For long, moving averages define the direction of a market. Any technical Forex analysis course starts with an exponential moving average. Or, any type of other moving averages that exist. Traders use moving averages to predict price direction. However, for many, they lag too much. It means that moving averages define a bull or a […]

Technical analysis is the base of speculation. Therefore, understanding technical analysis using multiple timeframes comes handy in Forex trading. Moreover, technical analysis using multiple timeframes by Brian Shannon became almost a cult among retail traders. And, for a good reason. Brian took technical analysis to a new level. His approach to Forex trading looks at […]

Forex money management should be every trader’s first concern. Managing Forex money means managing risk and a Forex money management strategy must exist. Traders use various tools, with a Forex money management calculator being one of them. It may sound fancy, but it’s true. No matter how good you are, or how good your trading […]

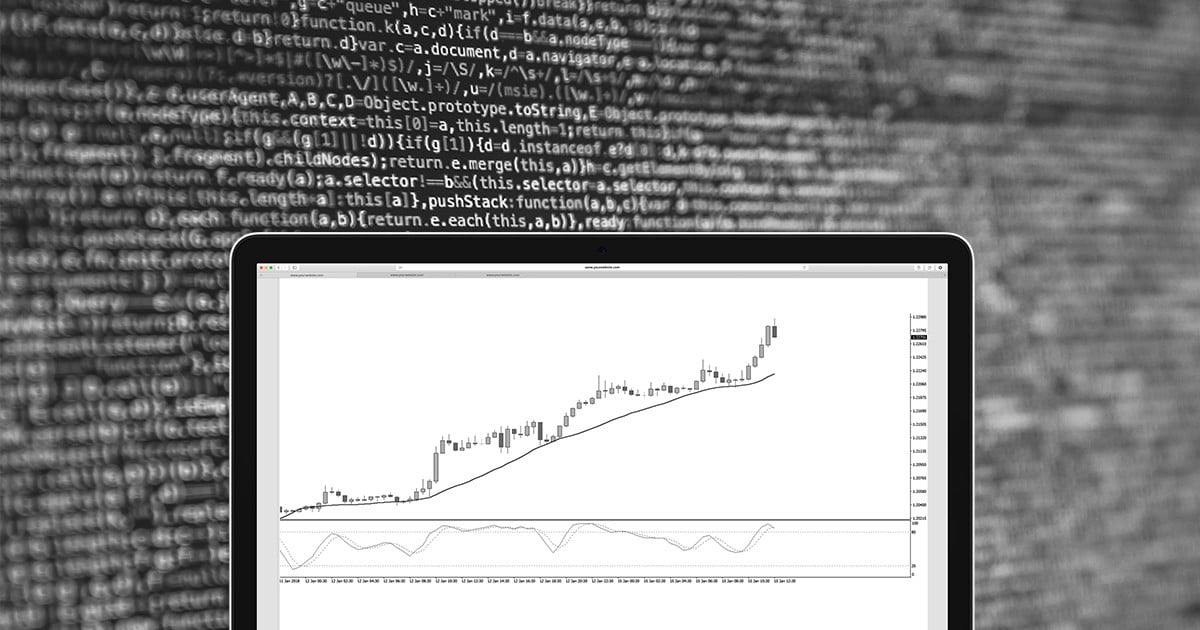

Technical analysis has plenty of indicators showing trending conditions or acting as oscillators. The TRIX indicator MT4 together with the TEMA indicator come to complete the list. Moreover, a TRIX Forex indicator acts like an oscillator, while the TEMA indicator shows trending conditions. When used together, TEMA and the TRIX indicator form one of the most […]

Among classic technical analysis pattern, the head and shoulder chart pattern stands out of the crowd. A head and shoulders chart is a reversal pattern that allows incorporating both price and time in an analysis. I wanted to get your attention from the first paragraph. Reread it! What’s unusual? Price and time. In Forex trading, […]

Forex traders approach the market from different perspectives. Some expect quick and very fast profits. This is scalp trading. Others, invest. They have a different time horizon in mind. As such, scalp trading strategies simply won’t fit their personality. Retail traders love scalping. They like the idea of making a quick profit. If you come […]

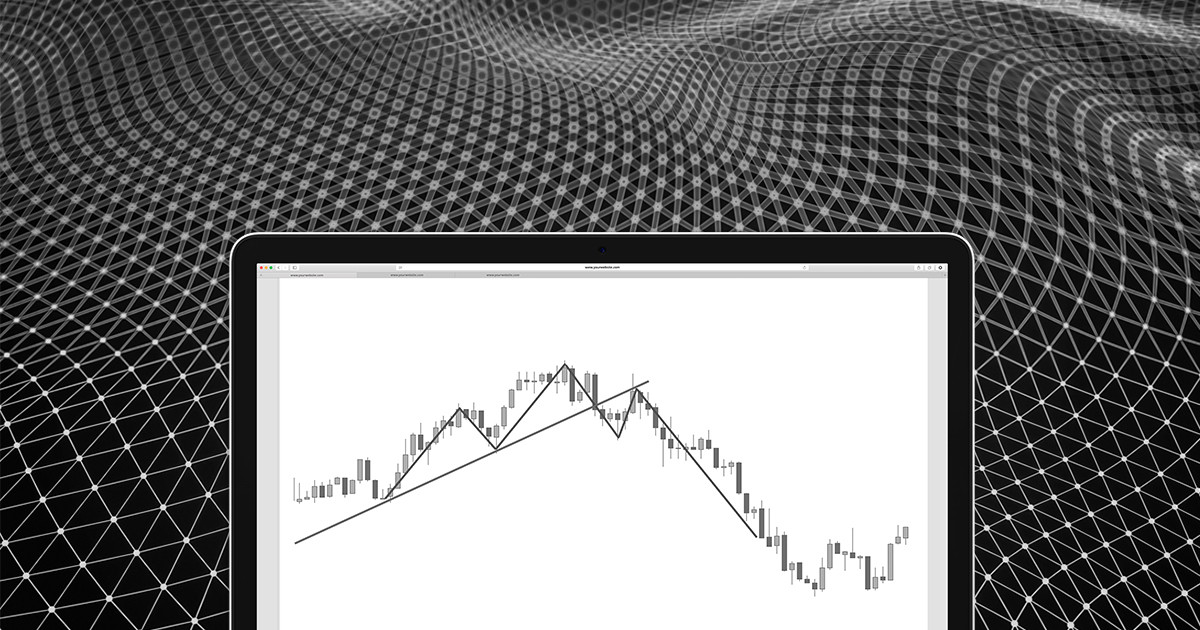

Spotting a trend reversal is the dream of every trader. It gives an early entry and offers a competitive advantage against conservative traders. As for reversal patterns, Forex traders have a plethora to choose from. Therefore, they focus on the most powerful reversal patterns and use them with a proper money management system. There are […]

In trading, like in life, simple things work best. Traders that search how to measure volatility use the average daily range for it. The idea is not a bad one. The average daily range represents the purest form of interpreting a market. The Forex dashboard consists of multiple currency pairs. Either a major pair or […]

Forex trading has much to do with trends. To ride them, traders look for trend continuation patterns. To fade them, they ignore continuation patterns and focus on reversal ones. There aren’t many continuation patterns technical analysis provides. But those that exist are enough for the right positioning. Any journey into continuation patterns technical analysis offer […]

One of the best volatility indicators, the average true range indicator helps traders understand the way a currency pair moves. Moreover, the atr formula considers large ranges that accompany strong moves. Any financial product moves in its own way. Stocks move differently than bonds, bond move differently than currency pairs…and so on. Even among currency […]