Every trader hates the false breakout pattern. However, a whipsaw Forex environment ends up in multiple fakeout moves. Or, false breakout situations. Therefore, a whipsaw on the Forex market is common. Hence, whipsaw trading is a reality for any Forex trader.

In Forex trading, and not only, a whipsaw shows levels of increased volatility. And, when volatility is on the rise, forecasting a price gets to be a difficult task.

How many times did you open a trade only to see the market moving in the opposite direction? And, now many times did you see that happening in a blink of an eye?

A false breakout does just that. That’s especially true these days.

Because high-frequency trading and automated trading are a reality, whipsaw Forex trading became a must-know technique.

A whipsaw phenomenon happens when markets go in the opposite direction than investor’s prediction. Such fakeout moves are the norm in FX trading.

Technical analysis tries to put an order in chart movements. But, that’s a daunting task.

As execution becomes faster, trading conditions become tougher. Traders face adversities.

And, if there’s one market known for fakeout moves, that’s the Forex market. A false breakout happens all the time.

With this article, the aim is to put an order in these moves. Or, at least to explain how to avoid them. And, recognize them.

As such, we’ll cover the following, but not only, topics:

- What is whipsaw trading?

- How to avoid whipsaw Forex moves

- Why do false breakout moves appear?

- How to spot a false breakout pattern

- How to trade the fakey candlestick pattern

Whipsaw Trading Explained

Forex prices reverse fast. If anything, there’s no other market environment that moves so fast like Forex prices do.

As such, traders end up being disoriented. Everyone agrees that losses are part of the trading game.

But, losses appear for various reasons. A whipsaw is one of them.

A trading loss is the result of a whipsaw. Therefore, traders must understand how they form. Moreover, how to spot them, to avoid being stopped.

In strong market fluctuations, technical analysis indicators give conflicting signals. Some say to go long. Others indicate ranging conditions. Or, to go short.

In the end, the market may do all those moves. It can move South to stop the bulls, only for bears to realize it was a fakeout move.

Next, it will go and stop the bears. Only to end the trading day/week in a range.

If there’s a definition for whipsaw Forex trading, the one above explains it perfectly. However, whipsaw Forex trading can be profitable.

Traders simply need a trading plan. And, it all starts with volatility…

Volatility Indicators in Whipsaw Forex Trading

One way to deal with a false breakout, or a whipsaw, is to trade volatility. That is, to base your trading on volatility.

Volatility levels are everything for a market. When the market doesn’t move, there’s no “vol”.

In traders’ language, “vol”, or volatility, is everything. A market that doesn’t move is dangerous.

It leads to overtrading. And, overtrading leads to excessive losses caused by a false breakout.

Luckily, volatility is a false breakout indicator. As such, volatility indicators represent a valuable tool in any Forex trader’s arsenal.

There are many volatility indicators to use to avoid a whipsaw. Some of the most representative ones are:

- The Average True Range (ATR).

- Chaikin’s Volatility

- The Donkian Channel

- The Normalized Average True Range (NATR)

- Volatility Quality Index.

We won’t go into explaining them all. But, we’ll show a couple of examples using the ATR.

The idea is the same for all volatility indicators. Therefore, if you know how to use one, you’ll know how to avoid whipsaw Forex trading.

ATR and Whipsaw Moves

The ATR or the Average True Range gives an estimation for volatility levels. It shows real trading conditions.

When Welles Wilder Jr. created it, he defined the range by showing the difference between the highest and lowest prices. Of course, within the time frame.

Moreover, the ATR is smoothed by a moving average. But, one should keep in mind that ATR does NOT show a trend’s strength.

It merely shows volatility levels for a currency pair. Lower ATR means lower volatility. As such, traders can adapt the trading style.

Higher ATR values show the possibility for a false break increases. Hence, traders should adjust their stops/strategy.

