Should we always rely on symmetry in buying and selling parameters?

Once you start learning about trading strategy and the technical indicators available, you will often see the same widely used parameters for popular indicators, as if these parameters were absolute rules that are set in stone.

On this blog post, we will know more about different perspectives on symmetrical parameters in Forex Trading.

Why do people get excited about Forex Trading but fail in the end?

When it comes to Forex trading, you see it’s not just about putting enthusiasm and setting trades based on a strategy or a gut feeling. Setting up a statistical approach is very important to get profitable results on the long term. You have to think and be smart by monitoring statistical parameters which can help you track and detect strategy deterioration. Regardless of whether you are using Forex Robots or you are trading manually, parameters such as profit factor, expected pay-off or recovery factor are just three of the things that you should never overlook.

Since publishing my video course on how to set up a Forex VPS I have been receiving lots of questions in regards to Amazon Web Services (AWS) and Amazon VPS for trading. Example:

“What do you think about AWS? Do you think if it has enough ram to support three instances of mt4 at the same time with 10 ea working in each platform?”

– Lucas

Amazon offer the first year of their subscription for FREE, and this means that if Algorithmic traders deploy their Forex Robots at Amazon they save some cash on VPS hosting.

A lot of traders out there do recommend AWS. But I’m going to take a different stance: in this blog I will give you five reasons why you should NOT use Amazon VPS for Forex Trading, and hopefully save you lots of heartache and stoplosses.

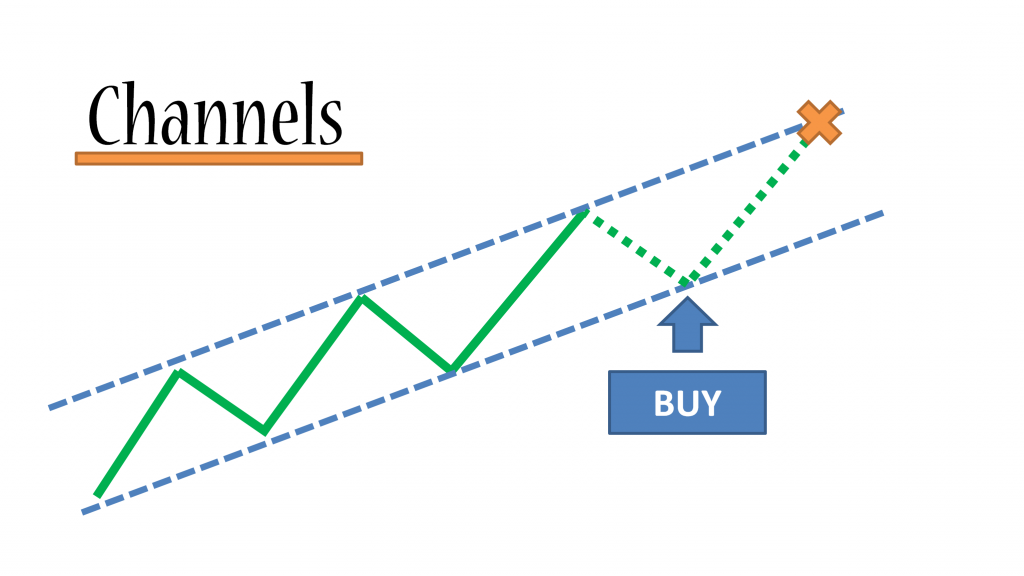

Channels (aka corridors) are, hands down, the most common formation on the Forex market. Combined with the triangle pattern, good ol’ channels cover 80% of market situations.

There are several strategies for trading channels in Forex. Today we discuss the main two: the “inner” and “breakthrough” strategies.

Have you ever wondered to yourself how to calculate EXACTLY what % of your account balance to risk on a given trade?

I mean you’re sitting there, about to open a trade for what seems to be a good opportunity, but you’re not sure what the optimal volume / lot size is. On one hand, you don’t want to risk too much in case the market goes against you, but on the other hand, you don’t want to risk too little either. Sound familiar?

That’s what we are going to explore today – EXACTLY what % of your balance is it optimal to risk on a given trade. It’s going to be fun!

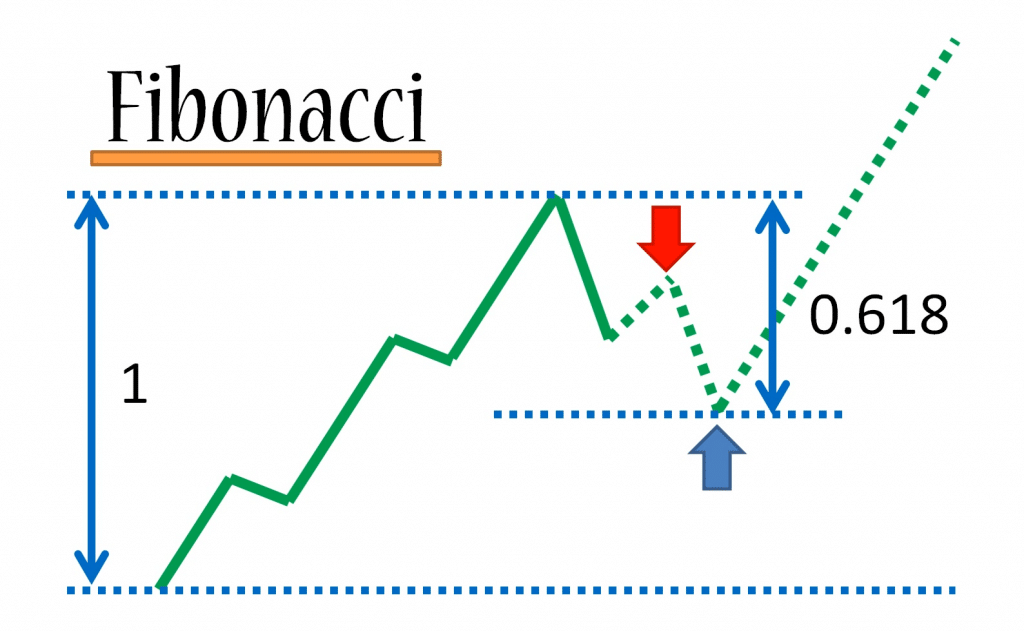

Today we will be looking at Fibonacci Retracements in Forex. The term ‘Fibo Levels’ is often used by analysts and traders. However, where do these levels actually come from? And what do the mean? How do you use them?

Those are exactly the questions we will answer today. Watch this 8 minute video and you will have a whole new appreciation for Fibonacci levels.