 4. This way you will have your screening tools in one place.

Online Forex Order Execution

The connectivity of your broker is very important in regards to price punctuality. The Forex market is very dynamic and the prices change constantly. Every Forex trade is likely to take a certain time for execution. The more time the order implementation takes, the more different the price will be from what you expected.

Imagine you are trading with a broker that takes 10 seconds to execute your trade. When you decide to enter the market at a certain price, 10 seconds later the price could be different. And there is no way back so you since you clicked the button to place the trade.

AxiTrader is one of the best Forex brokers in terms of connectivity. The average order implementation time is 6 milliseconds. One second has 1,000 milliseconds, meaning that AxiTrader processes the orders nearly instantly. In this way, you are very likely to enter the market at the exact price you wanted to get.

Another benefit of trading with Axi is that they will offer you a VPS solution to make sure your trades don’t get disrupted. Under certain trading volumes, AxiTrader will sponsor you for your VPS, and you might even get it for free.

Customer Support

The regulation and the technical parameters are important to choose the best Forex broker for beginners. However, that’s not all. The third parameter of a trusted Forex broker is great customer support.

It is not a good experience to get bad customer support when you have $10,000 in your trading account. Therefore, you better get professional assistance when needed – during deposits, withdrawals, or issues.

The best Forex brokers on the market will respond to your email inquiry in a relatively short time. Although the email support best practices suggest a response within one business day, good brokers will reply within an hour or two.

Reliable Forex brokers have physical offices and take phone calls during business days. This way, if you have an emergency you can get professional help instantly.

Fortunately, one of the strengths of AxiTrader is their dedicated customer support. They are available 24 hours a day in business days. You can reach them via email, live chat, and phone.

Axi also has contact lines in separate countries: Australia, China, Germany, Honk Kong, Indonesia, Malaysia, New Zealand, Singapore, Spain, Thailand, and the UK. Besides this, AxiTrader holds physical offices in Sydney, London, and Auckland, which is an indication of a trustworthy business.