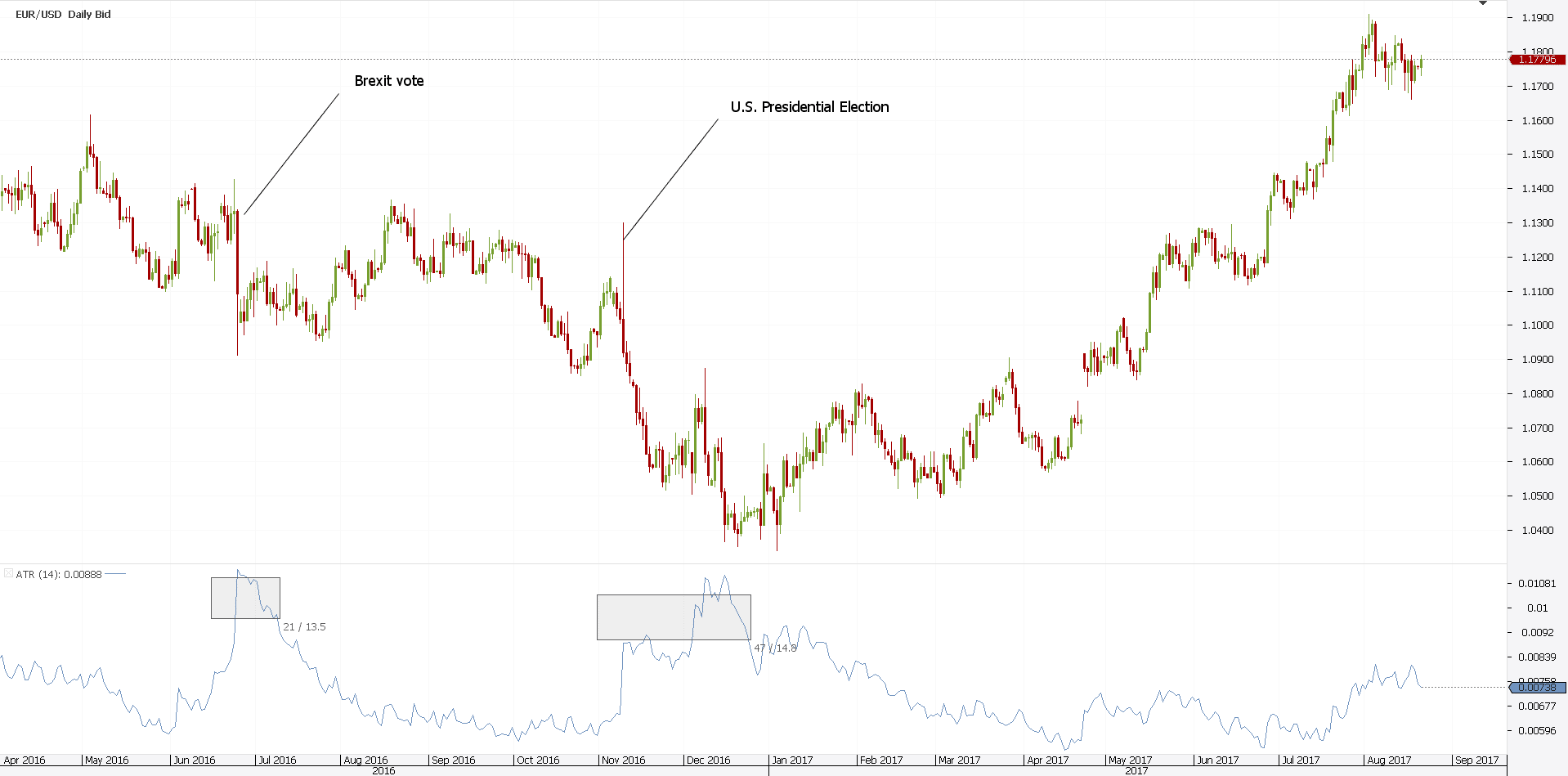

Above is the EURUSD daily chart. It has the ATR(14) attached to it.

