The EUR/CAD has reached the massive support area, which has been rejected once again. This might result in either a short term upswing or a trend reversal to the upside. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice. This analysis was done […]

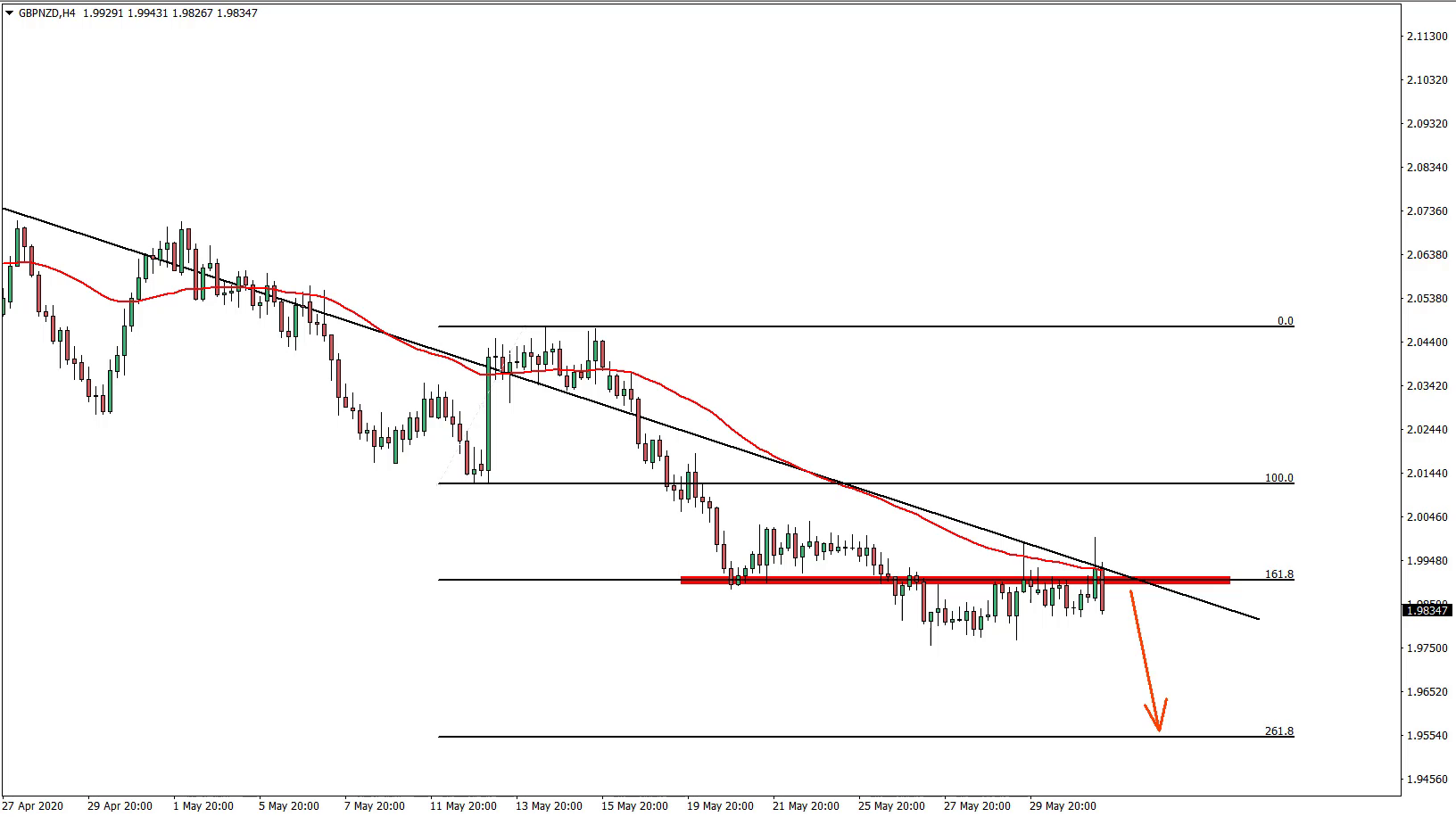

GBP/NZD has been trending down for quite some time, and soon this tendency can continue. Although before that, there is a final drop to be made, as long as 2.0000 resistance is holding. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice. This […]