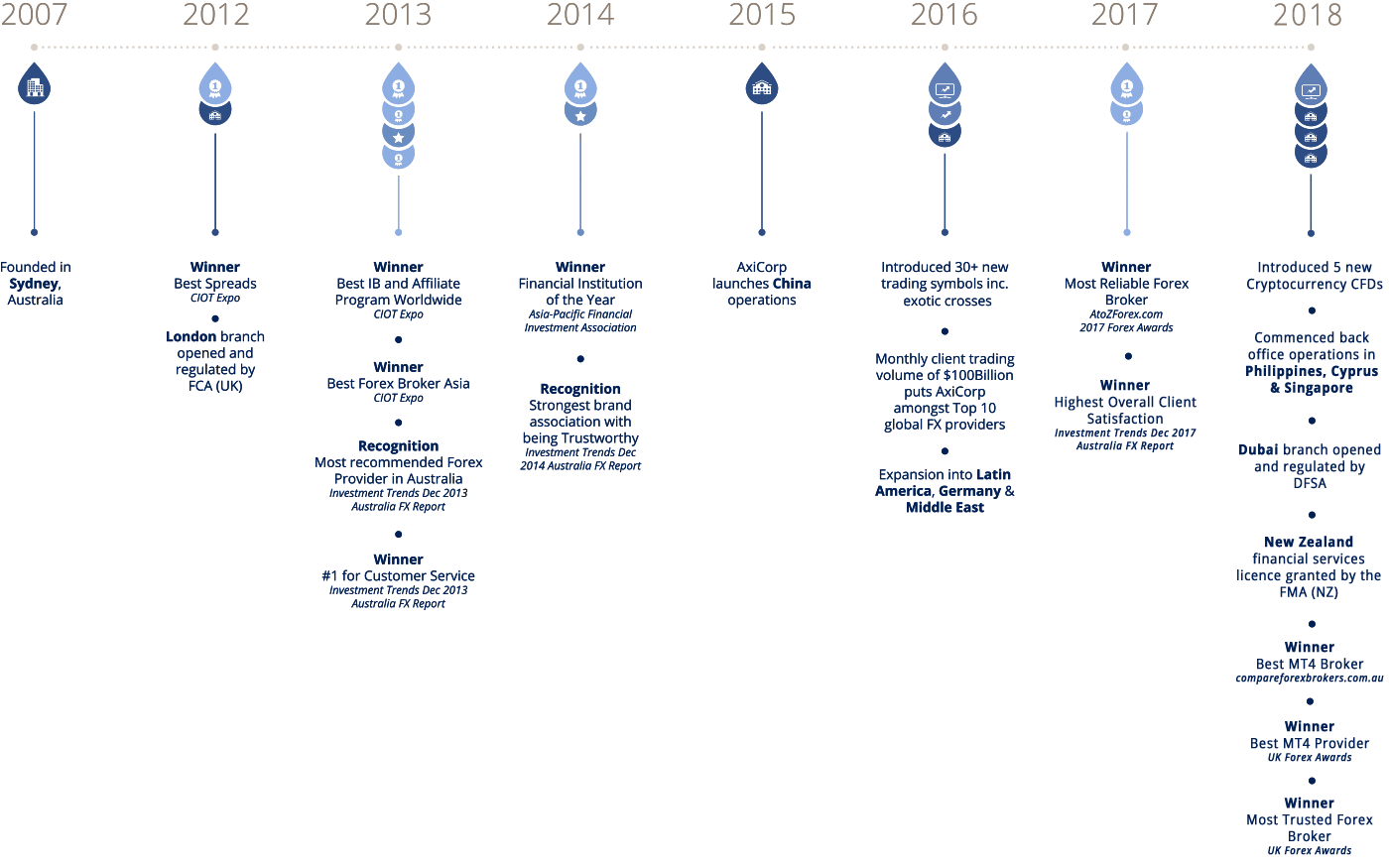

Take a look at the awards they have won throughout the last years:

Dispute Resolution

There are many dishonest Forex brokers on the market that you would like to avoid. A trustworthy Forex broker will provide a strict dispute resolution policy to its clients in order to keep trust.

AxiTrader has a comprehensive complaint handling procedure to guide parties through disputes. It includes instructions on how to file a complaint to their company and the regulatory authority. Compared to most of the brokers, which hide in their shells, Axi has a procedure for both internal and external dispute resolution.

Deposit Methods

You will need flexibility when depositing money into your trading account. Since different countries have different regulations, fees may vary. Therefore, it is convenient to choose the most inexpensive payment method to make your deposit.

The best Forex brokers will offer you a wide range of payment methods. Some of the most common ones are by debit or credit card, wire transfer, or via an online payment processor like Skrill or Neteller.

AxiTrader offers all the options above as deposit methods. Additionally, AxiTrader allows you to fund your account through Moneybookers, Global Collect, BPAY, China Union Pay, and via broker-to-broker transfer.

Withdrawal Options

Withdrawing money from your Forex trading account is one of the most important parts of successful trading. What is the point of having a profitable Forex trading strategy when you can’t get your profits back?

Many Forex brokers will offer you many deposit methods but will only let you withdraw funds via wire transfer. This represents a limitation, as a wire transfer might not be the best withdraw option for your location.

Fortunately, this is not the case with AxiTrader. With Axi, you can withdraw your funds at any time with almost all the payment methods available for a deposit. This includes wire transfer Neteller, Skrill, Moneybookers, BPAY, Global Collect, and China Union Pay. Your funds will arrive in 1-5 business days, depending on the withdrawal method you pick.

How does AxiTrader Stand versus other Brokers for beginners?

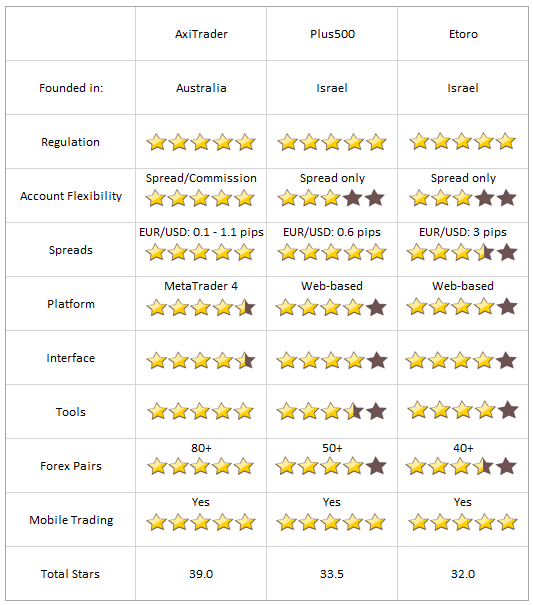

Now that you heard so much about Axi, we suggest comparing them to other top brokers on the market: Plus500 and Etoro.