Effectively, it shows the volatility levels for the previous fourteen days. Remember the interpretation?

Higher ATR levels show bigger chances for whipsaw trading conditions. Lower ATR levels define a trending environment. Or, decreased false breakout potential.

From left to right, in June last year, we had the Brexit vote. The United Kingdom opted to leave the European Union.

As a result, the EURUSD dropped. Traders sought refuge in the dollar as a safe-haven currency.

But, smart Forex traders know how to use a whipsaw. Or, how to prepare for whipsaw trading conditions.

The ATR was on the rise well before the Brexit vote. So, what did the market do?

A fakeout. That’s the short name for a false breakout.

First, it broke the previous highs. Only to reverse and break the lows. That’s false breakout Forex. And, smart traders know to avoid it by using the ATR.

The same happened with the U.S. Presidential Election event. ATR spiked then consolidated with the newly created trend, then spiked some more. Whipsaw trading at its best!

False Breakout Trading

A false breakout, or a fakeout, happens when the market makes a…false move. This happens often in Forex trading.

Most of the times trading algorithms are programmed to do just that. To push markets until the previous swing’s highs or lows are taken. Next, they reverse.

Is there a false breakout pattern? Or, can we find a pattern for when markets whipsaw?

The truth is that we can’t. There’s no way to find a pattern that fits false breakout trading.

I mean, a pattern that fits ALL whipsaw Forex moves.

But there’s a way to avoid it. That’s as valuable as a profitable trade.

If you can avoid a losing trade, it is like trading a profitable one. After all, only because the markets are open, it doesn’t mean trades should be open.

Quality, instead of quantity, should be the focus. In looking for quality trades, traders avoid a fakeout.

What Makes a False Breakout Pattern?

Pattern recognition is a valuable technical analysis tool. While there’s no pattern to fit all whipsaw Forex moves, there are some that integrate them.

The Elliott Wave Theory has some interesting patterns that fit the definition. But, before going in more details, what are the prerequisites of a false breakout pattern?

To start with, here’s what we should consider:

- A high or a low

- A contrarian move that takes the previous high/low

- Next, an opposite move that takes the previous swing.

If you look at any Forex chart, you’ll find these three conditions. In fact, you’ll find them quite often.