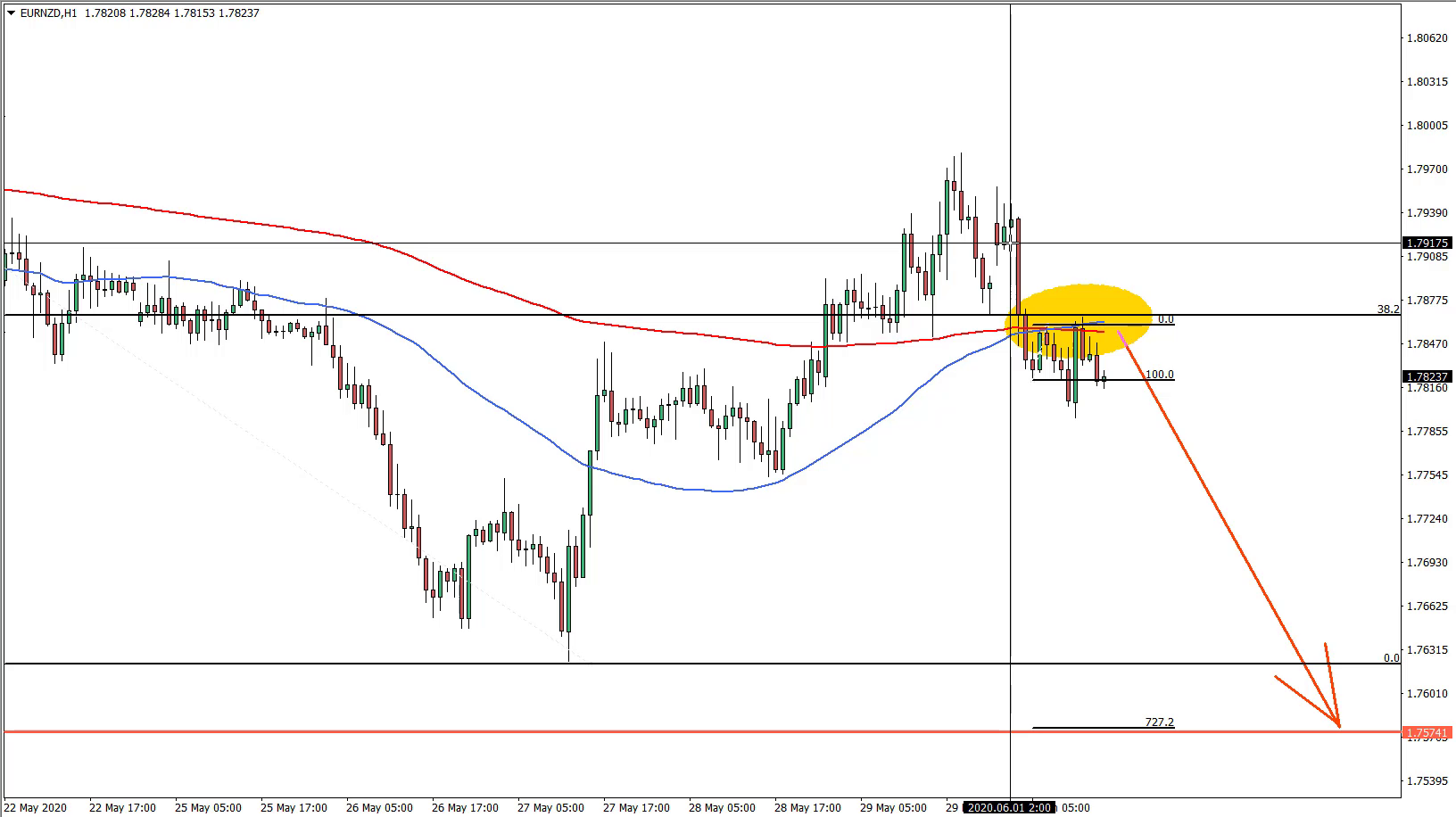

The validity of the EUR/NZD downtrend is confirmed by multiple rejections of resistance indicators. This should result in more selling pressure over the next 24 hours. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice. This analysis was done on MetaTrader 4. Click […]

