In this article, we will share a candlestick cheat sheet that will help you improve your price action technical analysis. In addition, you will be able to identify the top 5 candlestick patterns and improve your strategy. Forex candlestick patterns are special on-chart formations created by one, or a few, Japanese candlesticks. There are many […]

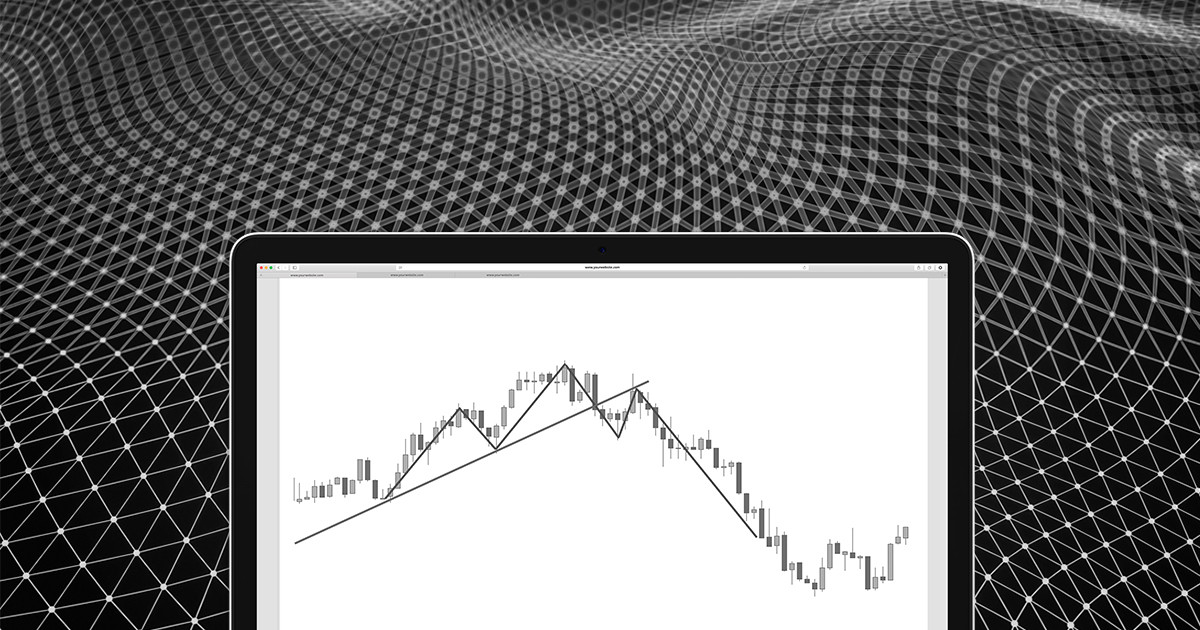

One of the most important ingredients for successful trading is Forex chart patterns technical analysis. Recognizing figures on the graph is an essential part of the Forex strategy of every trader. It is vital that you learn chart patterns and their meaning. I have decided to spare some time to show you how to trade […]

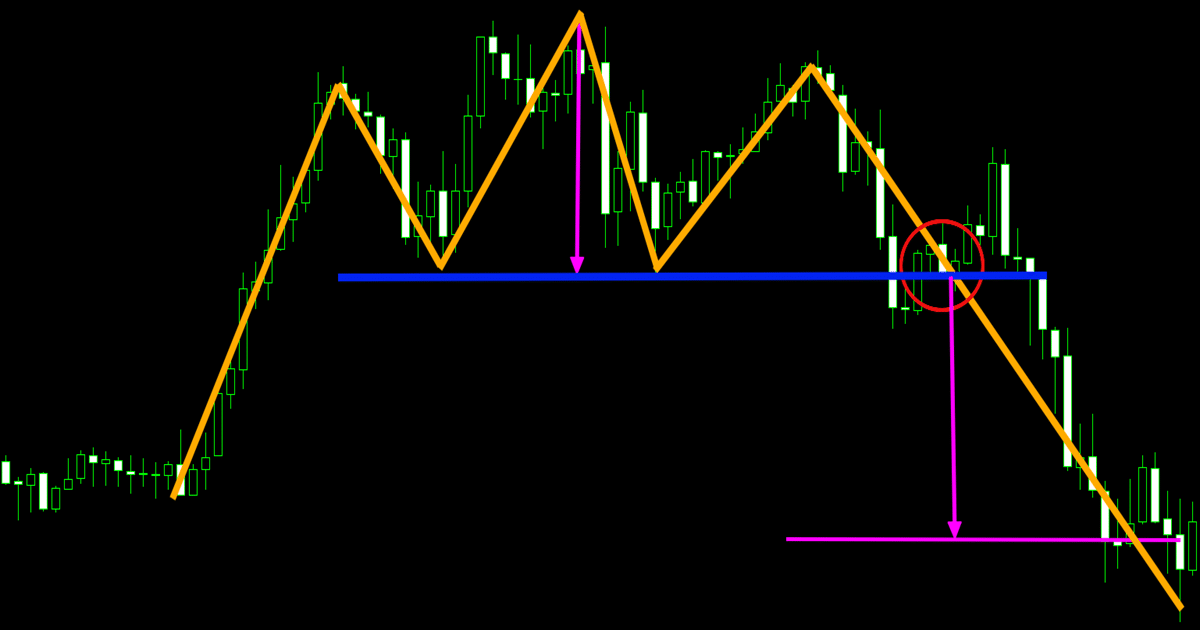

Price action trend reversal strategies are old as technical analysis. Before trading theories and indicators appeared, traders used naked charts to spot the best trade. Technical analysis using price action is the purest approach to markets. Because there’s no indicator to blur the charts, trades become apparent. Moreover, when applying money management rules, trend reversal […]

Among classic technical analysis pattern, the head and shoulder chart pattern stands out of the crowd. A head and shoulders chart is a reversal pattern that allows incorporating both price and time in an analysis. I wanted to get your attention from the first paragraph. Reread it! What’s unusual? Price and time. In Forex trading, […]

Spotting a trend reversal is the dream of every trader. It gives an early entry and offers a competitive advantage against conservative traders. As for reversal patterns, Forex traders have a plethora to choose from. Therefore, they focus on the most powerful reversal patterns and use them with a proper money management system. There are […]

Part of the Japanese candlestick techniques, the hammer candlestick stands out of the crowd. While a single candle pattern, it sends a strong signal to technical traders. Technical analysis as we know it today wasn’t always like this. In time, it suffered changes. A lot of changes. It appeared first in the Western world. This […]

This time I have a Forex video example of a classical pattern that often appears on the Forex charts. This is the Head and Shoulders chart pattern that usually reverses the bullish trends to set the beginning of a fresh bearish run. This is what actually happened on the chart. Signals of the Head and Shoulders Trade The […]

The Forex trading example we have for you today involves a well-known candlestick pattern called Spinning Bottom candlestick. This is a single candle pattern that has reversal functions on the chart. We spotted the pattern on the 15-minute chart of the USD/CHF Forex pair and we traded it successfully. The candle emerged during a price […]

Taking on Forex trading is, like any endeavor, a journey that has its own set of victories and defeats. For you to become a successful trader, besides diligently educating yourself, planning, and executing your strategies, the ability to remain coolheaded and not get tangled up in emotions is as crucial as the rest. This is […]

As you’re likely aware, there are a few different methods you can use to analyse the financial markets. One of them is called Technical Analysis (TA), which is the analysis of charts and the associated data surrounding them. Within this broad description there are a number of different ways you can apply TA, which at least partially depend on the chart types that you use. (more…)