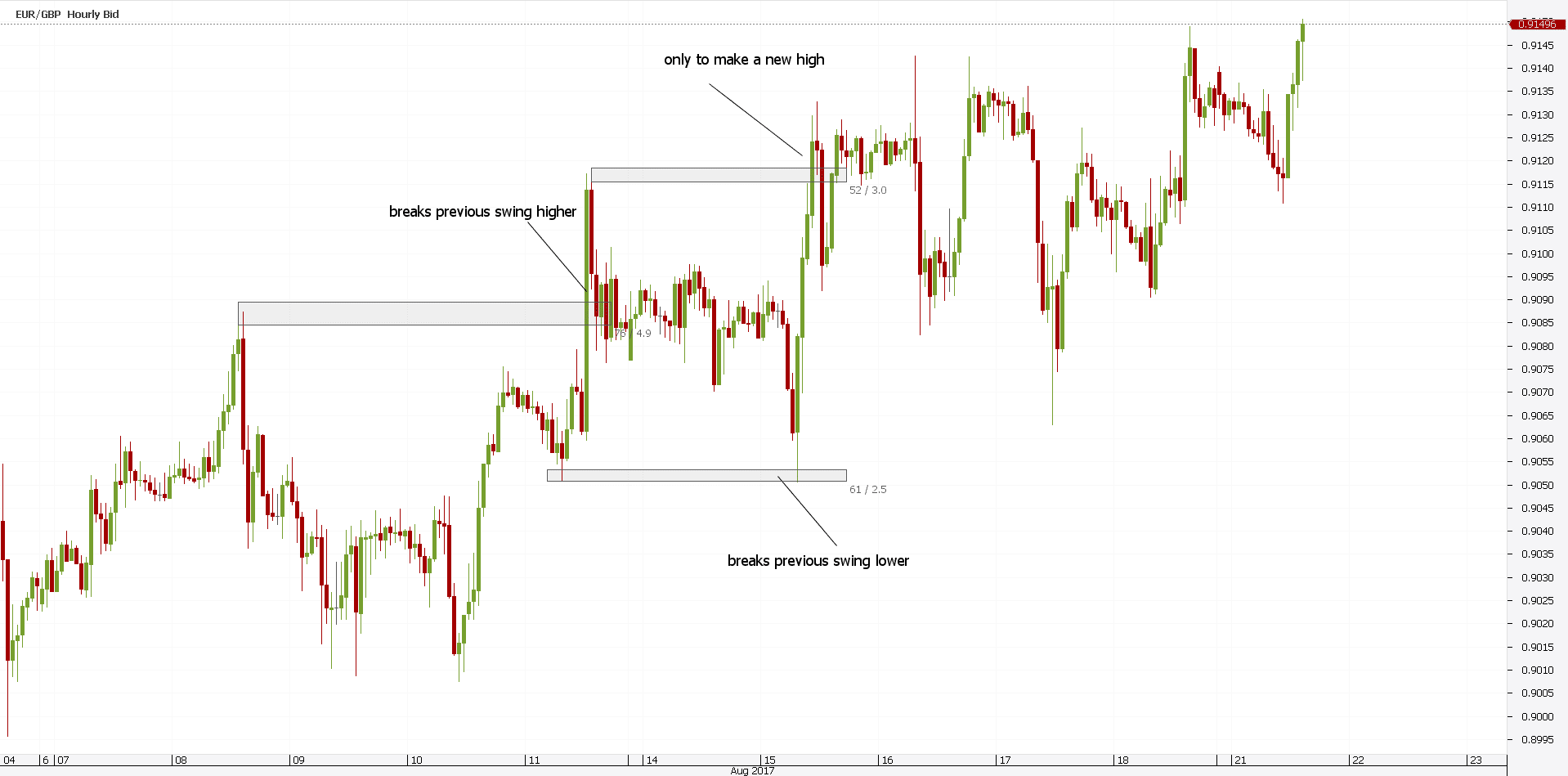

Below is the recent EURGBP price action on the hourly chart. Fakeout moves are the norm.

Both bulls and bears are in pain. Bulls consider every break higher as a true breakout.

Only to find out the market quickly retraces. Bears, on the other hand, wait for the previous swing lower to break.

They trade the break. But, only to find out what a whipsaw is! The market quickly retraces and makes a new high.

Why are these breaks important? Because of traders and their stop loss orders.

Typically, there’s a strong tendency to place the stops at the previous swing highs/lows. However, those stops are juicy for trading algorithms.

Why not trip the stops? Many of them are programmed only to do that.

By the time it happens, the interest is gone. That is until trending conditions come into play.

How to Trade a False Breakout

Is there a way to deal with a messy chart like the earlier one? Can we find an order in such moves?