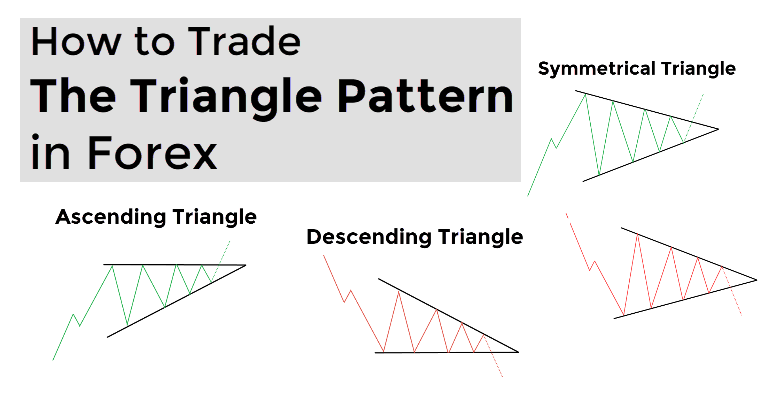

Most traders love continuation figures like the triangle pattern; this makes it one of the most commonly traded chart formations in Forex. Unlike reversal patterns that signal an impending change in the trend direction, triangles are used to make profits in trend extensions. The Triangle Pattern in Forex is a price formation that signals a […]

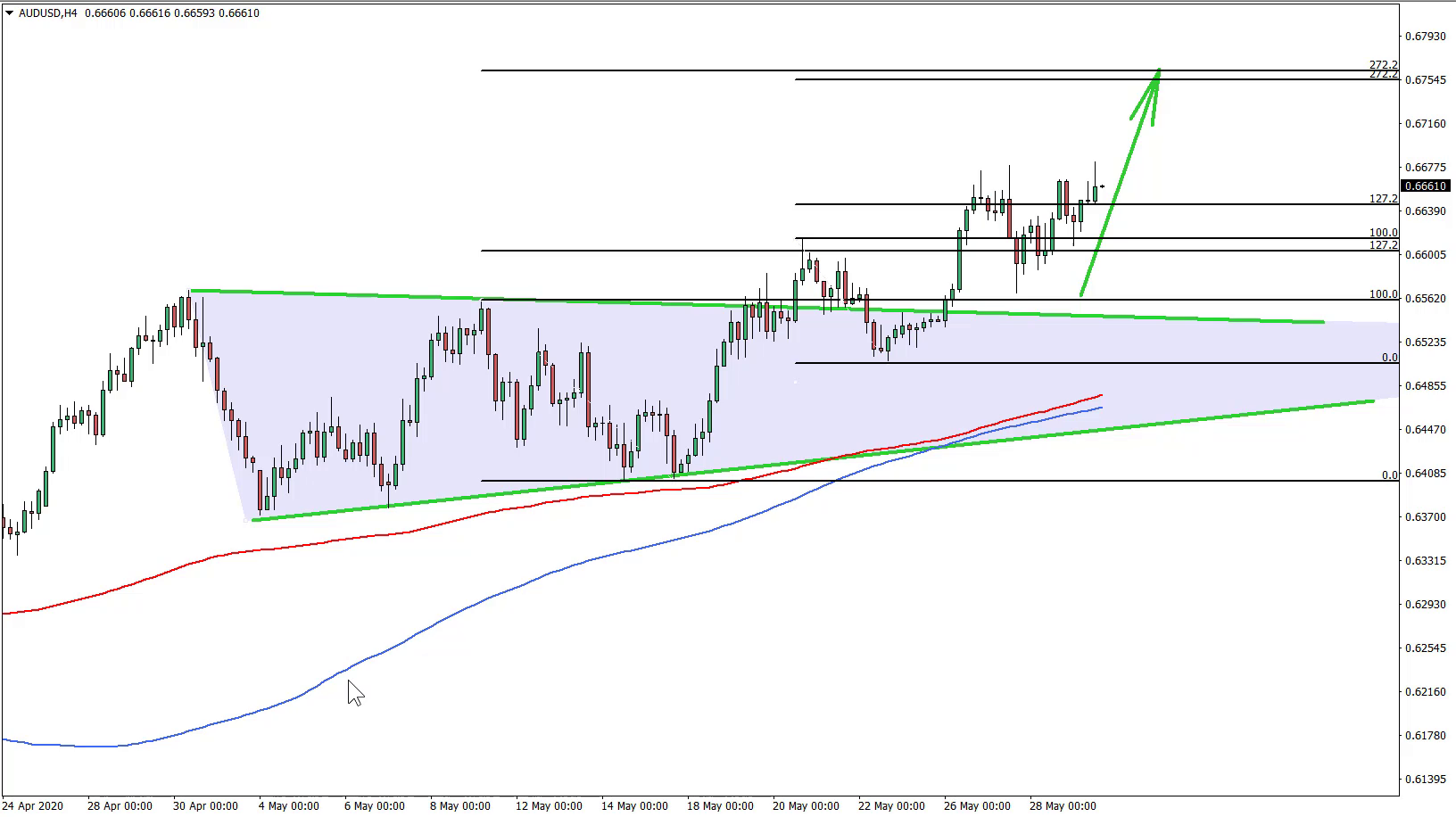

AUD/USD remains very bullish, with a high probability of the uptrend continuation. Any small pullback could be considered as a potential buying opportunity for the short to medium term. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice. This analysis was done on […]

