The forex market is fast-paced, so much so that it’s easy to overlook how a winning trade can easily turn into a losing position and leave you with considerable losses. Good thing that a TakeProfit order exists, right? On that note, let’s start by giving a quick answer to the frequently asked “what is a […]

As Forex traders, it is very important to know what is the availability of the market. Moreover, it is important to understand how do the different trading hours or sessions impact your trading strategy. The Forex market is open 24-hours a day from Sunday 10:00 PM GMT to Friday 10:00 PM GMT, this includes most […]

In this article, we will share a candlestick cheat sheet that will help you improve your price action technical analysis. In addition, you will be able to identify the top 5 candlestick patterns and improve your strategy. Forex candlestick patterns are special on-chart formations created by one, or a few, Japanese candlesticks. There are many […]

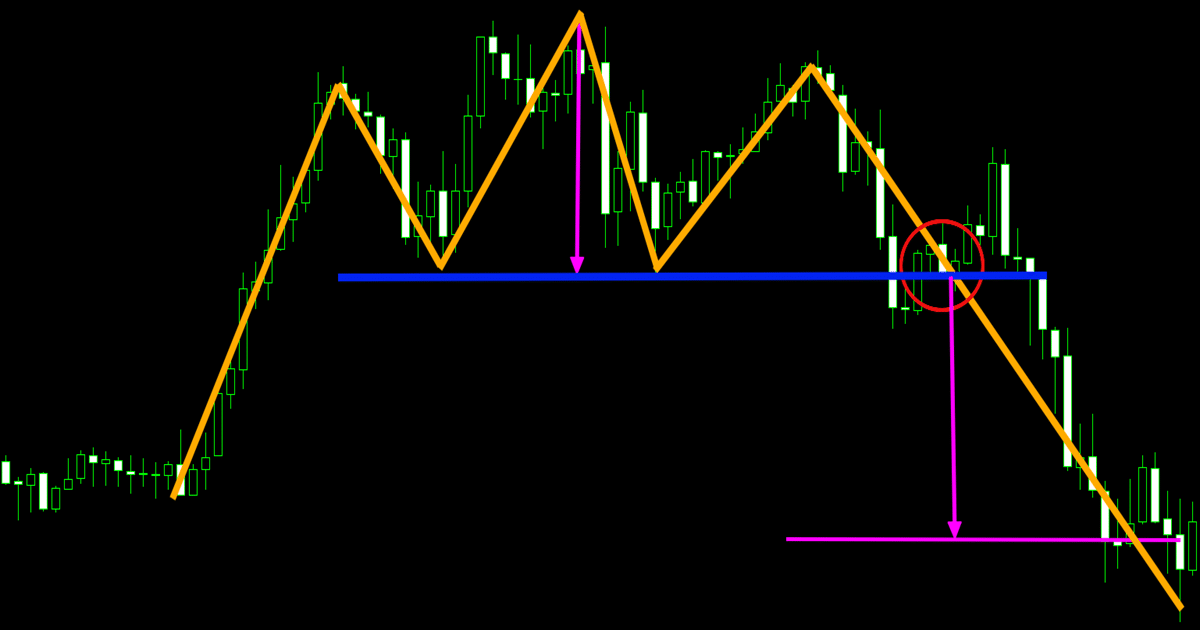

One of the most important ingredients for successful trading is Forex chart patterns technical analysis. Recognizing figures on the graph is an essential part of the Forex strategy of every trader. It is vital that you learn chart patterns and their meaning. I have decided to spare some time to show you how to trade […]

Yet another Japanese concept, the Heikin Ashi candles provide a great setup in both swing trading and Forex scalping. When the Western technical analysis world met the Japanese approach, it was stunned to find out the simplicity and the power of the Japanese candlesticks. As it turned out, the Japanese traders used candlesticks patterns to […]

Part of money management in currency trading, the diversification method protects the trading account. Applying diversification method principles to the Forex trading account results in increased chances to survive in the currency markets. There are multiple ways to diversify a trading account. For instance, trading uncorrelated pairs means applying diversification method. Also, fundamental trades diversify […]

One of the biggest things in trading is the placement of stop losses in your trades. Part of any money management system, stop losses orders bring discipline to Forex trades. Many traders choose not to use stop losses orders. At all. The reasoning isn’t that bad. They fear brokerage houses interfere with market activity. And, […]

Retail traders often make the mistake of not knowing the best time to trade in the Forex market. For this reason, they trade all the time. However, markets don’t always move. In fact, statistics show that markets mostly range, then a trend. Hence, knowing the best time to trade and when to sit on your […]