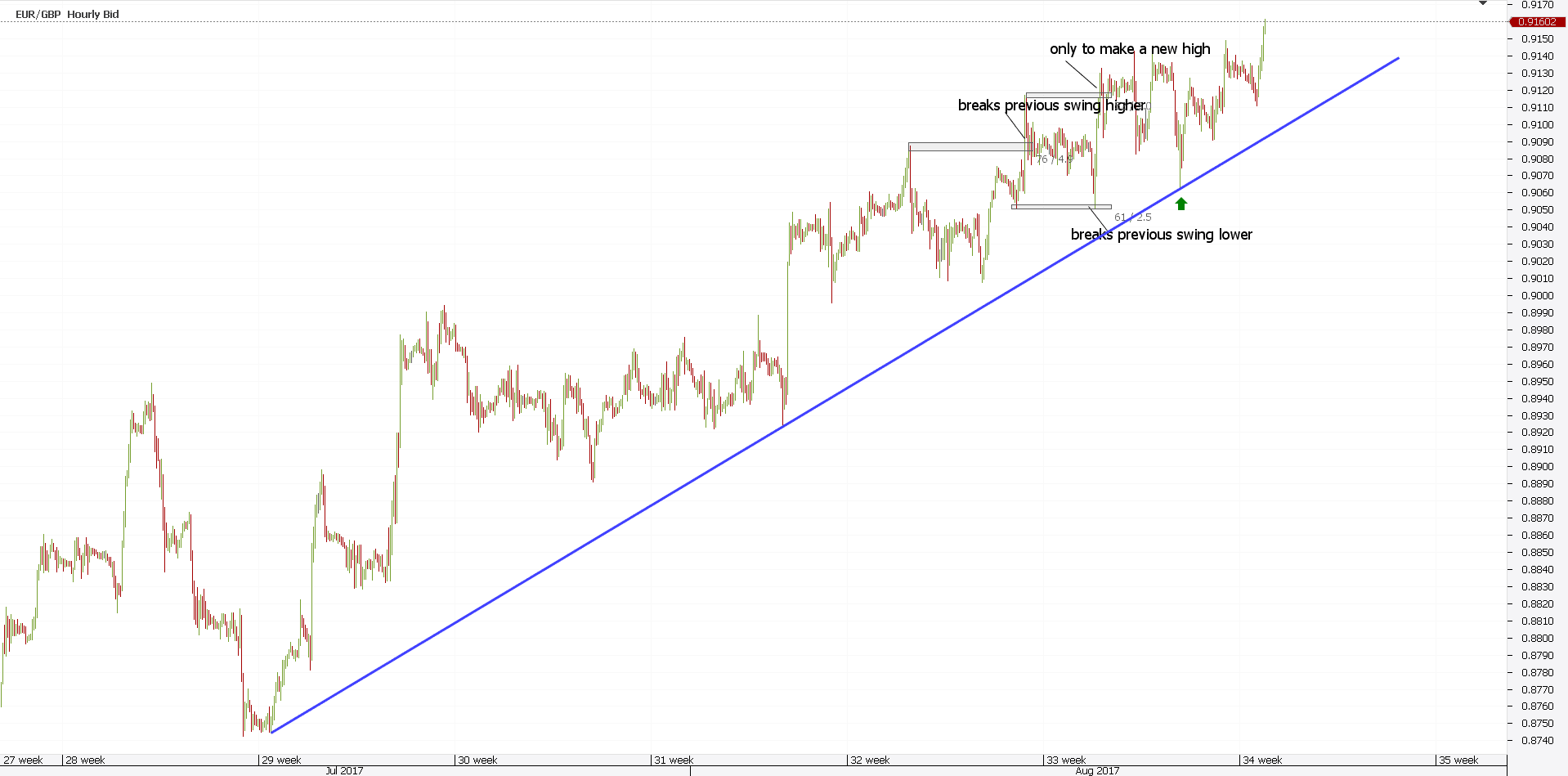

One answer, and perhaps the best one, is to stick to the underlying trend. Of course, if there is one.

As such, the thing to do is to go on the bigger time frames. Or, to zoom in.

This way, more price action appears on the chart. Simply draw the main, dominant trend line.

Next, use it to filter the fakeout moves. Here’s the result on the chart below.

What I did was to zoom out on that hourly EURGBP chart. Just to see if there is a possible trend.

It turns out it is! Quite a strong one.

Hence, we can use whipsaw Forex moves to our advantage. Namely, we can filter the trades.

More exactly, if you are to go long at the blue trend line, where would you set the take profit? Obviously, at the previous swing highs!

Just like that, we used a false breakout pattern conditions in our advantage. It turned out it was a great trade.

Elliott Waves and Fakeout Trading

The Elliott Waves Theory deals with patterns. A lot of them.

The whole theory is a logical approach to market moves. A logical process guides traders when counting waves.