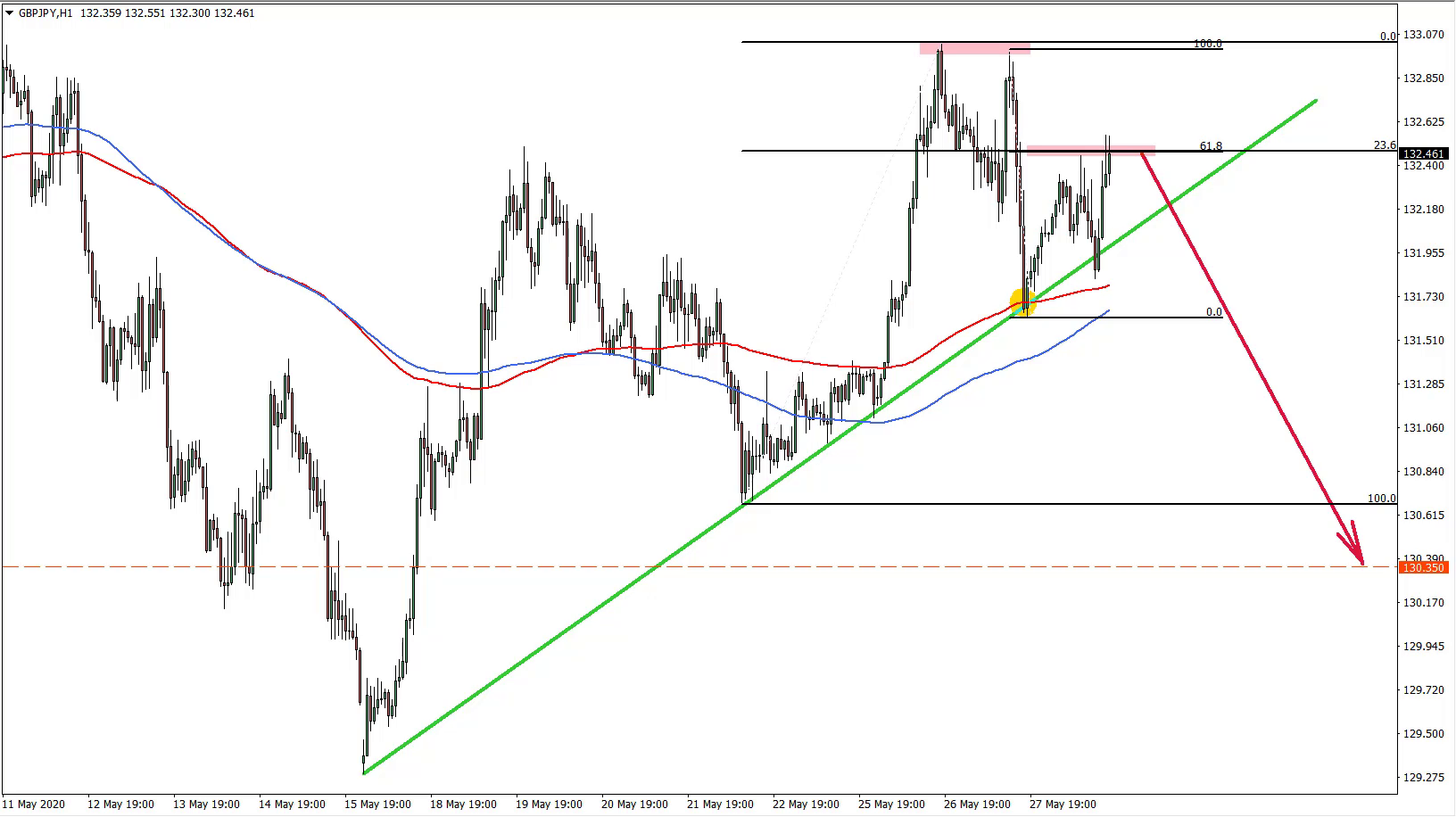

GBP/JPY formed a double top near 133.00, which is a very strong physiological resistance level, which was rejected previously several times. On the daily chart, the downtrend is still valid, and current price could be very attractive for sellers. Disclaimer: The analysis presented in this article is for educational purposes only and should not […]