The table below contains 10 parameters for each broker: Where it was founded, level of regulation, account flexibility, spreads, platform, interface, tools, Forex pairs, mobile trading, and total stars rating.

Origin

Axi is an Australian broker. Plus500 and Etoro were founded in Israel.

Account Flexibility

Axi is more flexible for Forex trading as it also offers an account, which charges based on commission. This way, if you trade huge amounts you will only pay the fixed $3.50 commission ($7.00 round turn), and not a huge spread.

Spread

Plus500 maintains a very low spread on the EUR/USD – 0.6 pips. If you trade based on spread, you will get around 1.1 pips with Axi. Yet, you can always switch on the commission plan and beat that cost. Etoro has a relatively high spread on the EUR/USD – 3 pips.

Platforms

We believe MetaTrader 4 is the best alternative here. It is fully customizable and you can build your indicators, charts, robots, etc. Compared to this, Etoro and Puls500 are limited as you can trade with their web platforms only.

Interface

The interface of the MetaTrader 4 platform is extremely simple. No surprise it is the most used trading platform for retail trading. Plus500 and Etoro also have a clean interface, but still, you will experience limitations.

Tools

MetaTrader 4 is the most complete platform. As we stated, if something is missing, you can either build it yourself or download it. Plus500 and Etoro are behind here.

Forex Pairs

AxiTrader offers more than 80 Forex pairs for trading. Compared to this, Plus500 has 50+ and Etoro – 40+.

Mobile Trading

All three brokers offer mobile trading, which is great!

Total Stars

AxiTrader is the winner here with 39.0 stars. Based on this review, Plus500 gets 33.5 stars and Etoro – 32 stars. With their web platforms, Etoro and Plus500 are weaker in customization. Also, AxiTrader gets ahead with Forex pairs available for trading and with the commission account, which offers cost flexibility.

AxiTrader – The Best Forex Broker for Beginners?

AxiTrader is certainly one of the best Forex brokers for beginners. The main reason for this is that AxiTrader keeps things simple – trading happens on MT4 and pricing is straight-forward.

Axi is one of the best Forex brokers on the market. Since AxiCorp is an Australian company, it is subject to a high-level regulation. A company of this rank can’t take the risk to scam people.

Another great advantage of AxiTrader is that it runs on mobile devices as well – smartphones and tablets.

Trading with Axi is diversified and informed. If you have a hard time with your analysis, the Autochartist tool comes in handy. It will help you comprehend the different market conditions.

With low spreads and the rapid order execution, you are placing orders in one of the safest and cheapest environments. However, always protect your trades with a stop-loss order, you can find this tool in their MetaTrader 4 platform.

Something that makes Axi stand out is the many withdrawal options. You are only 1-5 business days away from your funds.

AxiTrader relies on simplicity and straight-forward trading practices – no sophistication there. This puts Axi as probably the best Forex broker for beginners on the market. See, beginner traders like to keep things simple. If you pile them with complicated trading terminals and comprehensive calculations, you are likely to overwhelm them. This is why AxiTrader stands out when speaking about trading for beginners.

Bonuses and Trading Credit for Beginners

If you are getting started in Forex and you need help to get more funds for trading, we suggest a couple of options here that you can check the following option:

- AxiTrader: 30% extra trading credit in your first live account deposit.

- Forex Penguin compiled a list of brokers that offer no deposit bonus.

START LEARNING FOREX TODAY!

- best Forex broker for beginners

- Broker for Beginners

- currency trading

- day trading for beginners

- Forex Broker

- FOREX for beginners

- Forex regulation

- Forex Trading Broker

- Forex Trading for Beginners

- Metatrader 4

share This:

Leave a Reply