The patterns part of this process help traders understand false breakout trading. Perhaps the most representative ones are:

- An expanding triangle

- An irregular flat

Expanding Triangles – the Perfect Whipsaw Trading Example

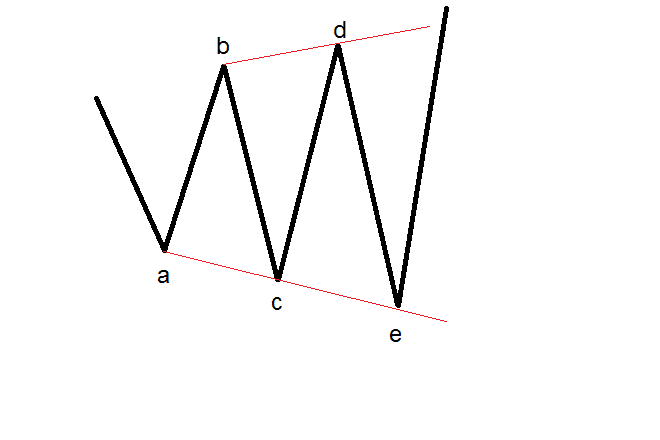

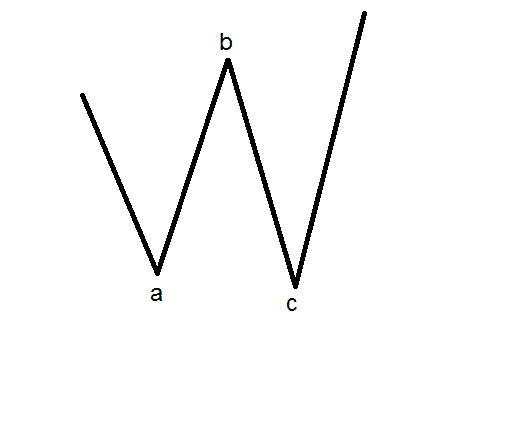

Elliott found that a triangle has five legs. All of them labeled with letters: a-b-c-d-e.

If one connects the a-c and b-d points, two lines result. These are the triangle’s trend lines.

The key is to interpret them. If they contract, the market forms a contracting triangle.

But, when they expand, they form an expanding one. However, to do that, fakeout moves are the norm.

The market makes whipsaw after whipsaw. It simply takes the previous highs and lows multiple times.

Hence, if there’s a way to find an order in whipsaw Forex trading, perhaps we should start from the rules of an expanding triangle.

Look at the pattern above. That’s an expanding triangle with the Elliott Wave Theory.

What is it if not the perfect whipsaw Forex trading illustration? The market keeps breaking the previous swings’ highs and lows until finally breaking.

More exactly, it did that for five times. Five times!

And yet, Elliott found a way to put these fakeout moves into a false breakout pattern.

Moreover, it did the same with an irregular flat pattern.

False Breakout Trading with Irregular Flats

A flat pattern is a corrective wave. In fact, it is a three-wave structure. A simple one.

As such, traders use letters to illustrate the waves: a-b-c. But such a pattern is the perfect whipsaw trading illustration.

It is a sign of counter-trend strength. The market makes a whipsaw after whipsaw until eventually, the pattern ends.

The two Elliott examples here show the efforts to put an order in such whipsaw Forex environment. As all Forex traders know, these patterns form often.

Spotting a Fakeout with the Fakey Candlestick Pattern

In Forex trading, the market looks for tripping stops. Most of the times, it trips the stops and then reverses.

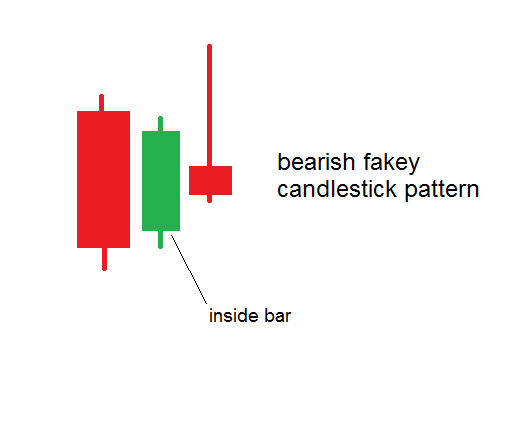

The fakey candlestick pattern is designed to spot false breakout Forex patterns. Unfortunately, there’s not one single setup that defines the fakey candlestick pattern.

The pattern is a three-candle pattern. However, sometimes, more than three candles appear.

That happens when the fakeout price activity happens in more than a candle’s time. The best fakey setup, though, is the one that has an inside bar as the second candle.

Here’s a bearish fakey candlestick pattern with an inside bar. A closer look at it is full of bearish signs.

But, that is clear only after the false breakout came. Or, after the market made a whipsaw that took the previous highs.

The inside bar calls for a break. Indeed, the break came.

But, after the fakeout move, the candlestick pattern shows a shooting star. That’s a bearish pattern on its own.

It only comes to confirm the break higher was a fakeout move. Hence, the fakey setup will lead to a bearish move, after all. Despite the whipsaw higher!

The shooting star, or the pin bar, is a bearish candle on its own. Traders can enter at the candle’s closing, and place a stop at its highs.

Using a risk-reward ratio of 1:3 will do the trick for the trade. Of course, the usual caveat applies here too: the bigger the time frame, the more powerful the fakey setup is.

Fundamental Whipsaw Forex Moves

Despite the general believes, fakeout moves happen in fundamental analysis too. Or, illogical moves.

Let me explain a bit. A central bank has the most powerful market-driven tool: the interest rate.

A change in the interest rate leads to a change in the currency’s value. Hence, it leads to the Forex market moving.