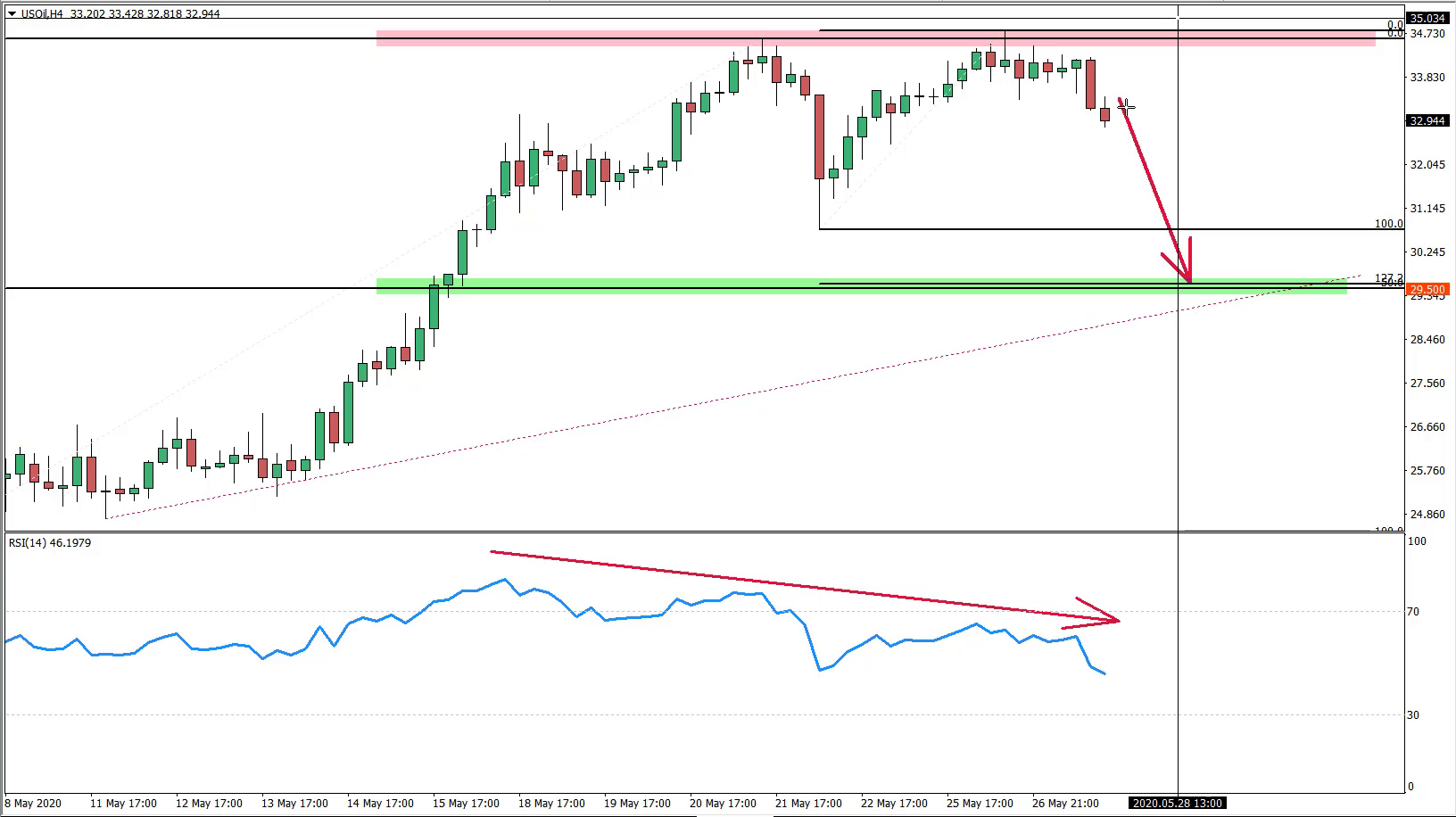

The USOIL uptrend seems to have exhausted itself after rejecting 61.8% Fibs on a Daily chart. Lower lows and lower highs are now being printed, confirming the validity of the downtrend in the short to medium term. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered […]