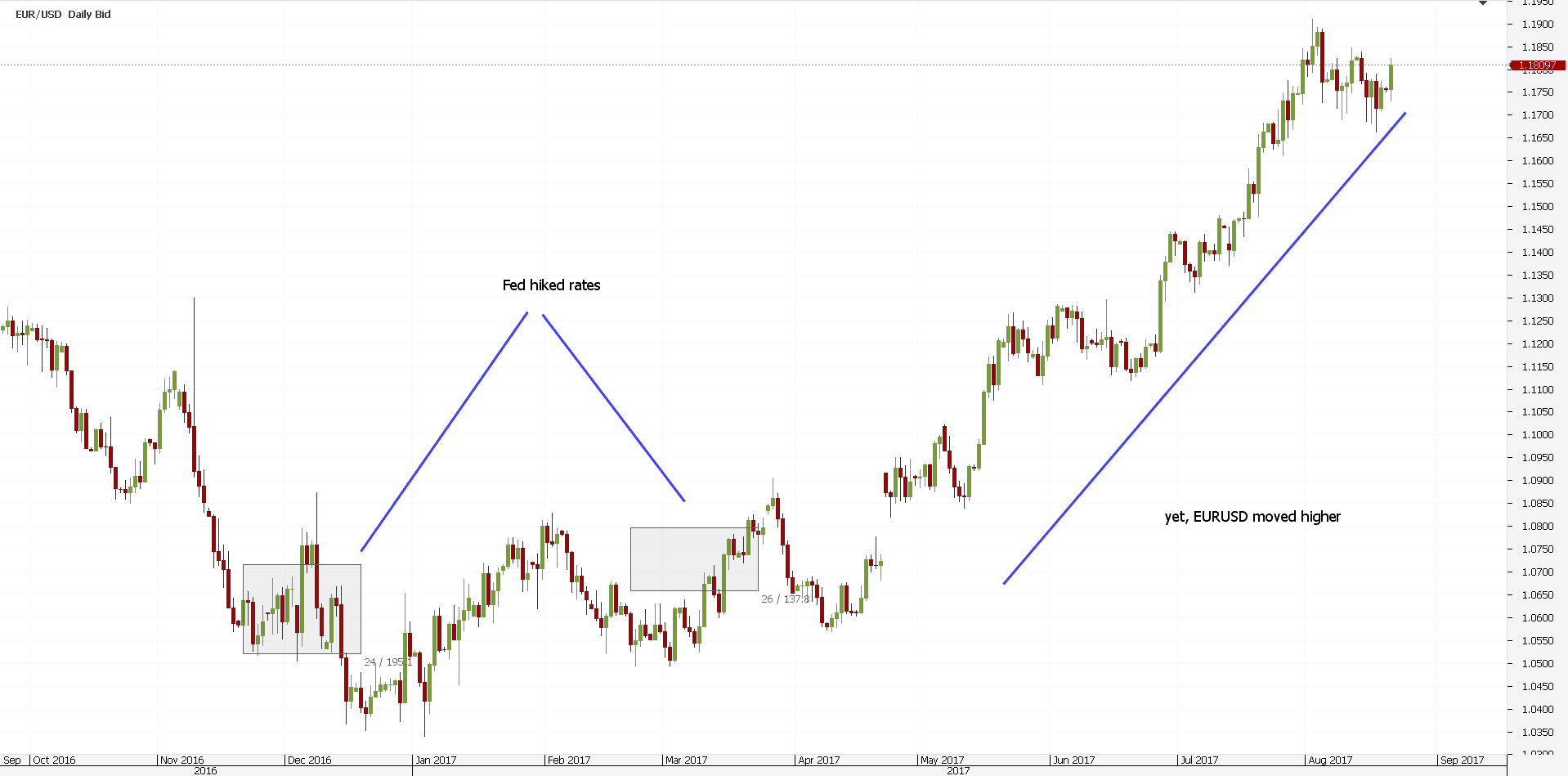

But, fakeout moves or a false breakout appears in interpreting fundamentals too. Consider the recent EURUSD price action.

The Federal Reserve of the United States (Fed) started a tightening cycle. That’s raising the interest rate.

The logical trade would be to buy US dollars. Yet, a funny thing happened.

Despite the interest rate rising, the dollar kept falling against the Euro. In fact, not only against the Euro but across the Forex dashboard.

So, we can argue that the market went for fundamental traders’ stops. That’s weird, isn’t it? Yet, so true in Forex trading.

Conclusion

False breakouts occur in all market types. Be it a ranging market, a trending one, or not, fakeout moves appear all the time.

And, they’ll continue to appear. Moreover, even fundamental analysis of a currency leads to false breakout trading.

Above all, false breakout trading represents contrarian trading. But trading a counter-trend is difficult. Only some Elliott Waves patterns have the power to spot counter-trend activity.

Unfortunately, whipsaw conditions appear every day in Forex trading. That’s why trading the currency markets is a difficult task.

One way to deal with whipsaw trading is to look at bigger time frames. As such, to interpret daily, weekly and monthly charts.

Another way is to think differently. If the market goes for the previous stops on lower time frames, try to think differently. Where would you place the stops to avoid being a victim of a fakeout move?

Empathy might be of help here. As a reminder, empathy refers to put yourself in the other people’s shoes.

In this case, if you’re a bull, imagine where your stop would be if you’re a bear. And, the other way around.

This way you’ll avoid whipsaw Forex moves. Or, at least, most of them.

All in all, a false breakout pattern is difficult to trade. The market participants experience quick price moves. And, fake ones.

There are no rules to follow. At least, not rules for all possible scenarios.

But, as always, traders have an ally. Money management.

The aspects discussed in this article help you filter good trades from bad ones. As such, the win ratio increases.

That’s pretty much all one can do with whipsaw Forex moves. Is it enough for profitable trading?

No. But, it surely helps understanding how and why false breakout situations occur. Even the fundamental ones.

START LEARNING FOREX TODAY!

share This:

Leave a Reply