By breaking the previous low, Gold seems to confirm further price weakness. It is unlikely that there will be any strong pullbacks after such a fast price drop in the past few hours. Therefore, any small pullbacks could be of great interest in terms of selling opportunity. Disclaimer: The analysis presented in this article […]

Right now EUR/NZD is trading at the level of interest, mostly for the sellers. As long as the downtrend trendline holds, selling pressure will only increase. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice. This analysis was done on MetaTrader 4. Click […]

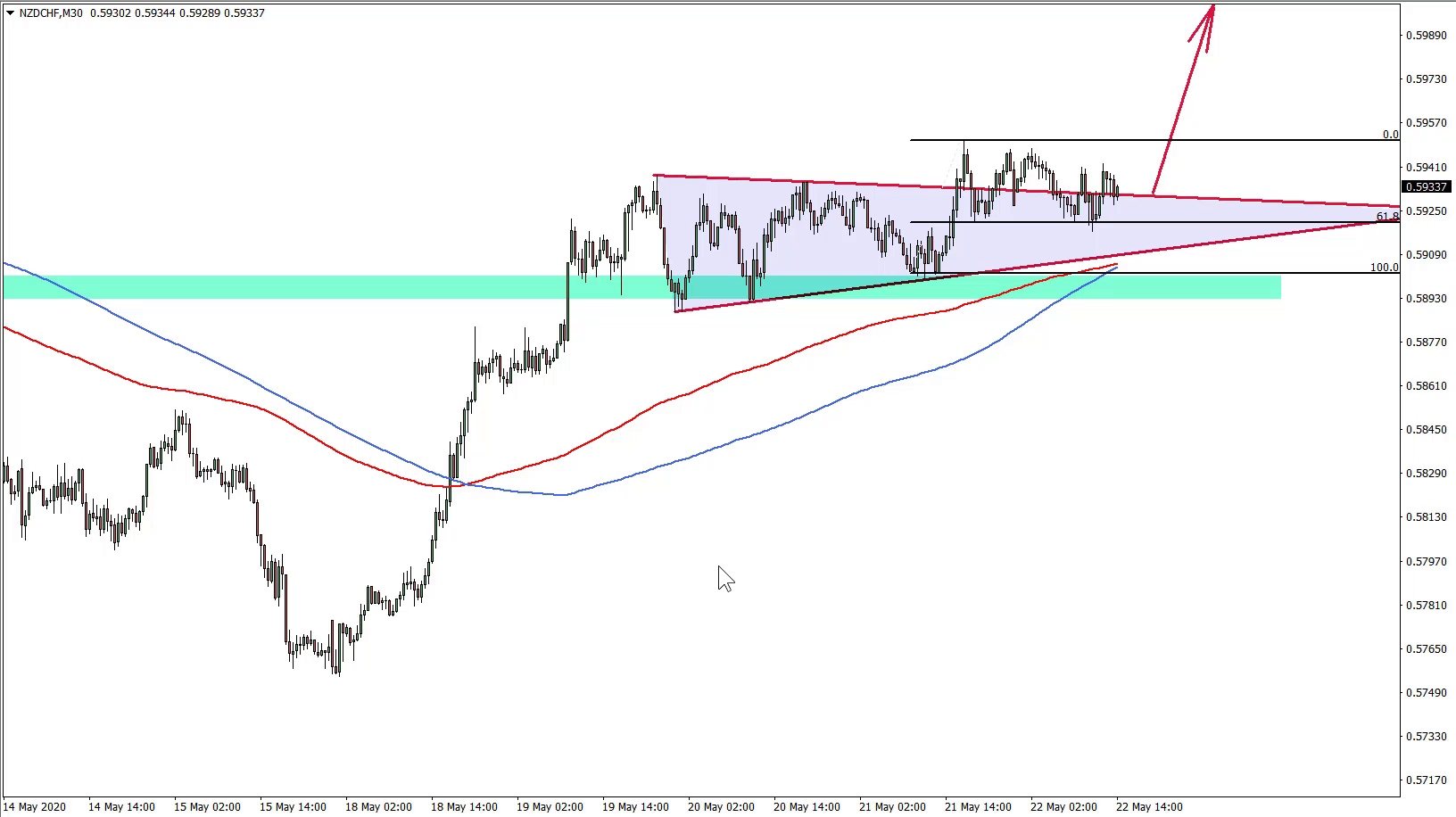

NZD/CHF has been consolidating during this week and stayed within the triangle pattern. The consolidation seems to come to an end after breaking the triangle and the price is expected to rise, starting next week. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial […]